18 marzo 2024

LIVES VERSUS LIVELIHOODS: THE COVID-19 TRADE-OFF FROM AN EPIDEMIOLOGICAL-ECONOMIC PERSPECTIVE

(synthesis; full article Vox Eu CEPR 7 Feb 2024 https://cepr.org/voxeu/columns/lives-versus-livelihoods-covid-19-trade-epidemiological-economic-perspective)

Abstract: The trade-off between ‘lives and livelihoods’ – i.e. more stringent public health and social measures at the cost of more acute economic losses – prompted a fierce debate during the COVID-19 pandemic. This column introduces an epidemiological-economic model to explore this debate from a firmer empirical footing. The model is calibrated for four Latin American countries and draws attention to the complex interplay of economic structures, health systems, and previous COVID-19 waves. The presence of a steep short-term trade-off between health and economics losses emphasises the relevance of targeted pharmaceutical policies, notably increased vaccination coverage.

Keywords. Pandemics, lockdown fatigue, public health interventions, Latin- America

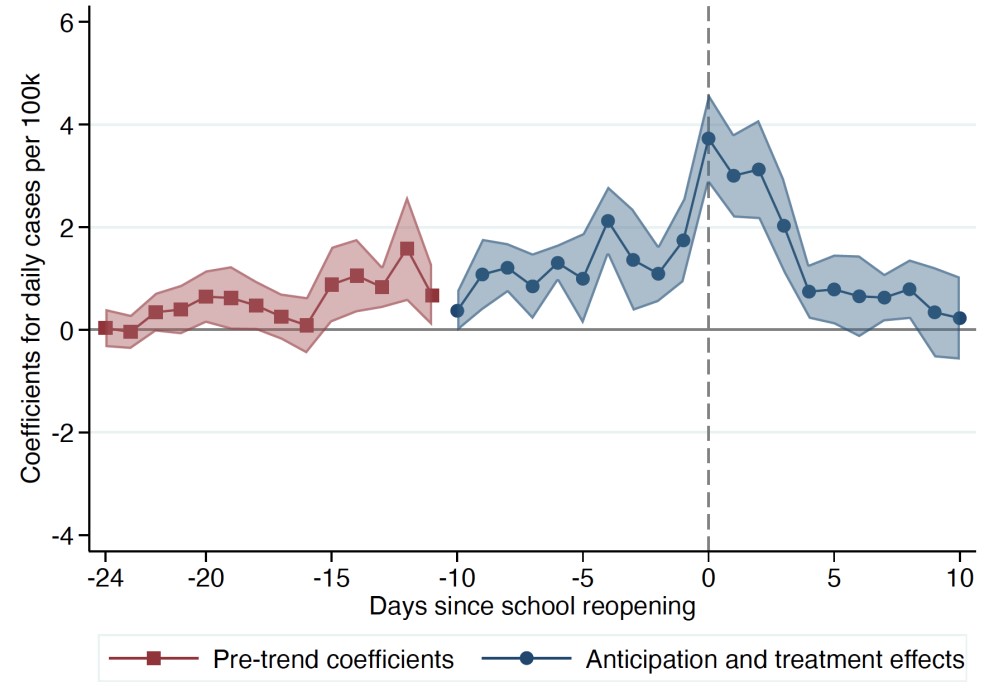

Latin America and the Caribbean (LAC) was the region with the highest COVID-19-related death count worldwide (Msemburi et al. 2023), despite implementing stringent public health and social measures (PHSM). At the same time, these policies caused large short-term economic losses by reducing working hours in a sizable fraction of the labour force. In many cases, these short-term costs, mainly in terms of productivity losses and social isolation, were so high that policymakers and individuals were unable to sustain them. This, in turn, triggered a heated and broadly politicised ‘lives vs livelihood’ debate (Rothwell and Makridis 2020, Levy Yeyati and Malamus 2020), with wildly dissimilar government responses across the region despite the recognition that most economic losses in output (Levy Yeyati and Filippini 2021b) and human capital (de La Maisonneuve et al. 2023) were persistent, affecting lives in the long run. Yet, the question remained unanswered: what would have been the economic impact of tighter/looser PHSM?

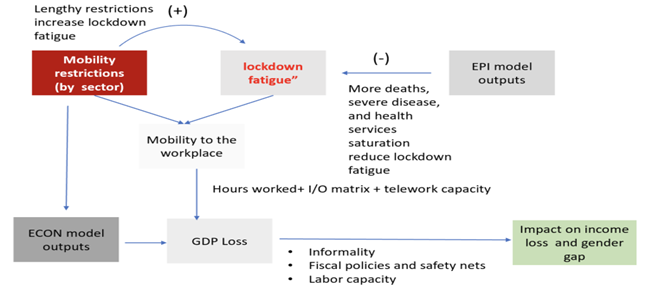

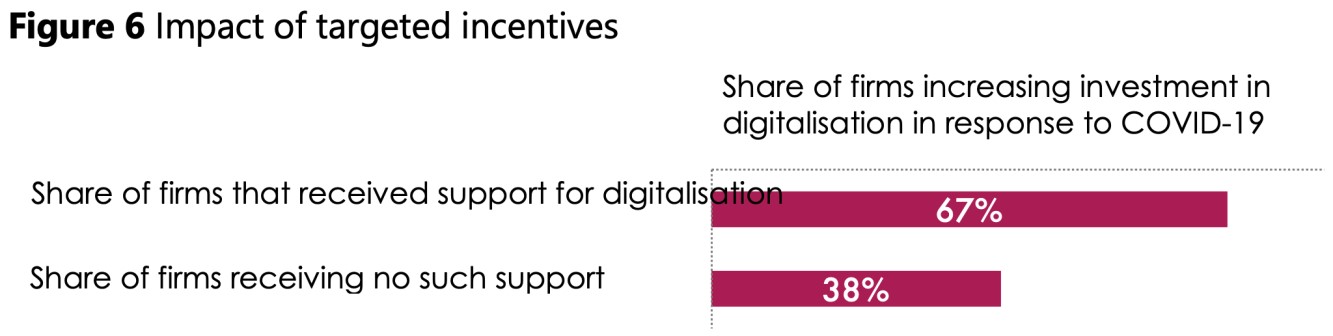

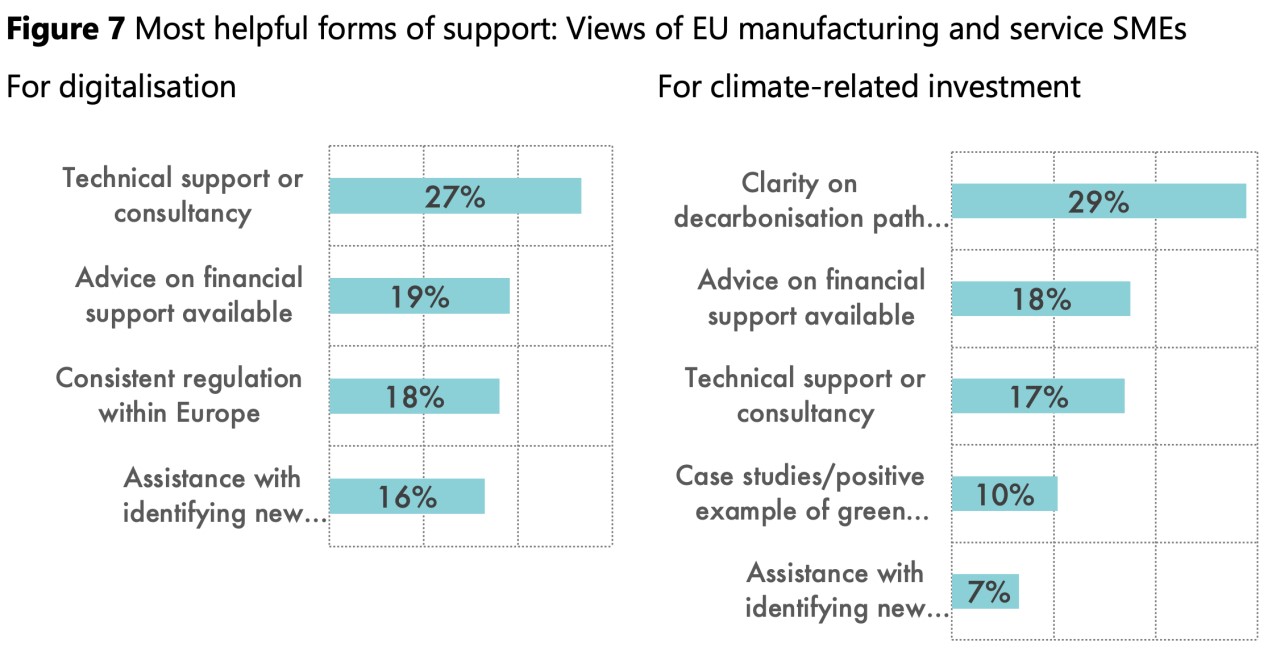

To address this question, we built an integrated epidemiological-economic (epi-econ) model to evaluate, in hindsight, the epidemiological, economic, and social trade-offs involved in the PHSM decision, and calibrated it to four LAC countries – Argentina, Brazil, Mexico, and Jamaica – in the year with the highest death toll in the region, 2021 (Rubenstein et al. 2023). Our model, available at https://iecs.shinyapps.io/covid-model-v2/, is recursive: the outcome from the epidemiological side block impacts the economic outcomes, and vice versa, by incorporating a novel component: ‘lockdown fatigue’ (Levy Yeyati and Sartorio 2020), that is, the marginal compliance of the PHSM decreases with the stringency/length of the measures, and the drop of the death count (reflecting psychosocial and economic factors).

In line with the DAEDALUS model (Haw et al. 2022), if the policymaker has an ‘economy-focused’ approach, PHSM will ease and the mortality rate will likely increase. On the other hand, if the priority is to curb the case curve (a ‘safety-focused’ approach), the economy will have to endure a highly stringent and lengthy lockdown and a likely sizable decline in GDP. However, the lockdown fatigue limits the capacity of the policymaker to discourage mobility over time, constraining the effectiveness of prolonged PHSM policies.

The model

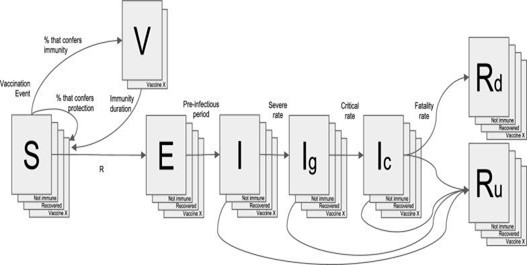

On the epidemiological side, our model provides a framework in which population dynamics are described in mathematical terms, capturing the number of people in separate compartments and the relationships between those compartments. We use an SVEIR transmission model (Augustovski et al. 2023), augmented with a macroeconomic and social impact model of the PHSM, adjusted for the different vaccination strategies in each country.

Figure 1 The SVEIR transmission model

To improve the transmission dynamics, we incorporate specific age-strata mixing patterns matrices to represent the social interactions and effective contact rates at each of these four settings: home, school, work (including transportation), and community. Modified matrices are derived from a model representing the impact of PHSMs on each stratum (school closures, non-essential business and public transport restrictions, staying at home, shielding the elderly, mandatory masks, etc.)

On the economic side, the model quantifies the GDP loss associated with mobility restrictions, incorporating the interaction of the lockdown measures with the behaviour of the population (‘lockdown fatigue’, estimated as the time-varying degree of compliance with mobility measures).

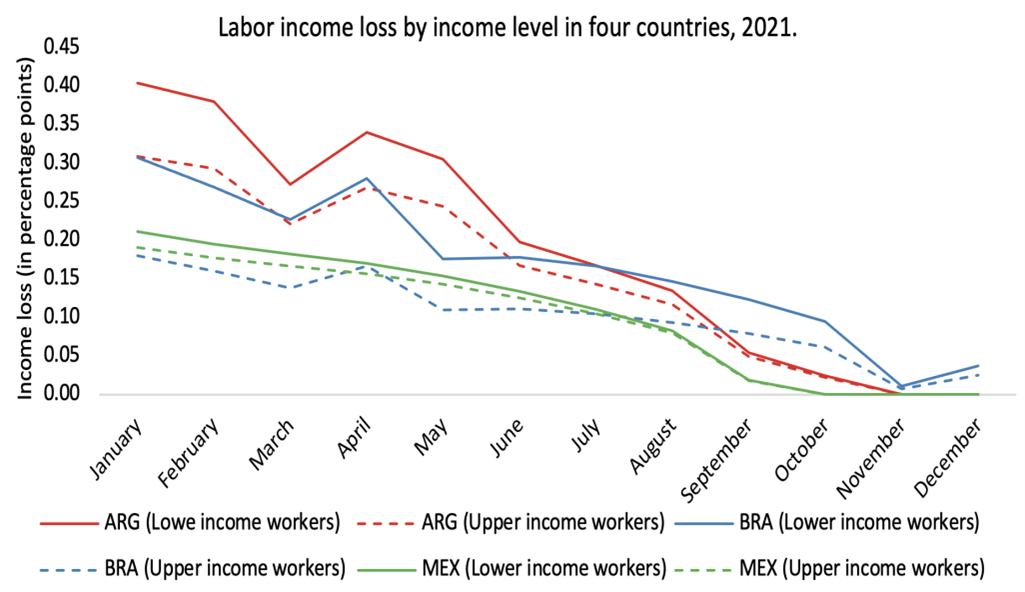

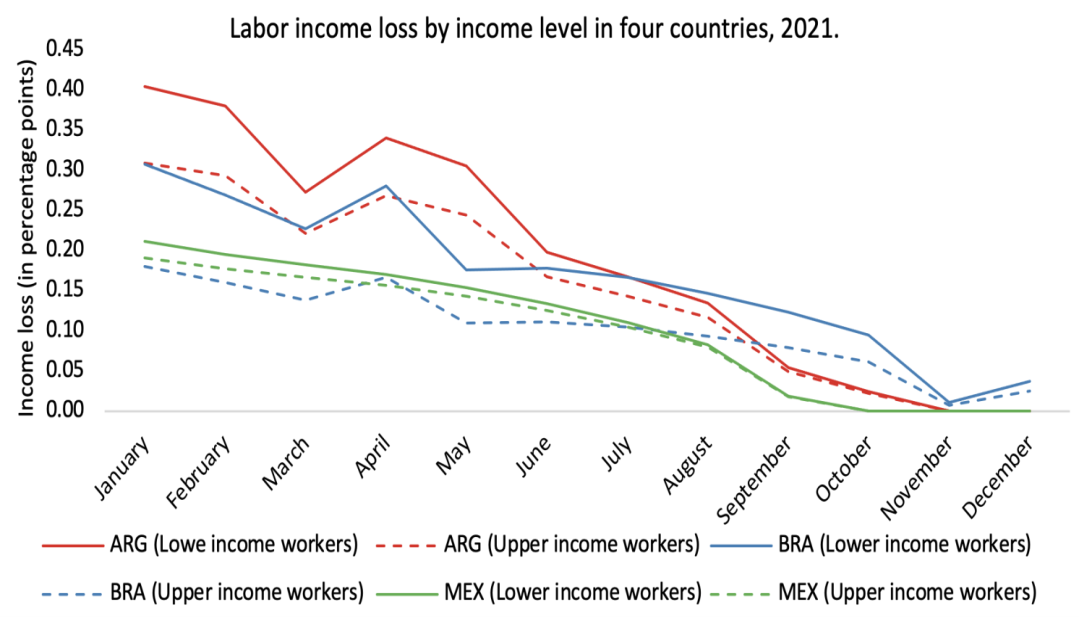

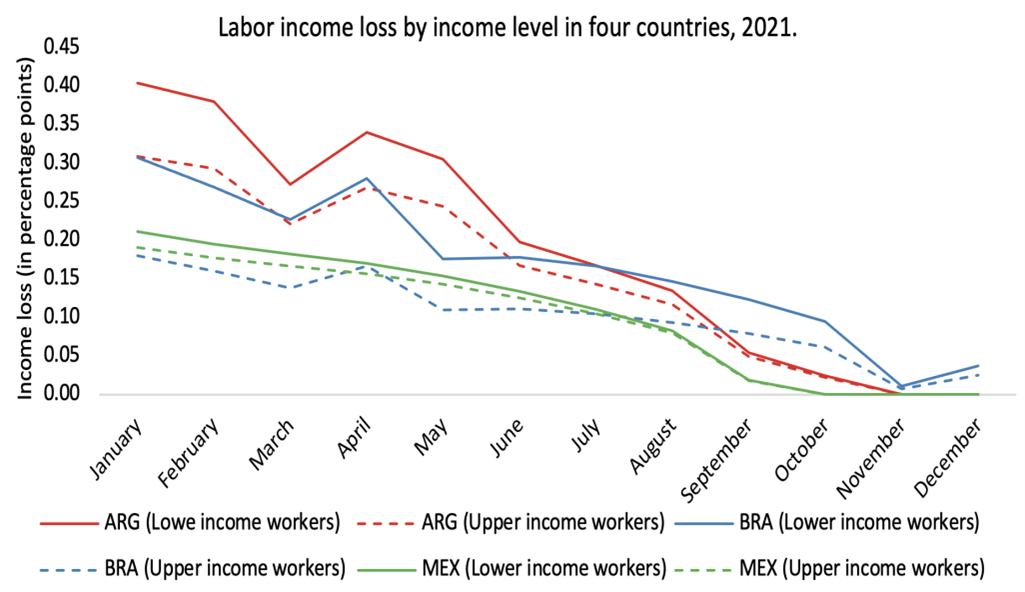

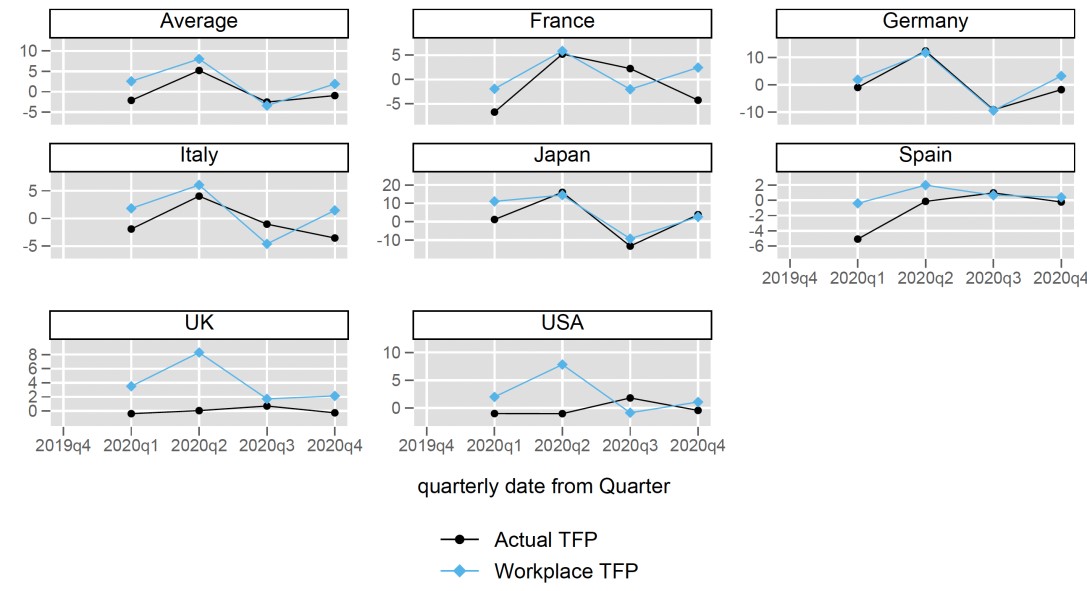

The main link between the PHSM and the economic impact works through the reduction in working hours. The stringency of the mobility restrictions precludes workers to get to the workplaces, effectively reducing the workings hours and producing an economic loss. We assumed that, prior to the PHSM, workers put an ‘optimal’ amount of hours into work; with PHSM in place, a share of workers is unable to go to their workplaces, reducing economic output (although we account for the fact that some work can be done remotely) and workplace mobility (in turn, viral spread).

In order to quantify the GDP loss, we need a detailed structure of the economic activity of the country, as more labour-intensive economies will be more exposed to mobility restrictions, and more informality in labour intensive sectors will amplify the GDP loss and the need for fiscal support to attenuate the impact of PHSM on the GDP loss. To map the impact of reduced mobility on GDP, we use sectoral value added and labour shares. Moreover, we calibrated incorporated differences in transitioning into remote working across sectors of the economy and countries.

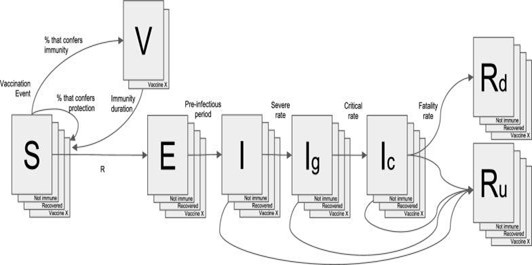

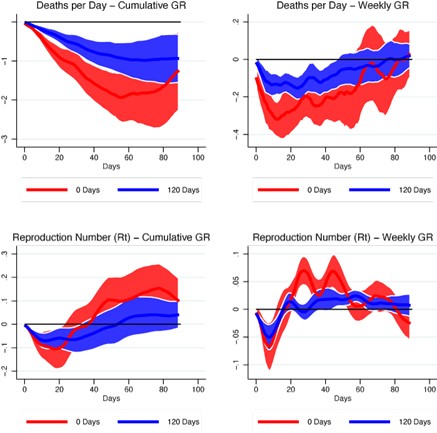

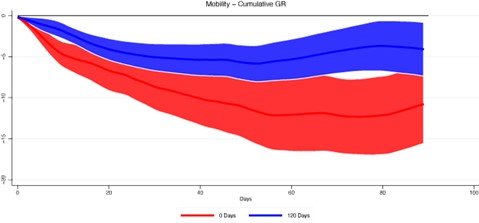

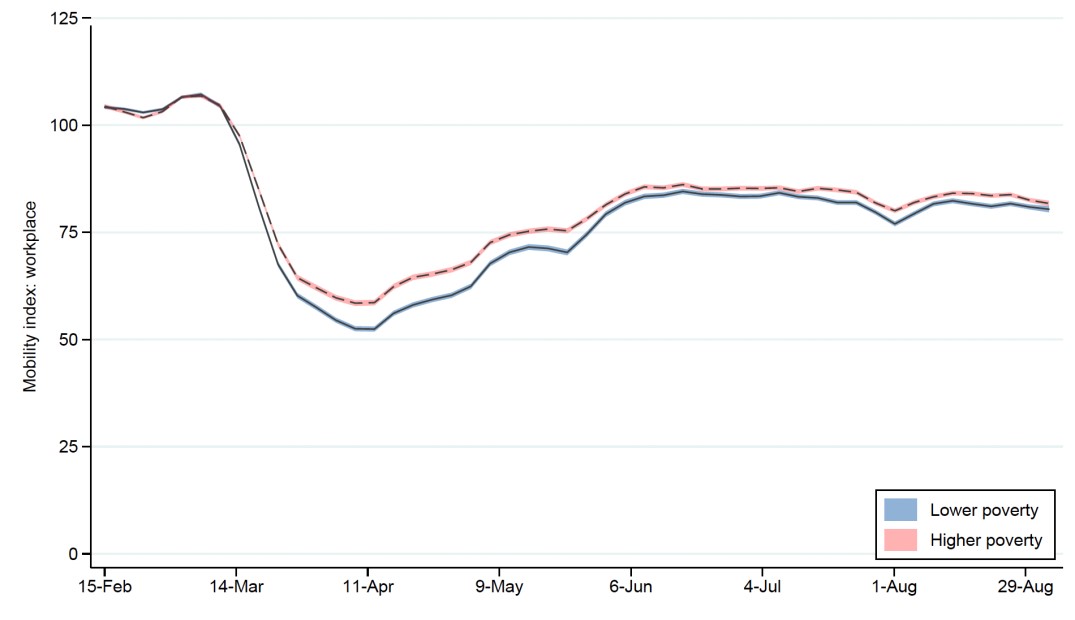

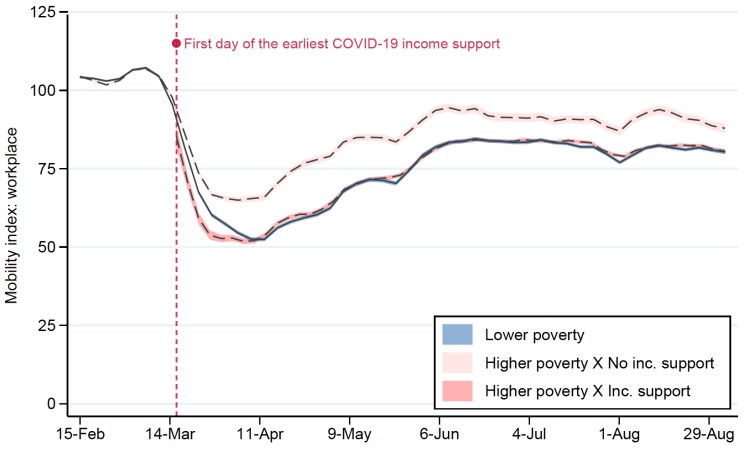

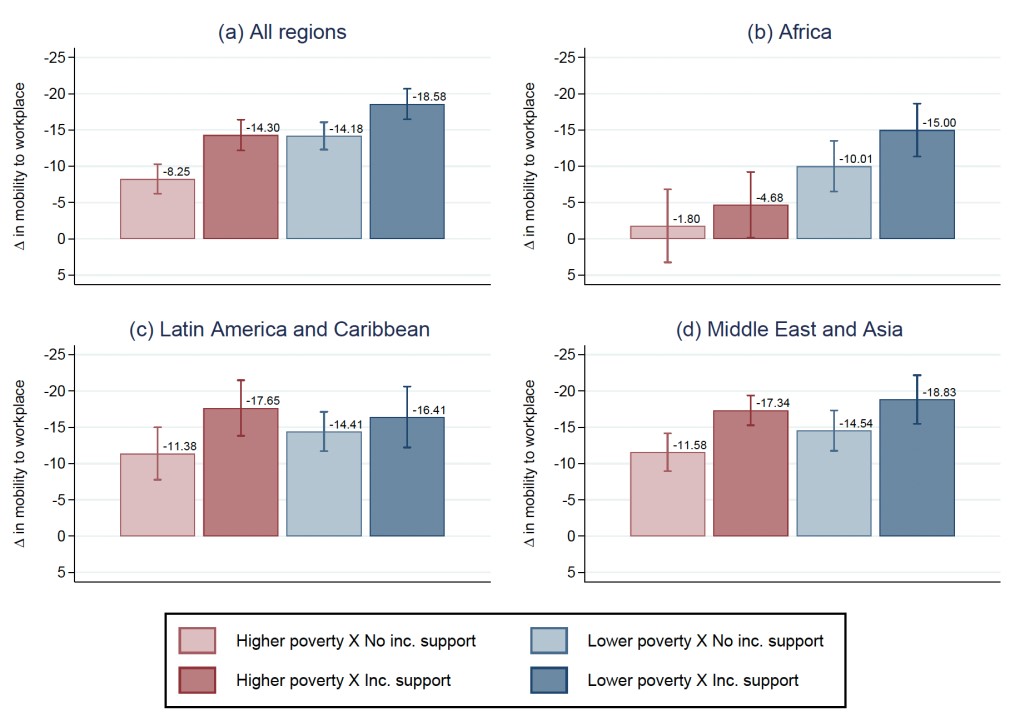

Lockdown fatigue reflects both the increasing psychosocial burden of isolation, including living conditions, and a growing income need, particular taxing for low-income households and informal workers, leading to a decreasing effectiveness of PHSM policies (Levy Yeyati et al. 2021). We estimate a relationship between mobility restrictions and working hours (compliance) that decreases with the cumulative effective length (length adjusted by intensity) of the PHSM, and increases with recent COVID-related deaths (the ‘fear factor’). The results in a non-linear relationship that captures the gap between de-jure and de-facto intensity of mobility restrictions (Figure 2).

Figure 2 Lockdown fatigue: Mobility restriction and de facto reduction

The trade-off

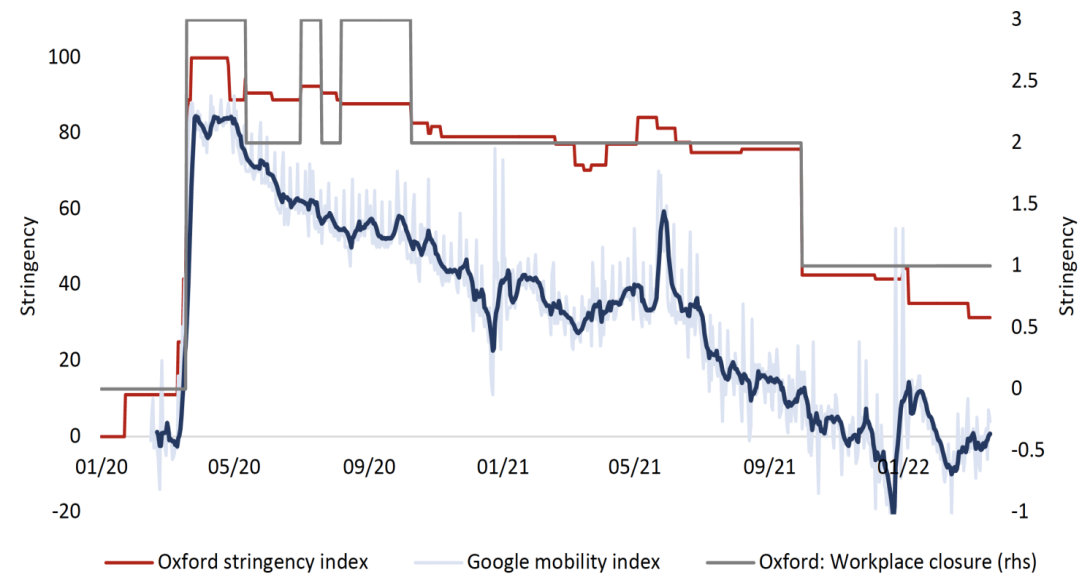

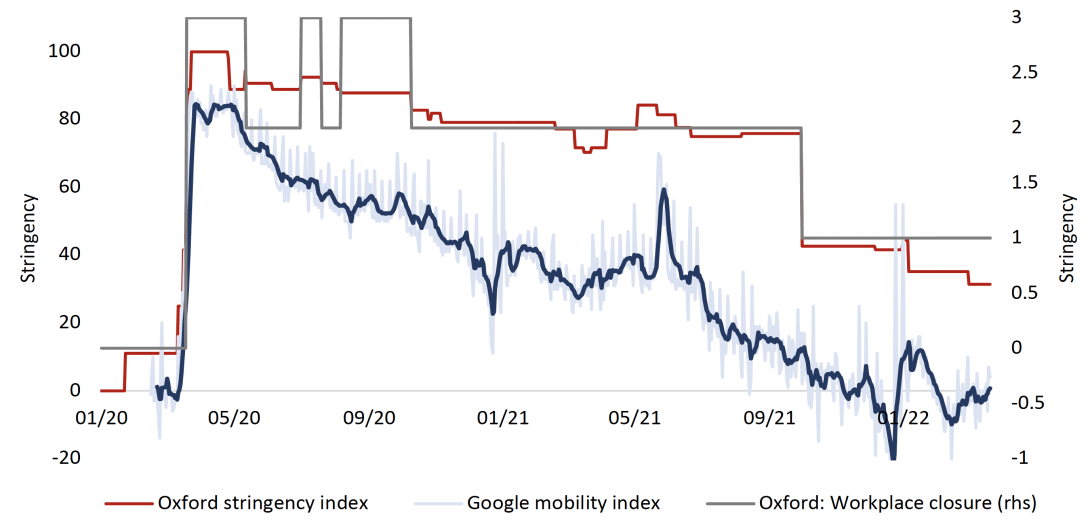

To calibrate the model, we map the sequence of PHSM measures actually implemented at the country level in 2021. This sequence yields both a path for cumulative deaths over the year, and an estimation of the GDP loss. In general, governments imposed stringent measures earlier in 2021 and were able to ease them as the vaccination rates accelerated. These results determine benchmark deaths and GDP losses that are later compared to alternative simulated scenarios.

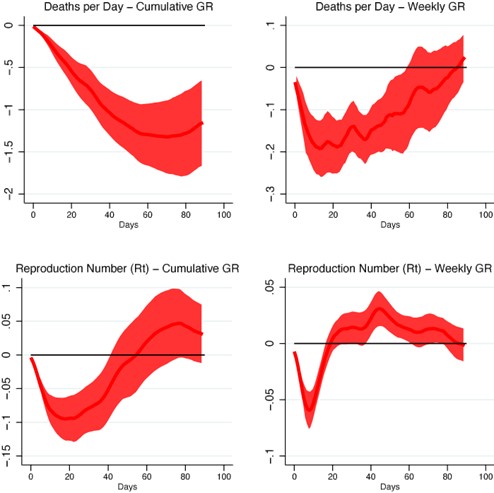

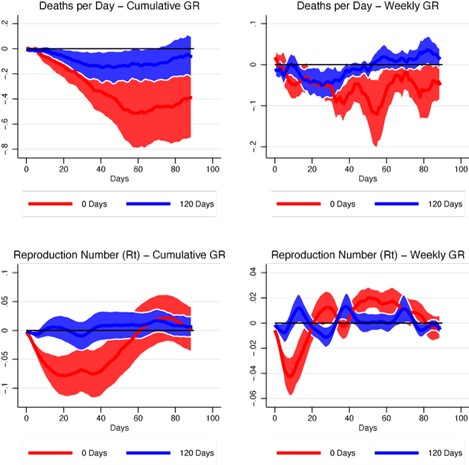

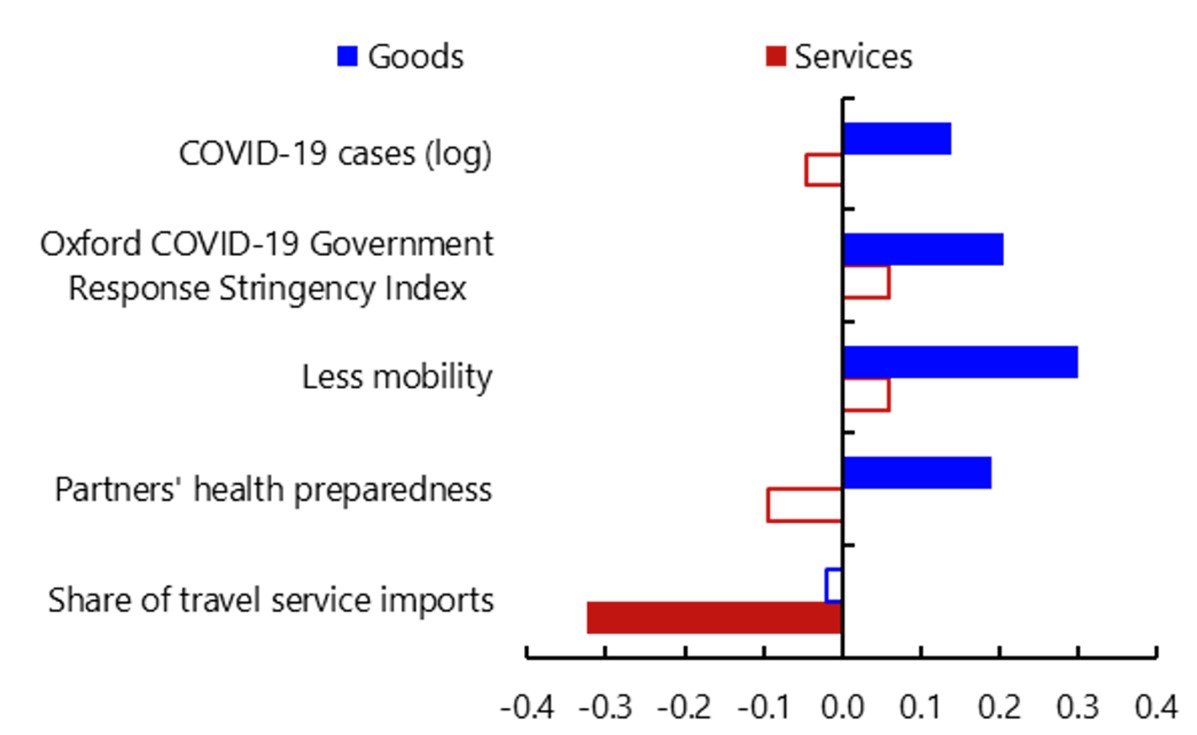

Figure 3 summarises how the two sides of the model interact. For each decision period, the economic model takes the epidemiological output (number of deaths in the previous seven days)

as an input, whereas the epidemiological model takes the economic output (working hours) as an input.

Figure 3 Epi-econ integration

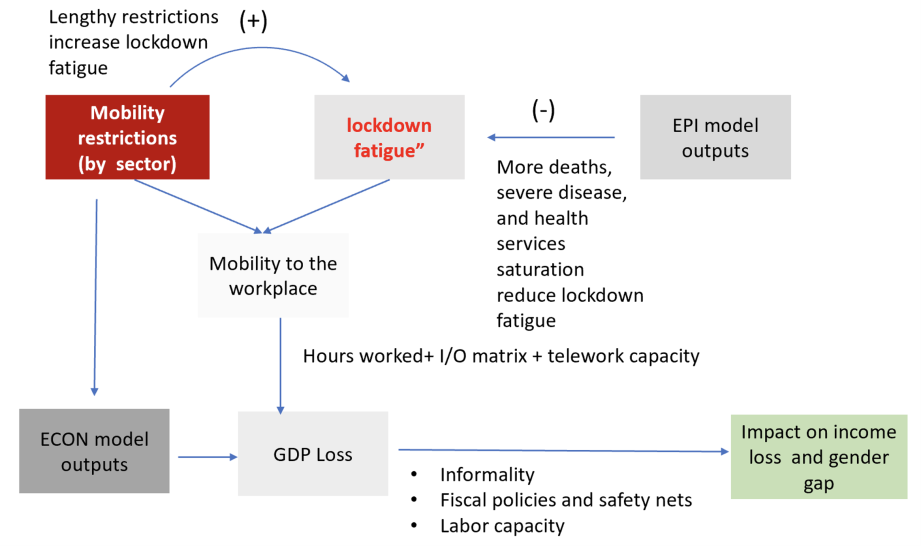

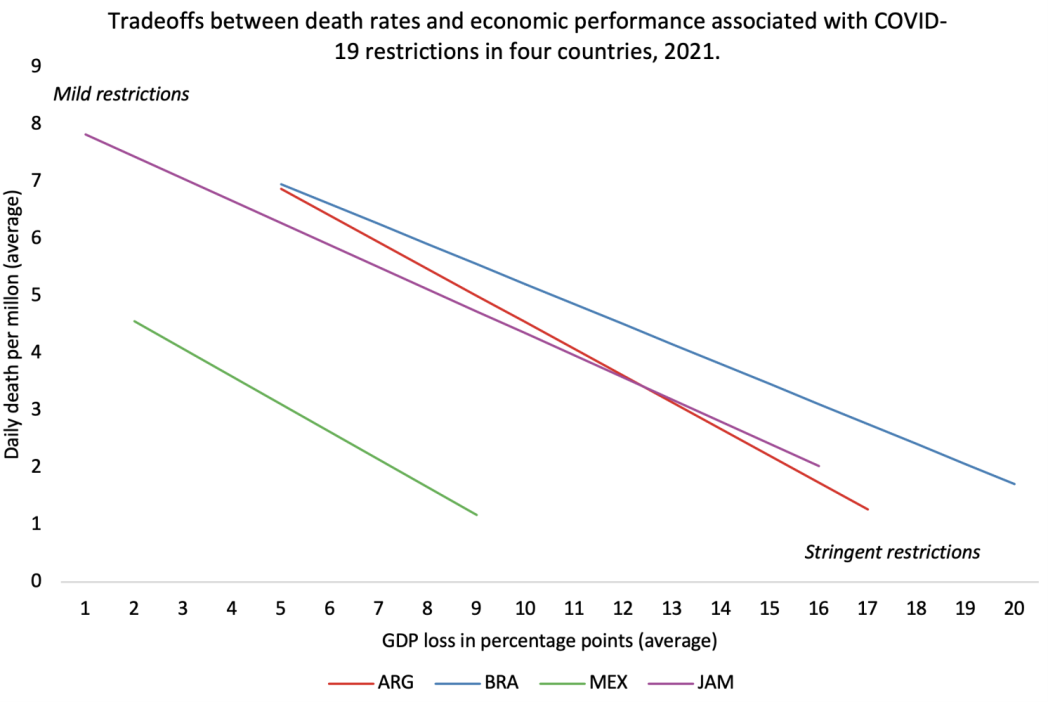

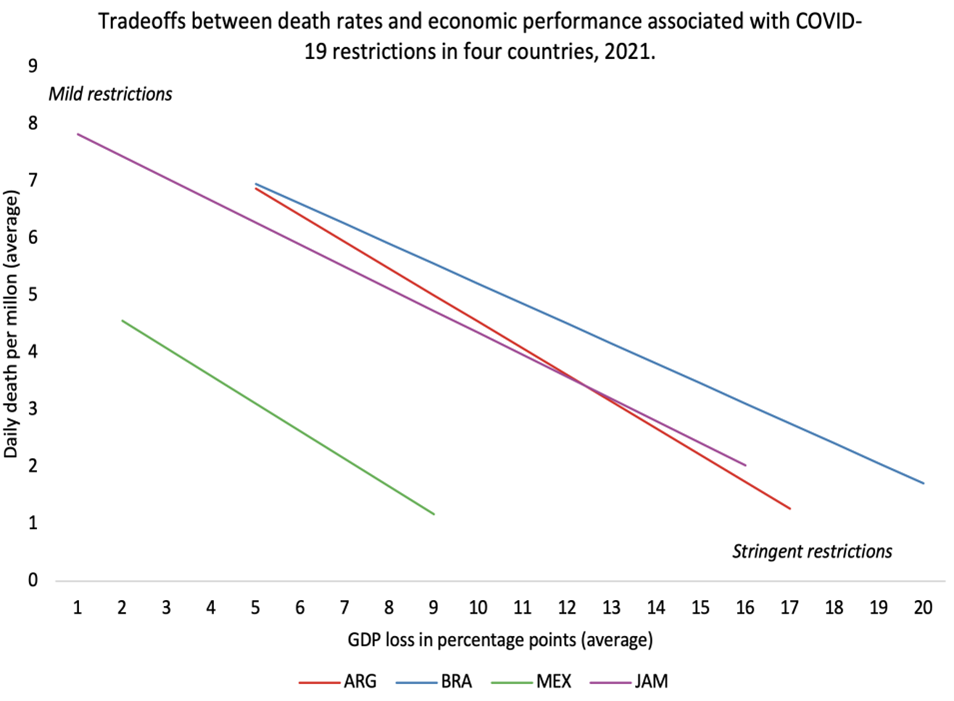

Our primary counterfactual scenario is that governments implement less stringent PHSM measures leading to increased deaths but a more modest GDP loss. Based on these alternative outcomes, we quantify the lives-livelihood trade-off as a ‘sacrifice ratio’: changes in GDP losses and COVID-related deaths when PHSM become less stringent. Naturally, we are not interested in comparing GDP with deaths, but rather in illustrating the short-run trade-offs, its determinants (comparing slopes) and the policy choices in each case (Figure 4). In particular, the slopes highlight disparities among countries. A steeper slope indicates that reducing GDP loss by 1% would result in a more substantial increase in the daily deaths – a difference that emanates from a complex interplay of economic structures, health systems, and previous COVID-19 waves. More generally, the steeper the slope of the trade-off lines, the more challenging the epidemiological-economic trade-offs.

Figure 4 Lives versus livelihoods

Social outcomes

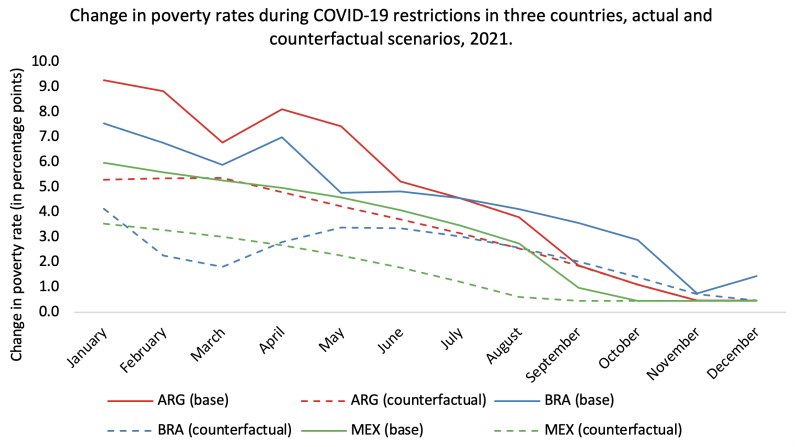

The model also looks into the interaction of PHSM and social indicators. In particular, it illustrates the widening poverty gap as the stringency of PHSM policies soften in the counterfactual scenario, converging as restrictions eased toward the end of 2021 (Figure 5).

Figure 5 Poverty rates

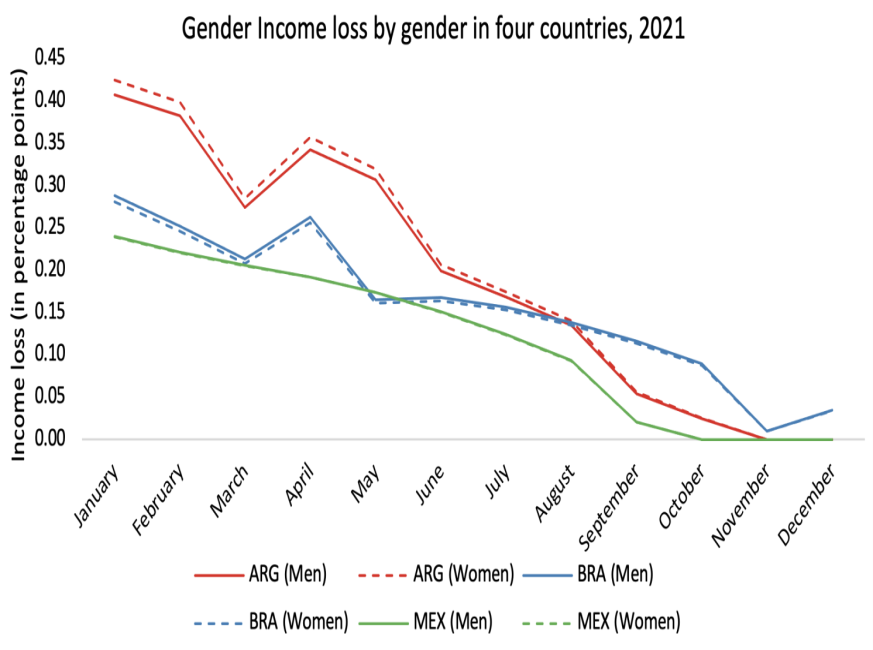

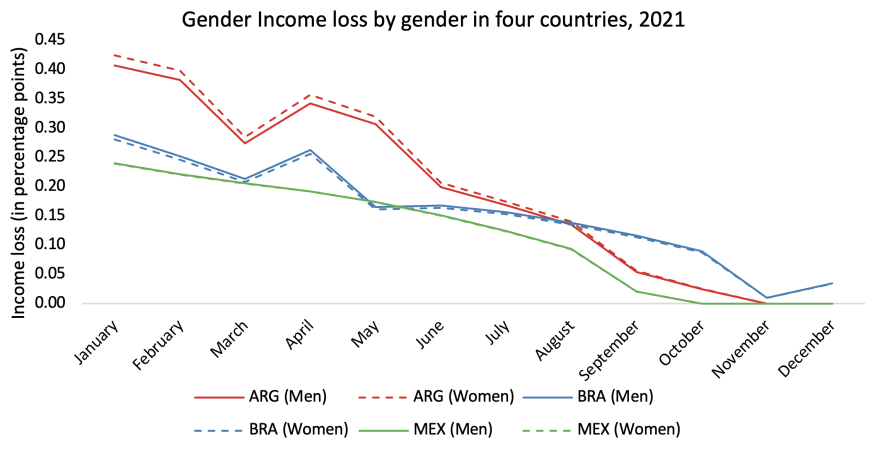

Finally, regarding gender disparities, the results somewhat challenge conventional expectations. We find no statistically significant difference between the income loss for both men and women, particularly during the initial stricter PHSM periods – although the simulations do not take into account the incidence of the increased burden of home work within the household.

Figure 7 Gender gap

Conclusion

In navigating the fraught complexities of pandemic response, policymakers face the daunting task of strategic decision-making (Ferranna et al. 2021), particularly in emerging economies where economic losses are expected to be more persistent. Our model, publicly available and customizable, is a powerful tool for policymakers to assess trade-offs in the context of their unique socio-economic landscapes. In particular, the presence of a steep short-term trade-off between health and economics losses emphasises the relevance of targeted pharmaceutical policies, notably increased vaccination coverage. The model is not intended to pin down an optimal PHSM schedule, a balancing act (Baldwin 2020) that ultimately depends on policy weights that are bound to differ even between policy makers in the same country. Rather, it offers a first insight on the dynamic relationship between PHSM, public behaviour and outcomes in a policy tool that simulates the costs of alternative PHSM programmes and updates them as data becomes available, a first step for better preparedness in the future.

25 gennaio 2023

CHRISTINE DE LA MAISONNEUVE, BALÁZS ÉGERT, DAVE TURNER

Quantifying the macroeconomic impact of COVID-19-related school closures on human capital

(synthesis; full article – https://cepr.org/voxeu/columns/quantifying-macroeconomic-impact-covid-19-related-school-closures-human-capital)

Abstract: The COVID-19 pandemic caused school closures in almost all countries, leading to learning losses. This column uses a new measure of human capital to estimate the long-term effect on aggregate productivity across OECD countries. The results show school closures lead to significant and persistent productivity losses, and the effects will peak in 2067. Policies aimed at improving the quality of education and adult training will be needed to offset or at least alleviate the impact of the pandemic on human capital.

Keywords: COVID-19, education, school closures, human capital, lost schooling.

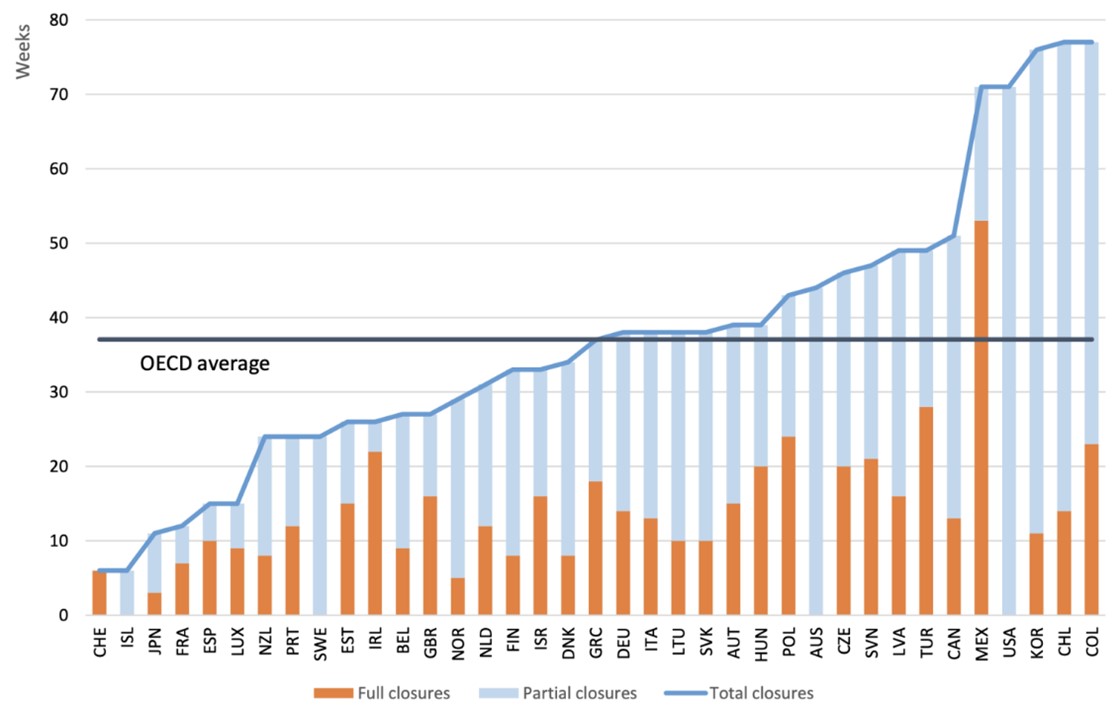

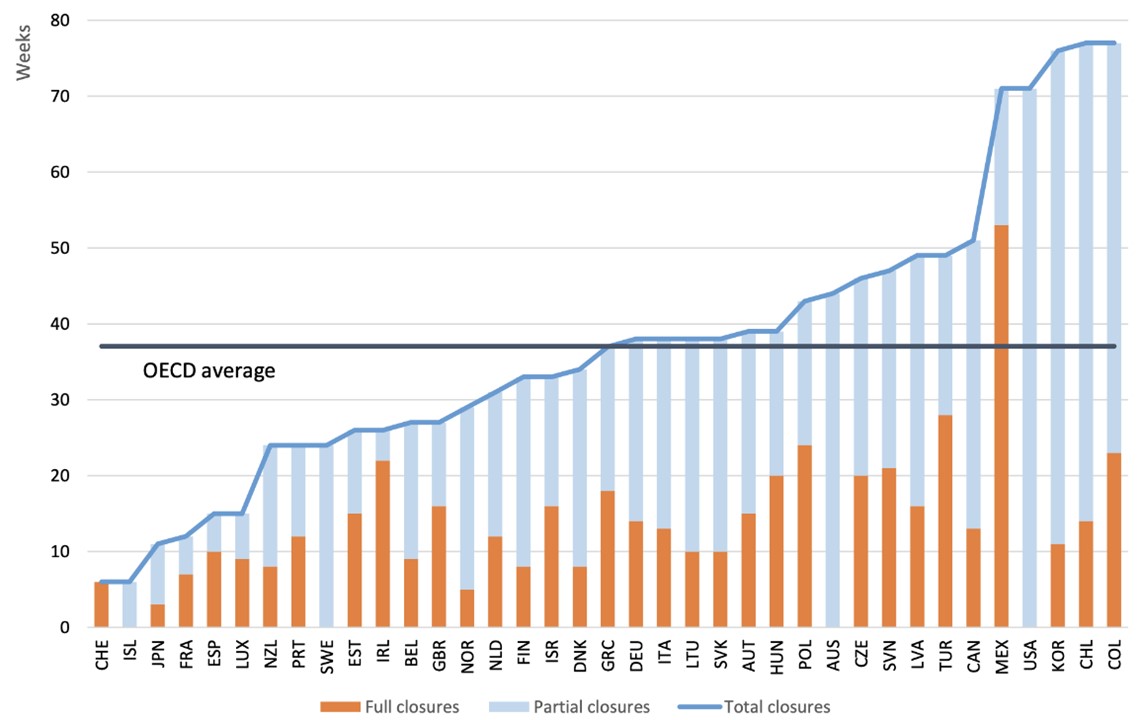

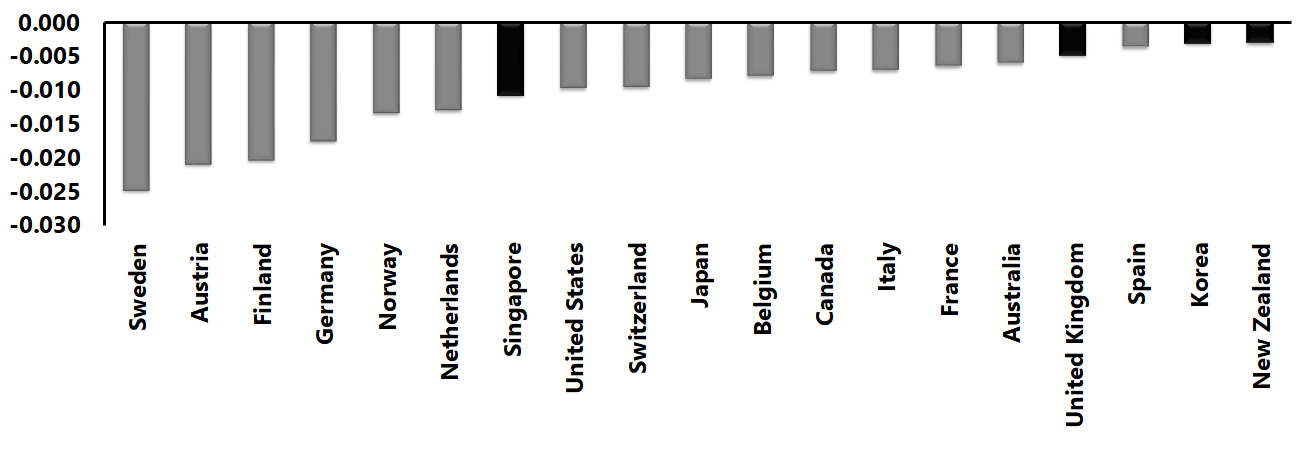

The COVID-19 pandemic led to the partial or full closure of schools in almost all countries around the world. On average, across OECD countries, school buildings were fully closed for 13 weeks and partially closed for a further 24 weeks between March 2020 and October 2021, which combined is equivalent to around one full school year. 1 Learning losses stemming from school closure may be difficult to make up and so may have a long-term economic impact on the students affected, with possible enduring macroeconomic consequences (Ilzetzki 2020, Kuhn et al. 2020, Popova et al. 2020).

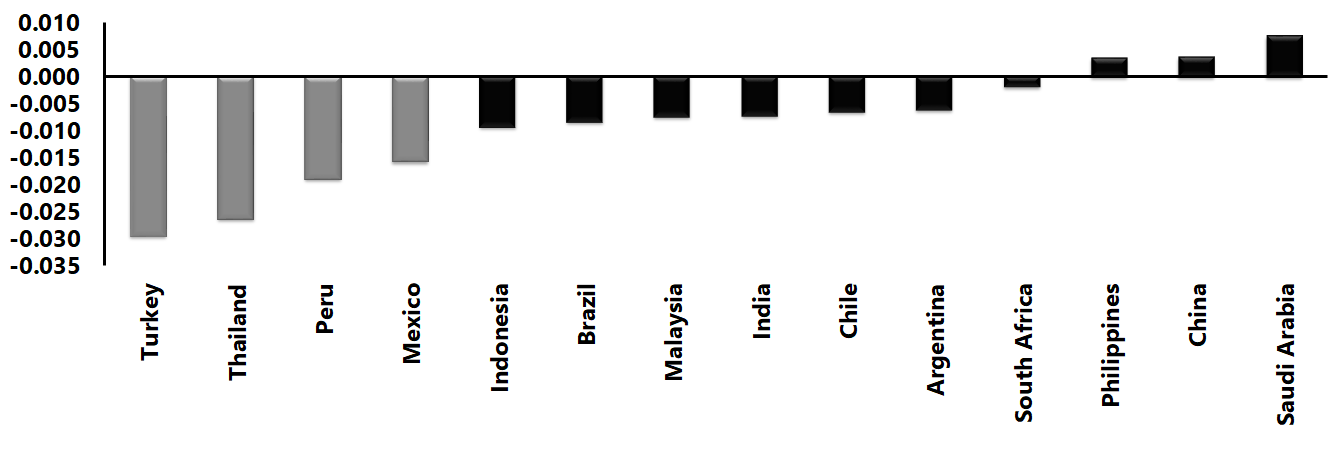

Figure 1 Duration of school closures between March 2020 and October 2021

Note: Full school closures refer to situations where all schools were closed nationwide due to COVID-19. Partial school closures refer to school closures in some regions or for some grades, or with reduced in-person instruction. Total closures are defined as the simple unweighted sum of these two aggregates. Source: UNESCO.

Note: Full school closures refer to situations where all schools were closed nationwide due to COVID-19. Partial school closures refer to school closures in some regions or for some grades, or with reduced in-person instruction. Total closures are defined as the simple unweighted sum of these two aggregates. Source: UNESCO.

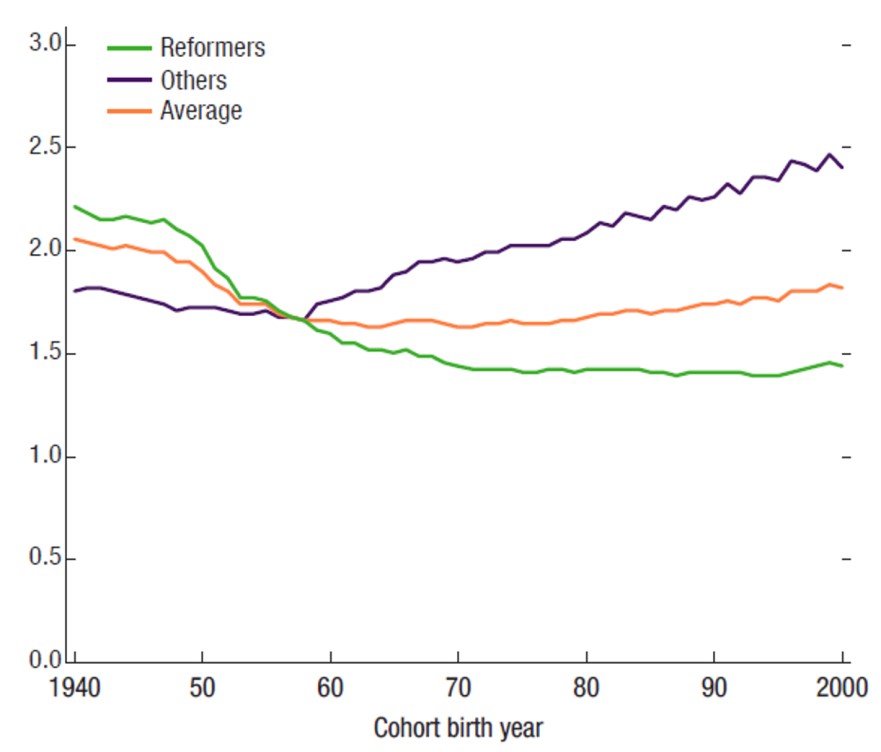

We exploit a new measure of human capital, derived in Égert et al. (2022), that combines mean years of schooling (MYS) and OECD data from the Programme for International Student Assessment (PISA). The new measure is a cohort-weighted average of past PISA scores (representing the quality of education) of the working-age population and the corresponding mean years of schooling (representing the quantity of education). Weights for PISA scores and mean years of schooling are estimated from regressions which consider how well the cohort-weighted variables explain scores from the Programme of International Assessment of Adult Competencies (PIACC).

Based on this new measure, we can compute separately the effect of the pandemic on PISA scores and mean years of schooling (MYS) and feed this into the stock measure of human capital. For each cohort impacted, we add up the effects of the pandemic on MYS and PISA test scores to estimate the overall effect on human capital. We calculate these using the elasticities of MYS and PISA with respect to human capital, estimated in Égert et al. (2022). We then calculate a population-weighted average of the impact of each cohort affected to provide the global effect on human capital.

The new measure of human capital shows a robust correlation with productivity for OECD countries in cross-country time-series panel regressions. This helps us quantify the macroeconomic losses due to school closures, reflected in losses in PISA scores and mean years of schooling.

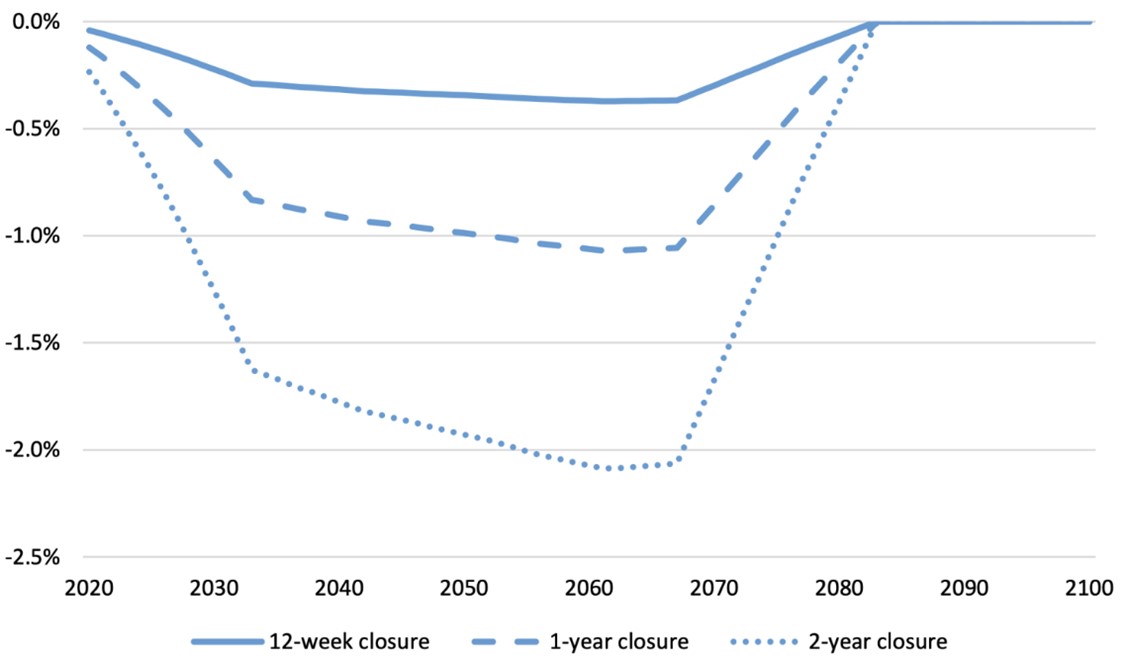

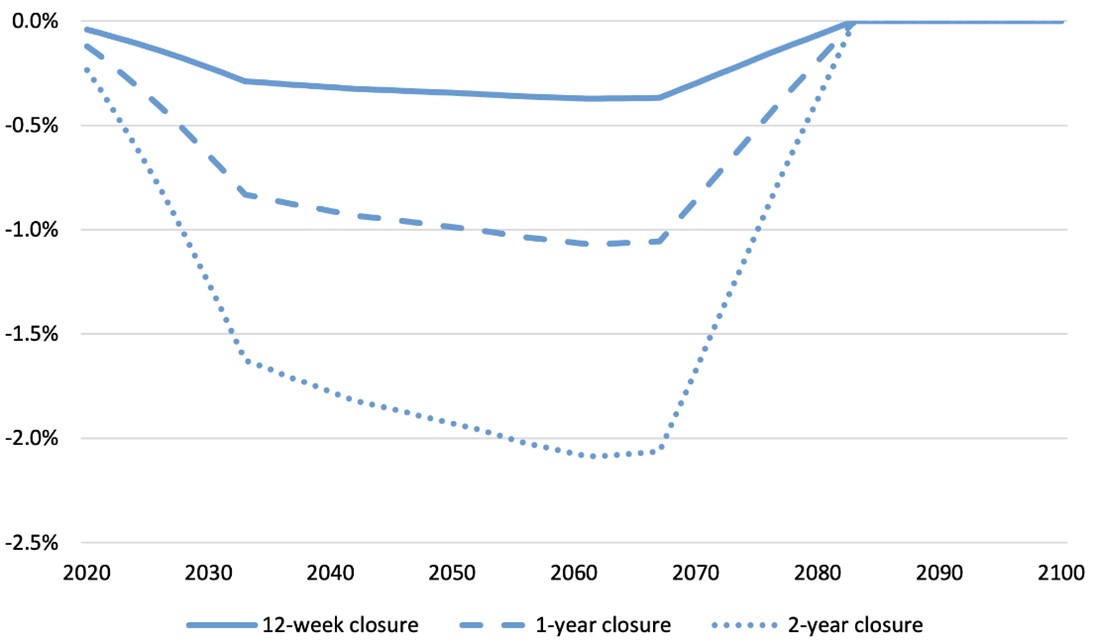

Using these estimates, we consider three scenarios:

- The effect of the spring 2020 school closuresexperienced in many OECD countries, which roughly corresponded to one-third of a school year closure. This period of closure translates into a -2.6% decrease in mean years of schooling 2 and, using the rule-of-thumb described above, a 0.14 standard deviation fall in PISA scores, 3 corresponding to a 1.1% decrease in PISA scores. 4

- The effect of a one-year school closure, broadly corresponding to the average total (full and partial) school closures observed across OECD countries since the start of the pandemic and, according to a first assessment, to the learning loss of the most disadvantaged students in the US (US Department of Education, 2022). This scenario translates into a -8.2% decrease in MYS and a -0.37 standard deviation fall in PISA scores, corresponding to a 2.9% decrease in PISA scores.

- The effect of a two-year school closure, which occurred only rarely and broadly corresponding to the total (full and partial) school closure in Colombia, Chile, Korea, and Mexico since the start of the pandemic which translates into a -16.5% decrease in MYS and a 5.6% and a -0.72 standard deviation fall in PISA scores

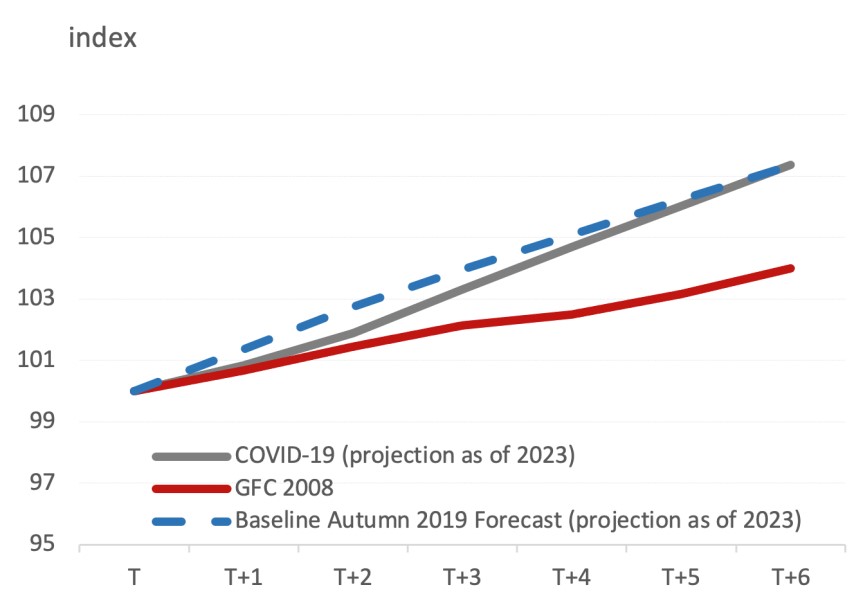

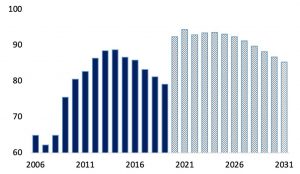

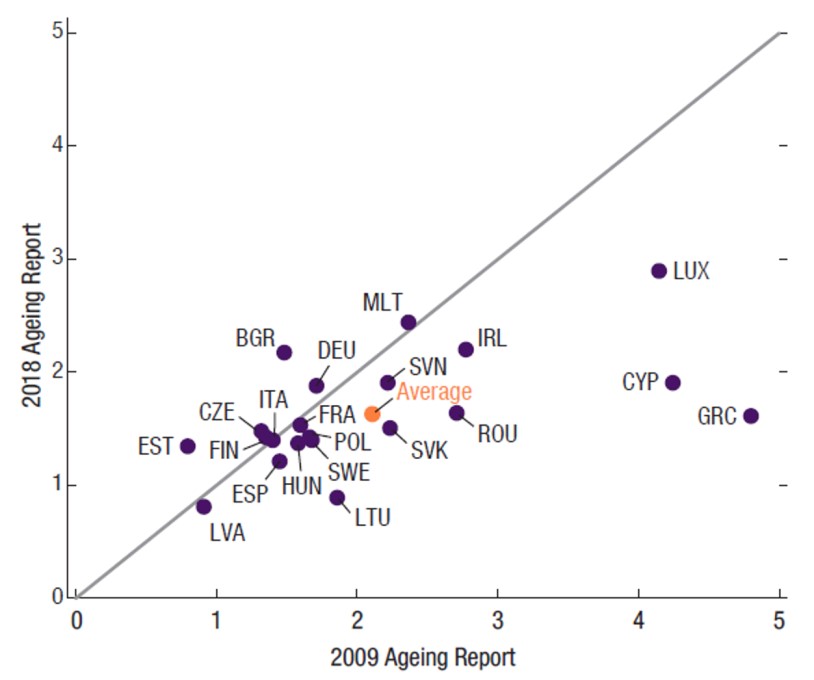

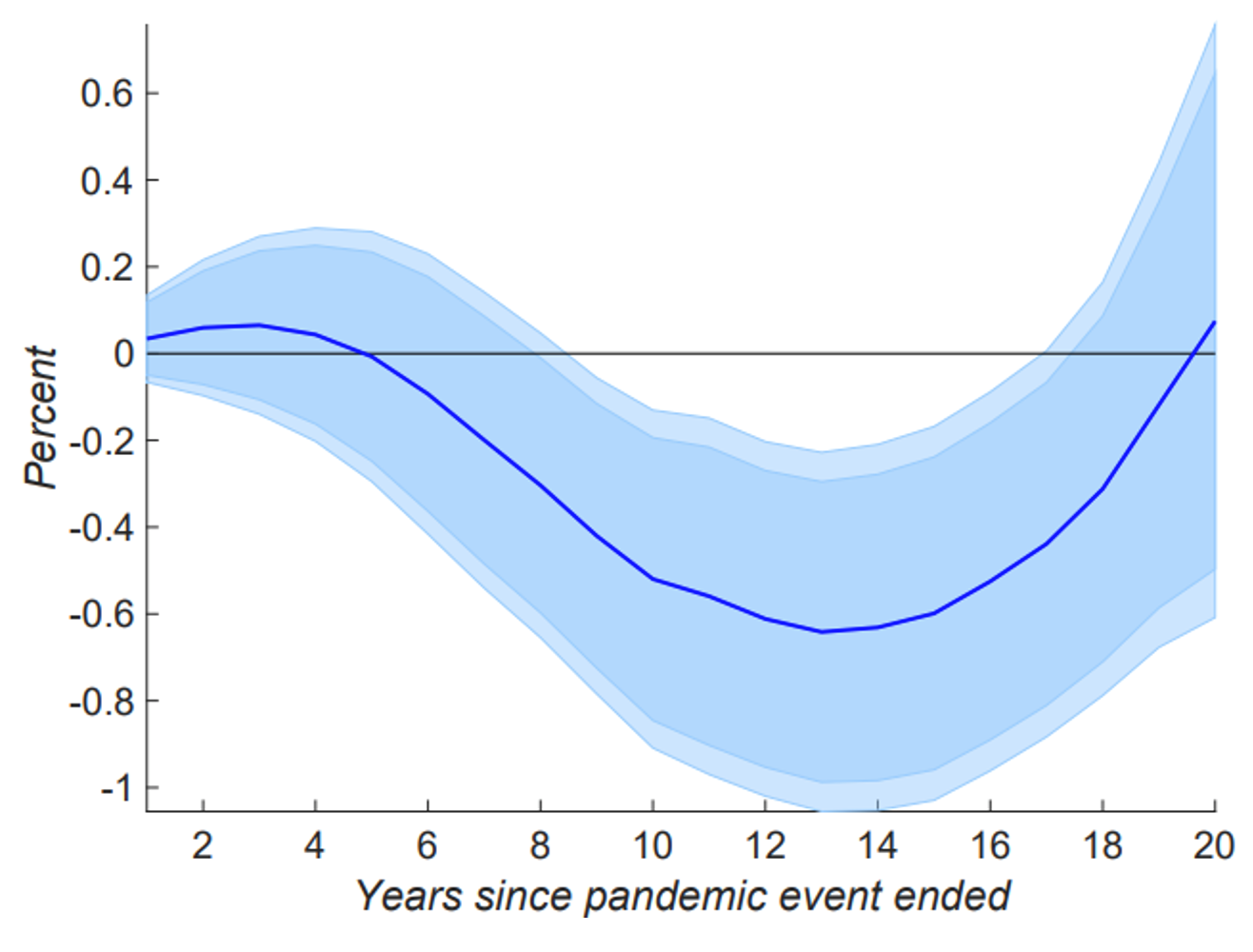

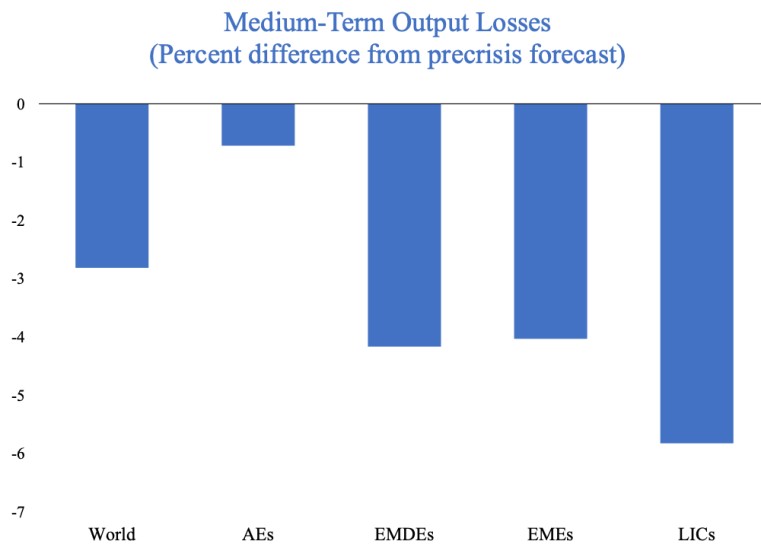

We estimate the impact of school closures on productivity through the human capital effect for these three scenarios. Multivariate productivity regressions link productivity to human capital in the presence of a number of control variables such as innovation intensity, product market regulation and trade openness. The impact will increase gradually as the student cohorts hit by the pandemic enter the labour force, reaching its peak in 2067. At that date, the impact of school closures on productivity will be -0.4%, -1.1% and -2.1% in the first, second and third scenarios, respectively. The impact will then dissipate gradually until the last impacted cohort retires in 2083 (Figure 2). The impact is largest in 2067, as this is when all the impacted cohorts will be in the older part of the labour force, and the impact on human capital is most important.

Figure 2 The impact of school closure on productivity

Source: Authors’ calculations.

Comparison with estimates in the existing literature

The empirical findings of the literature standardised to a one-year school closure imply a non-negligible impact of the crisis on the level of GDP ranging from -1.1% to -4.7% around 2040-2050 (Dorn et al. 2020, Hanushek and Woessmann 2020, and Viana Costa et al. 2021). Researchers have used different methodologies. Dom et al. (2020) set up various scenarios to produce back-of-the-envelope calculations. Viana Costa et al. (2021) derive the economic costs using microsimulation model calculations. The calculations of Hanushek and Woessmann (2020) use macro regression analysis, which links GDP per capita to student test scores in a multi-country error-correction framework. Our results are broadly consistent with much of the literature except

for Hanushek and Woessmann (2020), who found a much larger effect (-4.7%). Those results would be equivalent, ceteris paribus, for effect on GDP per capita.

Mitigation policies

Mitigating the COVID-19 impact on human capital is a major policy challenge because most, if not all, education policy reforms have long implementation lags, implying that education policies mitigating the pandemic’s effect will not be able to reach the oldest student cohorts affected by COVID-19. An additional difficulty is that some policies concern the youngest students. Measures that could be implemented to help the catch up of affected student generations include the following (OECD 2020, OECD-Education International 2021, and Molato-Gayares et al. 2022):

- Extending the teaching time by temporarily reducing school holidays and/or adding hours in a school day.

- Revising the curriculum to focus on key skills.

- Providing teachers with training.

- Considering the use of digital technologies to improve the diagnosis of learning gaps and facilitate more individualised teaching practices

- Spreading collaboration and professional ways of working to increase teachers’ effectiveness

For the cohorts that have already left school, it is important to strengthen young adult training programmes. However, these are notoriously not very cost-effective, and offsetting losses in learning at younger ages can turn out to be very costly for the government budget.

Further measures could include extending and improving the quality of pre-school education, considered by many as the best value for money, which would come too late for almost all student cohorts affected by the pandemic. Other education policy reforms, which are found to have a positive correlation with student test scores during normal times, but which might also help offset some of the losses for the younger generations in the aftermath of the pandemic, include increased school accountability and school autonomy, reduced early tracking and improved teacher quality and qualifications.

18 Dicembre 2022

MATHIAS DREHMANN, MIKAEL JUSELIUS, DAVID AIKMAN

Supply shocks, monetary policy, and scarring

(synthesis; full article: https://cepr.org/voxeu/columns/supply-shocks-monetary-policy-and-scarring)

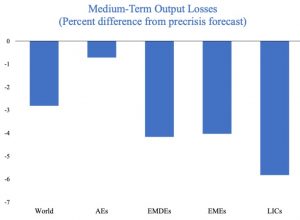

Abstract: There are heightened concerns that advanced economies are on the brink of a recession, but even the pessimists generally agree that economies will eventually converge back to trend. This column casts doubt on this view. Using a panel of 24 countries from 1970 onwards, the authors find that there is a significant tipping point in recovery dynamics, which depends on the size of the initial contraction: severe contractions have highly persistent effects, whereas smaller contractions do not. This finding holds regardless of whether the contraction follows aggressive monetary tightening to combat high inflation, energy price disruptions or other factors (including financial crises)

Keywords: ecomic recovery, recessions, economic expansions and contractions, business cycles, monetary policy, COVID-19.

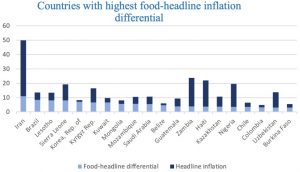

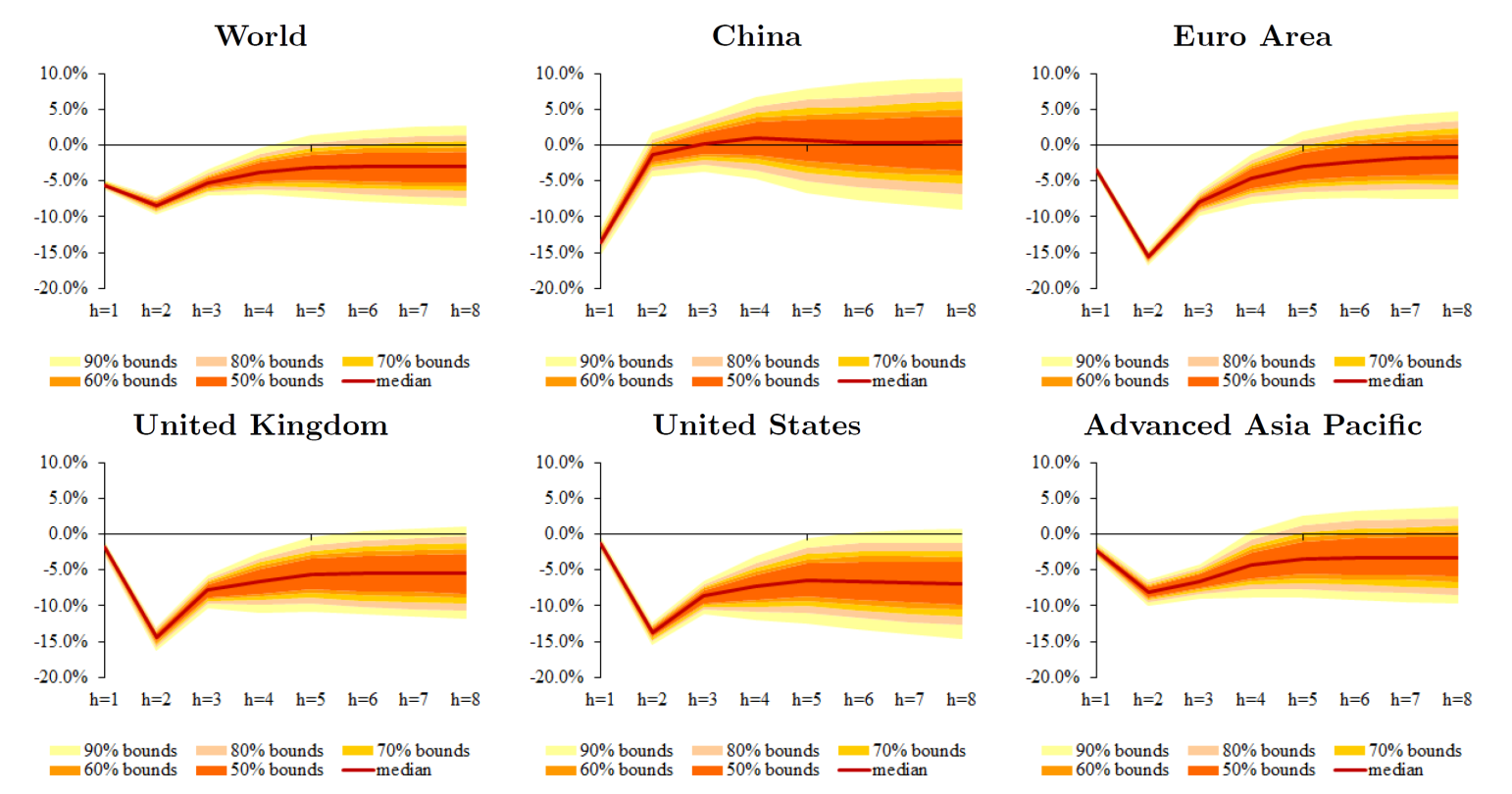

The current outlook for economies globally is bleak. Headline inflation rates around the world have soared following supply-side disruptions from the war in Ukraine, previous Covid-19 lockdowns, and possible further lockdowns in China. As central banks have pivoted to a more aggressive tightening phase, the question of whether they can manage soft landings or whether there will be recessions has been hotly debated (e.g. Boissay et al. 2022, Summers 2022, Yellen 2022). But despite major uncertainties ahead, private and public forecasters generally agree that the economy will revert back to trend in the medium run. One reason for this is that full recoveries are essentially baked into standard macro models qua assumption.

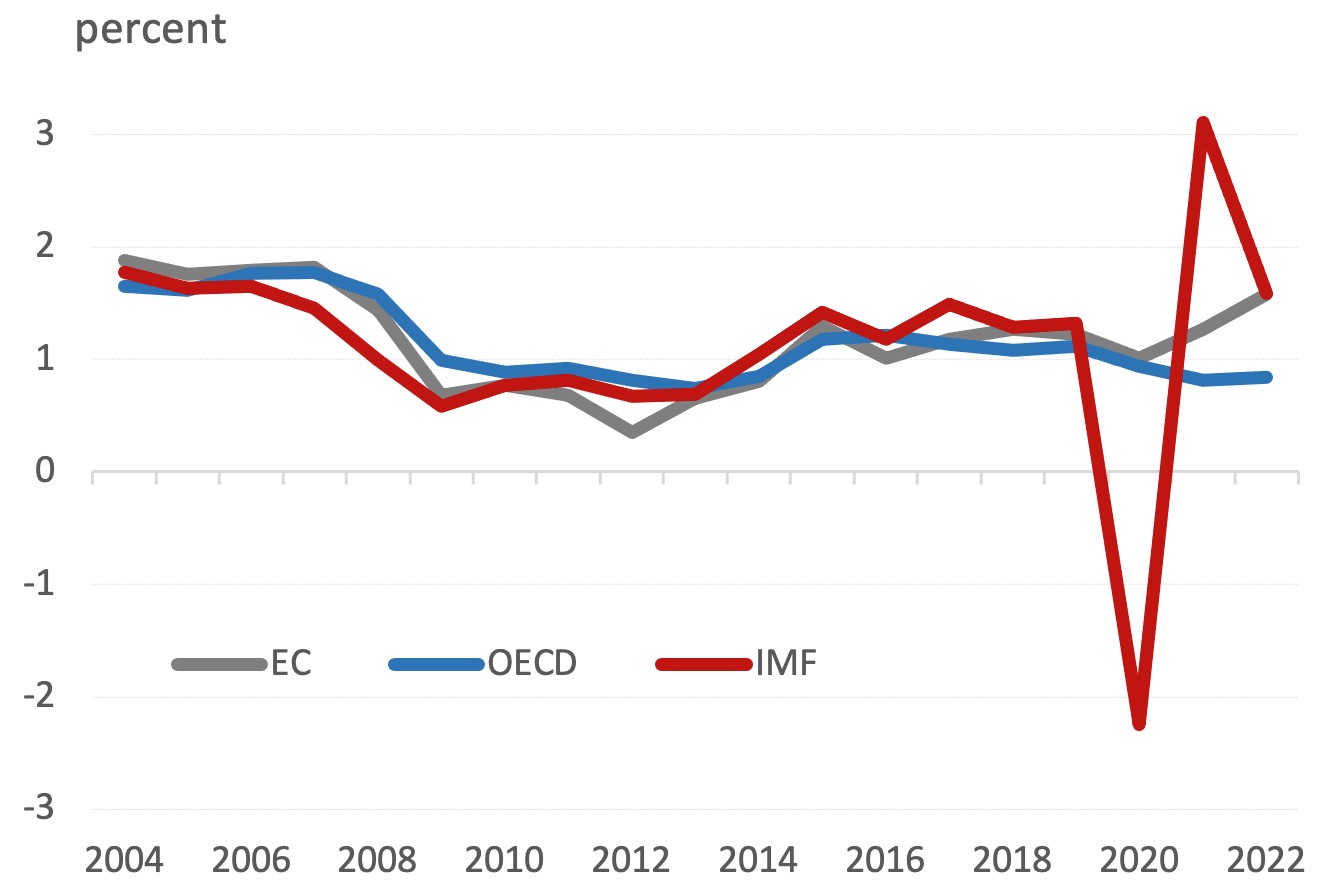

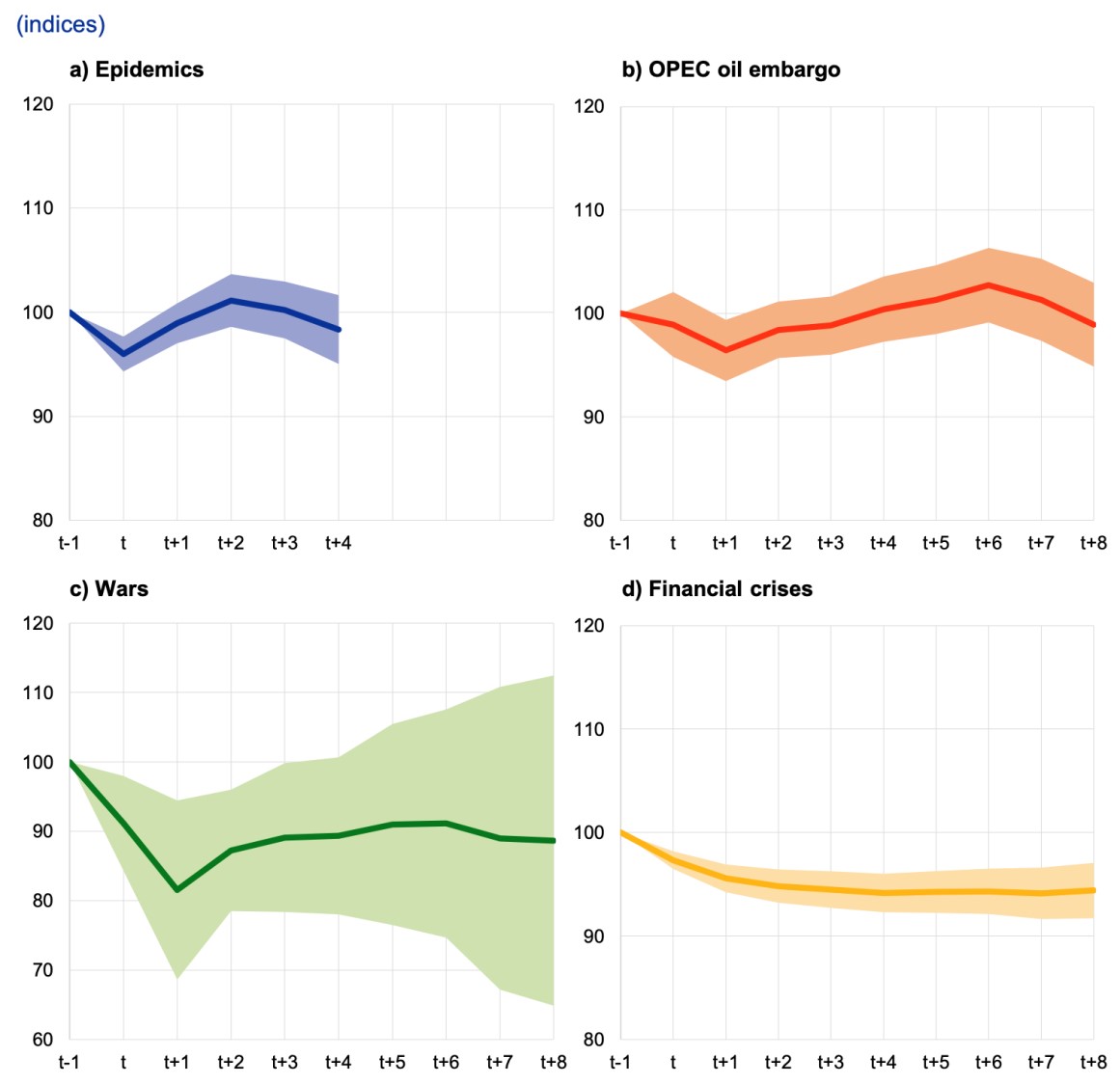

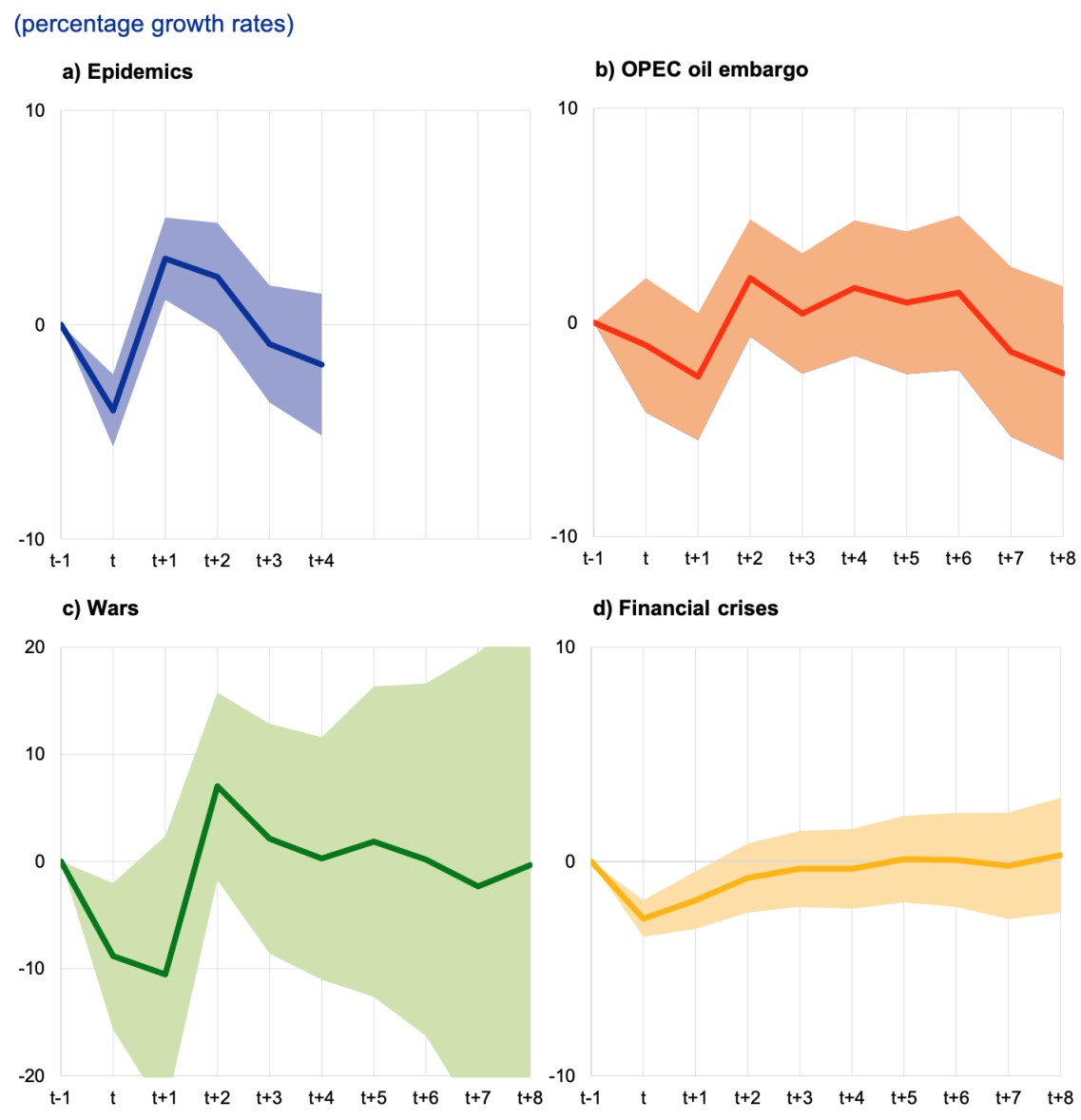

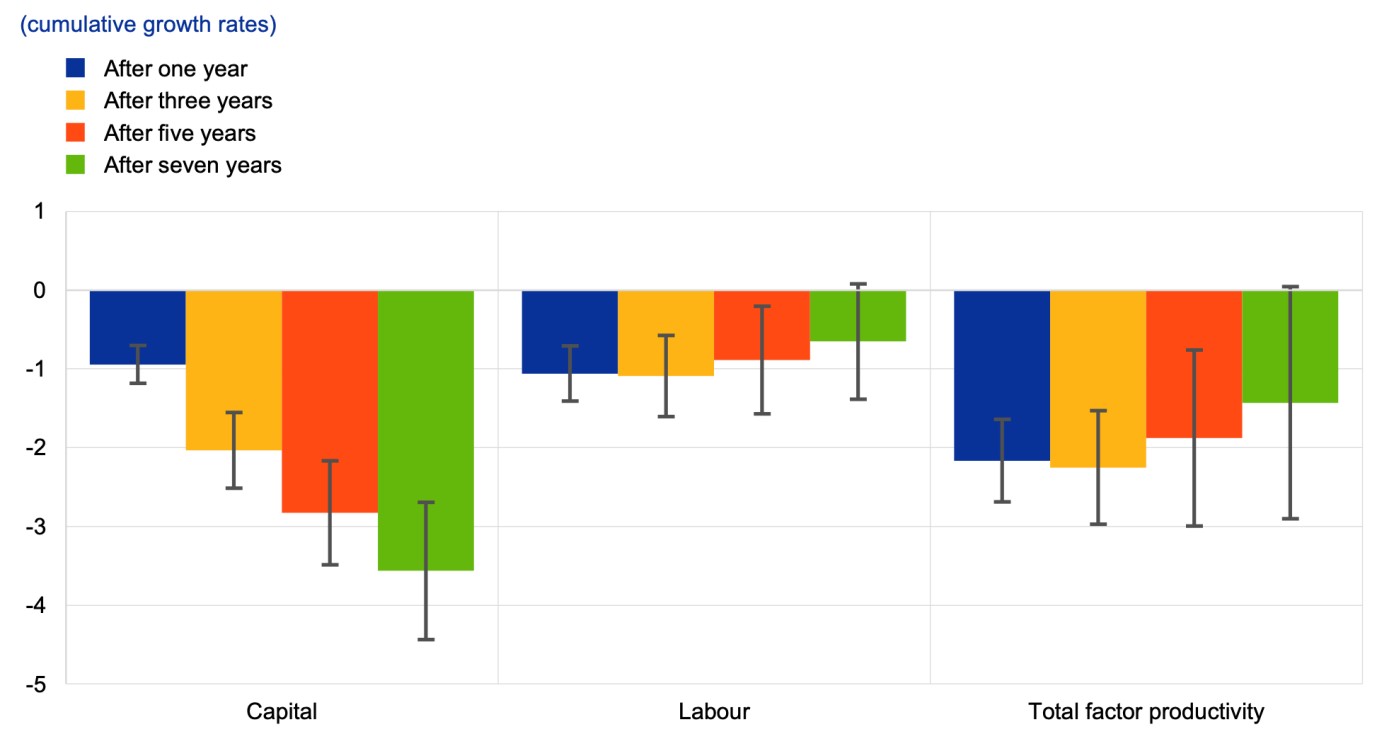

The data do not support such confidence in the stability of the medium-term outlook. Our research with Xiaochuan Xing (Aikman et al. 2022) highlights the fact that deep contractions more often than not leave long-term economic scars. It is well known that such scarring can occur following recessions caused by financial crises, such as that of 2007-09 (e.g. Cerra and Saxena 2008). What is less well known is that scarring also occurs after deep recessions associated with other factors, such as monetary policy tightening or oil price disruptions. 2 As we discuss below, this has important implications for policy.

The scarring effects of deep recessions

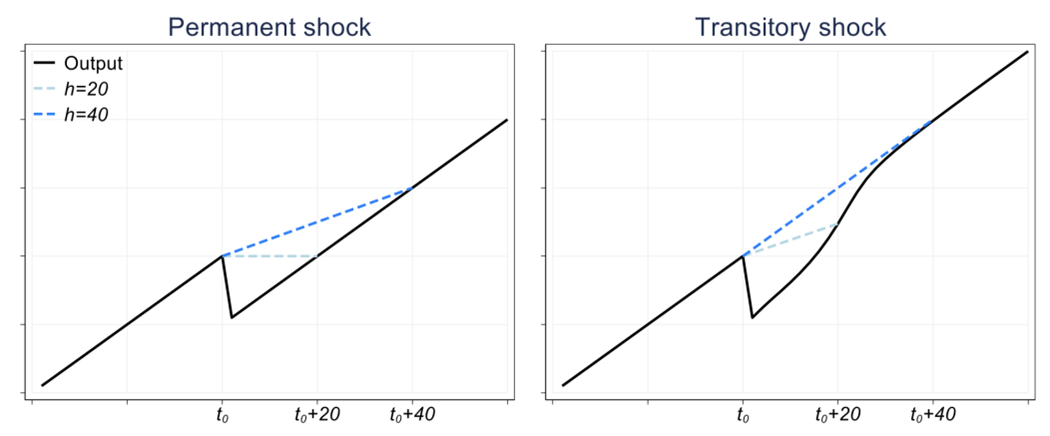

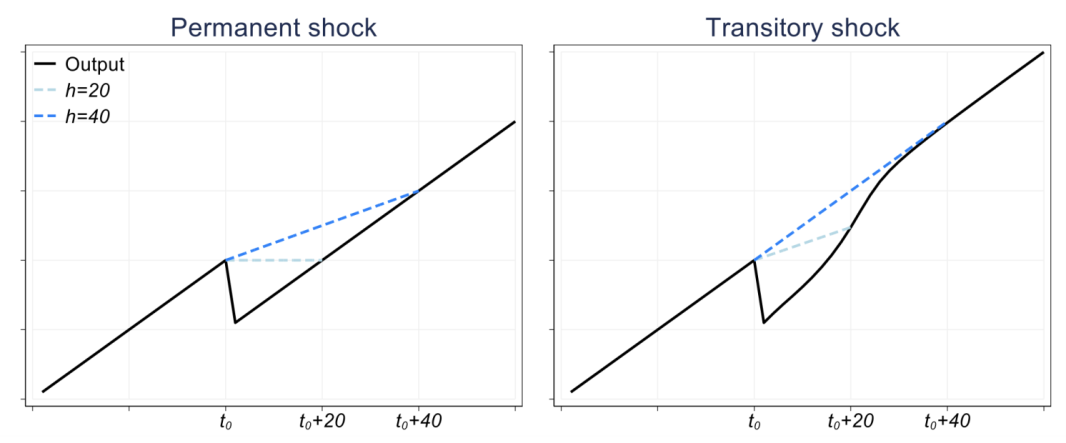

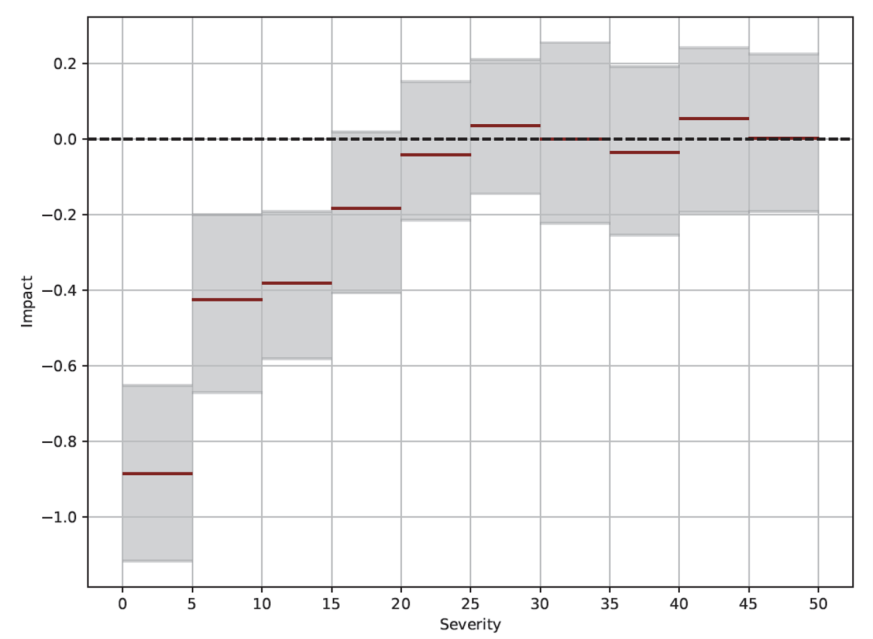

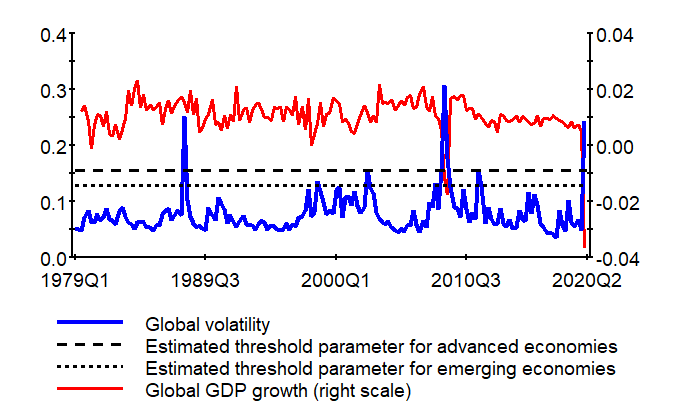

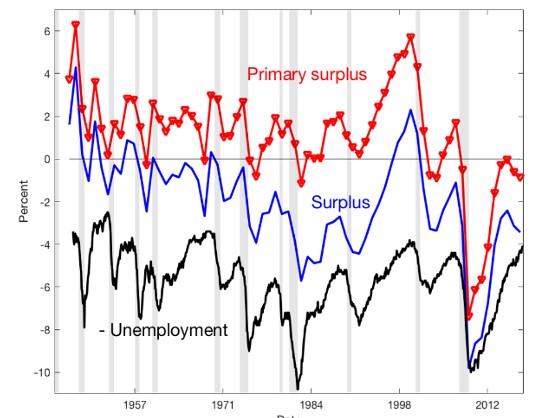

Our results are based on a simple, intuitive test, which is illustrated in Figure 1.

We first bucket together contractions of similar magnitudes in our dataset, starting with the weakest 5% of outcomes across countries. For these most severe contractions, we compare 10-year ahead growth rates calculated immediately prior to the contraction with those from all other points in our sample. If real output eventually recovers its previous trend, there should be no statistical difference between these two long-term growth rates on average. However, if contractions cause scarring, long-term growth rates taken from their eve will be lower than the rest.

We then repeat the process for successively milder outcomes in 5% intervals until we reach the median.

- Figure 1 Detecting scarring effects with long-run growth rates: An illustration

- Note: Illustration of the impact of alternative shocks at time t0 on multi-period growth rates. From the perspective of t0, a permanent shock (left panel) of size -d reduces the h-quarter ahead growth rate by -d/h (blue dotted lines). In contrast, if the shock is transitory, the average growth rate returns to the trend for large enough horizons (right panel).

- Our sample contains 19 advanced economies and five emerging market economies (EMEs) from 1970 to the present.3 We remove long-run growth trends and normalise growth rates by country-specific means and standard deviations to make sure that they are comparable across countries.

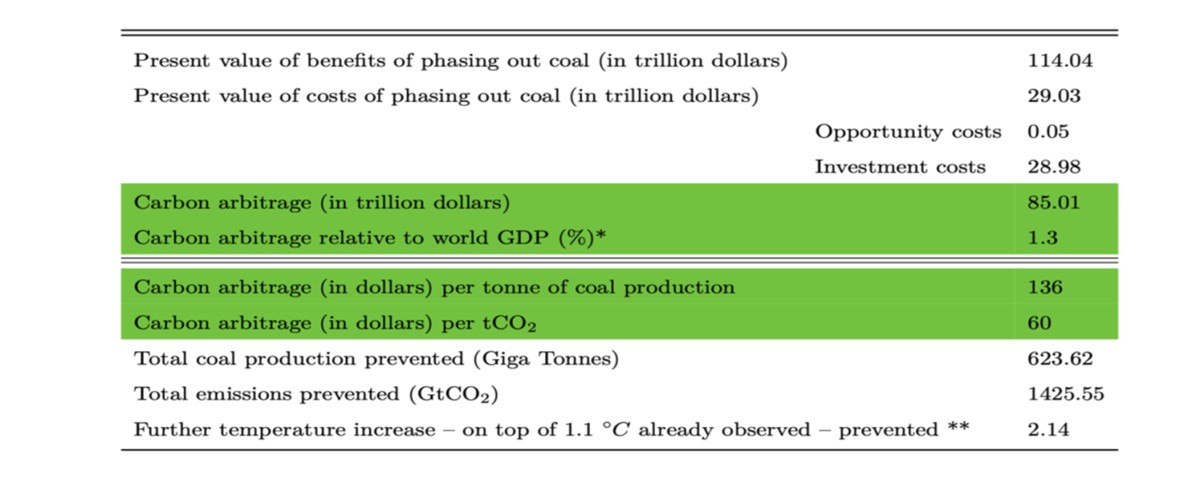

- Figure 2 shows the scarring effects of deep contractions. The dark red lines show the difference between the average 10-year ahead real GDP growth at the onset of the contraction and the rest of the sample. We calculate these differences for contractions of different sizes as described above (shown on the x-axis). Grey areas are confidence intervals.

- The worst 20% of contractions in terms of severity have highly persistent costs whose effects are visible in the level of GDP a decade hence. But the magnitude of the scarring increases more than proportionally with the size of the initial contraction. For the deepest contractions, i.e. those in the worst 5%, GDP growth in the decade that follows is substantially below the full sample mean. This translates into a persistent loss of 4.25% in the level of real GDP for an average economy.

- We also show in the paper that while the specific tipping point may vary with the test specification, the main takeaway that only severe contractions have scarring effects is very robust across samples, time periods, detrending methods, and approach used to identify contractions.

- Figure 2 Only severe contractions have scarring effects

- Note: Difference in mean 10-year growth rates following contractions of different severity versus that calculated using all other points in the sample. The solid lines show points estimates of this difference for contractions in the severity buckets indicated on the x-axis. The shaded areas are 95% confidence intervals. Severity buckets are based on distribution of annual real GDP growth outcomes starting with the weakest 5% outcomes (“most severe”) to then look at successively milder outcomes in 5% intervals until the 45th to 50th percentile (“mild”). The y-axis is standard deviations of 10-year real GDP growth.

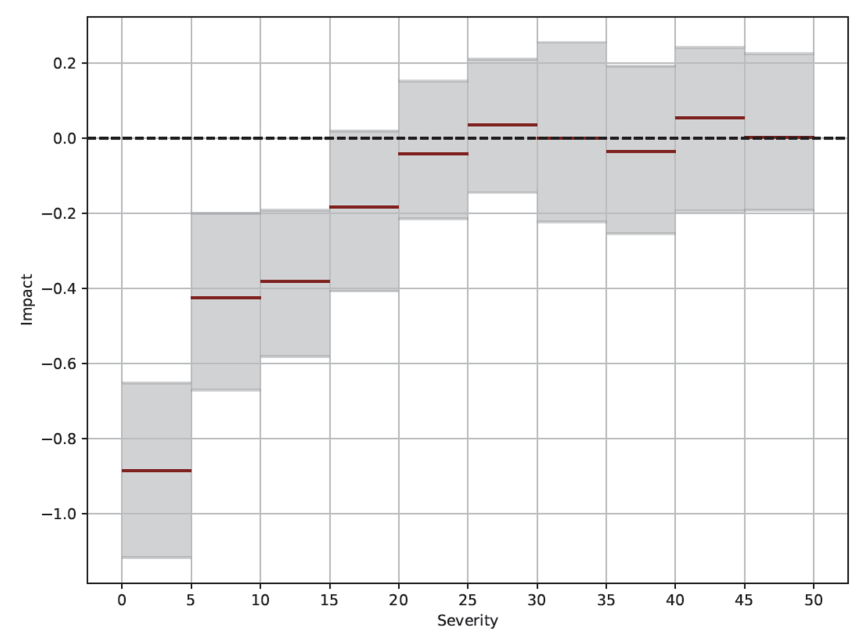

- A question of particular interest at this juncture is whether all large contractions come with long-term losses, or whether only certain types of contractions do. To analyse this, we focused on the 5% most severe contractions and classified them into one of the following four categories: (1) banking crisis; (2) restrictive monetary policy to combat high inflation; (3) oil shocks; and (4) other. In total, out of 198 large recessions we classified 100 as banking crisis-driven events, 51 as monetary policy-driven, 19 as driven by oil shocks, and 9 as having other causes.

- Using this classification, we find that the specific cause of the contraction does not matter much for our results. When conditioning on each type of contraction separately, we find long-run effects of roughly similar magnitude for banking crisis and those related to monetary policy tightening and of greater magnitude for oil shocks (Figure 3). Only “other” contractions, for which it is difficult to identify a single clear cause, are not associated with any significant long-lasting effects.

- Why should such permanent losses occur? Likely mechanisms historically have included slower technology growth due to lower investment in R&D, bankruptcies of highly productive start-ups, or the erosion of human capital from long spells of unemployment. At this juncture, an additional mechanism could be the process of deglobalisation and fragmentation kickstarted by Covid and the Russian invasion of Ukraine.

Figure 3 Long-term growth effects of severe economic contractions by proximate cause

- Note: This chart shows mean differences in 10-year growth rates after annual growth contractions in the worst 5% in terms of severity compared to the rest of the sample. The x-axis shows the different recession types. The y-axis shows standard deviations of 10-year growth rates.

· What does this all mean for policy?

- For one, our results put renewed emphasis on Olivier Blanchard’s assessment after the Great Financial Crisis that “authorities should make it one of the major objectives of policy—macroeconomic, financial regulatory, or macroprudential—to stay further away from the dark corners” (Blanchard 2014: 30), where he defines dark corners as those states of the world when the economy malfunctions badly and non-linearities kick in.

- But as several bad shocks have already occurred, a key question is whether policymakers have sufficient tools to avoid such a dark corner materialising, especially if they want to combat rising inflation at the same time. Many current forecasts anticipate that central banks will eventually deliver full recoveries. As such, long-term effects of the current predicament may be limited, with economies around the world eventually reverting to the previous trend.

- The situation is frail, however. It is, for instance, not inconceivable that supply disruptions could worsen as the war continues, or that Covid could surge again and hamper the global economy. Weighing these trade-offs is beyond the scope of our paper. But what is very clear from our analysis is that relying on standard macroeconomic models that assume the economy will inevitably recover the previous trend after a shock can be misleading, especially at times when the stakes are highest. And while there are many risks ahead, relying on wrong models is certainly one risk that policy makers can avoid.

11 Novembre 2022

PATRICK BOLTON, ALISSA KLEINNIJENHUIS, TOBIAS ADRIAN

COP27: Climate finance for developing countries is not just equitable, it is self-interest

(synthesis; full article – https://cepr.org/voxeu/columns/cop27-climate-finance-developing-countries-not-just-equitable-it-self-interest)

Abstract: During the COP27 debates, there will be demands for more climate aid from wealthy countries. This column argues that aside from equity concerns, once one takes account of the benefits to each country from emission reductions brought about by replacing fossil fuels with renewables anywhere in the world, there is a much more direct impetus for action – self-interest. The authors conservatively estimate that the net global economic gain from replacing coal with renewables is around $85 trillion, and suggest that the most effective way to make “finance flows a reality” at COP27 may be to make countries aware of the net gain they can reap from financing the phase out of coal

Keywords: Climate change, climate finance, international finance, renewable energy, COP 27.

One of the key targets at COP27 is to make “finance flows a reality”. “Providing, mobilising and deliver climate finance for developing countries is an urgent priority [..].” 1 The importance of scaling up sustainable finance is underscored by Dursun-de Neef et al. (2022) and Schoenmaker and Voltz (2022). At the COP27 debates, there will be demands for more climate aid from wealthy countries. Financing is set to be the make-or-break issue for this COP. Wealthy nations pledged to mobilise $100 billion a year by 2020, but are still about $17 billion short. Progress on delivery of the annual $100 billion will build more trust between developed and developing countries and make progress towards tackling the global climate change problem more probable.

Equity considerations have been a core rationale behind the pledge to provide $100 billion a year in climate finance to developing countries. The argument typically runs as follows: (1) developed countries have historically emitted more carbon, so bear a larger responsibility for the adverse impacts of climate change; and (2) developed countries are wealthier than developing countries, so must help poor countries with climate mitigation and adaptation. In the run-up to COP27, the call to offer compensation finance for “loss and damage’’ has become especially prominent. “Loss and damage” has become shorthand for the call for funding by wealthy countries for poor countries suffering the consequences of climate change. The matter has grown more urgent this year, marked by a succession of extreme weather events including the recent widespread flooding in Pakistan. 2 As UN Secretary-General António Guterres put it at the opening of COP27: “Loss and damage can no longer be swept under the rug. It is a moral imperative.”

While such equity considerations matter profoundly, they have so far, however, not proved to be a strong impetus for action, as the difficulties of garnering a mere $100 billion a year in climate finance for developing countries have demonstrated. Once one takes account of the benefits to each country from emission reductions brought about by replacing fossil fuels with renewables anywhere in the world, there is a much more direct impetus for action: self-interest! Indeed, the Coase theorem states that it is in the economic interests of a country A to pay a polluting country B to stop polluting if that makes country A better off. From a Coasian perspective, it is thus sound economic logic to pay polluters for the costs of replacing fossil fuels with renewables, if the benefits exceed the cost. Indeed, Coase provides a new perspective on and rationale for (foreign transfers of) climate finance. Tangible net benefits can be reaped even if only a coalition of the willing (e.g. a region) strikes a Coasian deal to phase out of fossil fuels. The larger the climate club in terms of the emissions it can avoid, the closer the net benefits of such a deal get to the large net benefits in a global deal to get rid of fossil fuels.

Looking back at COP26, two distinct discussions took place: (1) ending coal; and (2) providing $100 billion in climate finance a year for developing countries. Looking forward, at COP27 these distinct discussions should be merged. Climate finance to help build renewables should be made conditional on the commitment to end coal (and fossil fuels more generally). Indeed, only if climate finance for phasing in renewables happens concurrently with phasing out coal is energy supply maintained and the risk of carbon leakage (a salient concern if only a subset of the world strikes a deal to phase out coal) limited. Building conditionality into climate finance is key to achieve emission reductions and thus the benefits of providing climate finance. To be equitable, such conditionality must come with compensation for the opportunity costs of coal. Indeed, coal owners and coal workers must be compensated for their missed income. Retraining programmes must be funded to make workers qualified for employment in the replacement renewable industry.

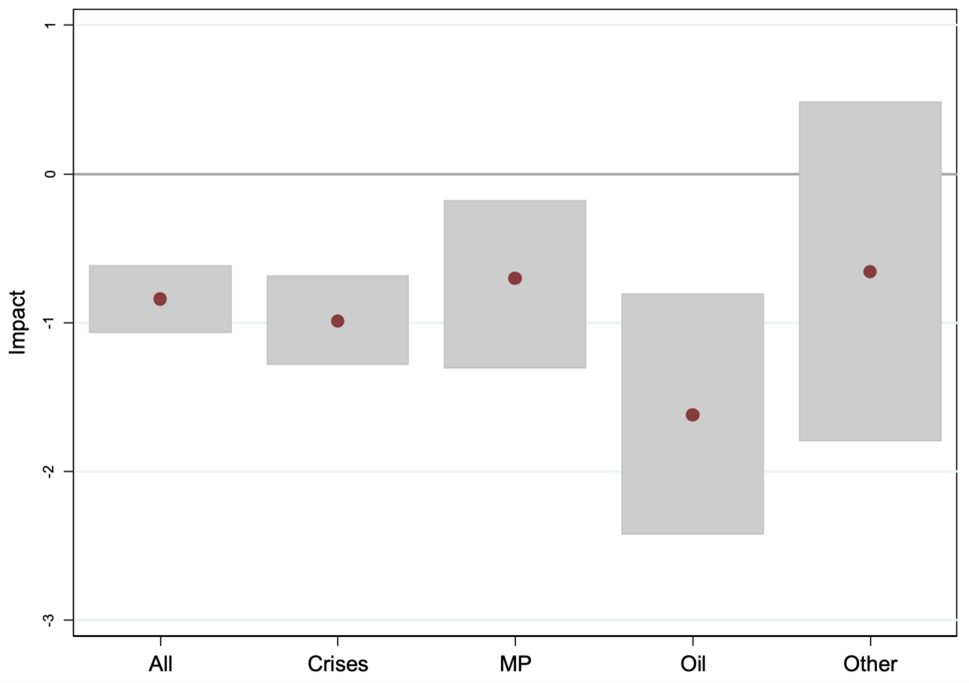

The Great Carbon Arbitrage

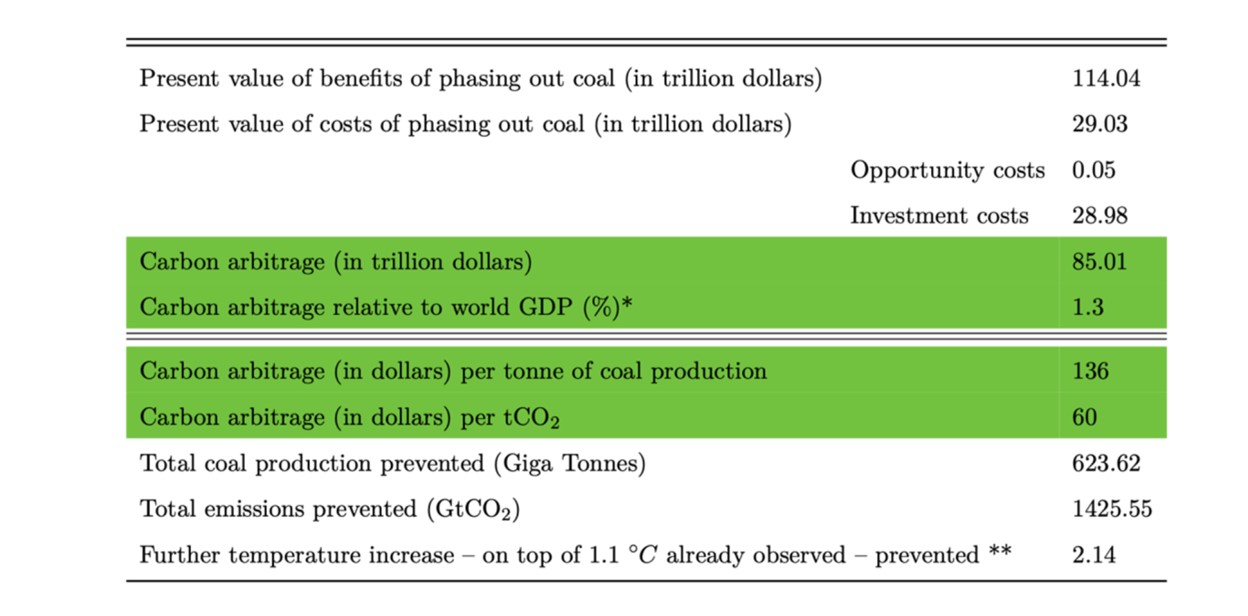

In a recent paper (Adrian et al. 2022), we study the net benefits from phasing out coal and replacing it with renewables. Our quantitative analysis makes a simple but important observation: phasing out coal and replacing it with renewables is not just a matter of urgent necessity to limit global warming. When its costs and benefits are considered, it also turns out to be a source of considerable net economic and social gain – the economic gain is around $85 trillion under a conservative estimate (see Table 1). Faced with the prospect of such an enormous gain, it is puzzling for any economist inculcated with the tenets of “there is no such thing as a free lunch” and “no money left on the table” how the world could indeed leave so much money on the table. Even faced with “high transaction costs” and “poorly defined property rights”, to use the main notions behind the Coase Theorem (Coase 1960), it is astonishing that a Coasian bargain of such proportions could be left untouched. One plausible explanation could be that the countries involved in working out a global agreement to phase out coal are not aware of the size of the benefits from such a phase-out, even taking into account the costs of replacing coal with renewables and the cost of compensating coal businesses and workers.

Benefits consist of the avoided climate damages from reduced emissions by shutting coal mines down early, and are under our baseline conservatively priced at an average social cost of carbon (SCC) of $80/tCO2. Costs consist of investment costs to build replacement renewable energy and compensate for opportunity costs of coal. We observe that the lion share of costs consists of the investment costs in renewables (at $29 trillion), 3 while only a small part consists of costs to compensate for the opportunity costs of coal (at $50 billion).

The quantified global opportunity costs of coal remain small even when we consider a broader definition of opportunity costs that includes not only missed revenues to coal owners from shutting mines down early, but also compensation for missed wages of coal workers losing their jobs in the coal phase out (for the duration of five years while they seek employment in other industries or retire early) and compensation for retraining costs to qualify for employment in other industries (e.g. the renewable industry). These broader opportunity costs bring our baseline estimate of the global opportunity costs of coal from $50 billion up to $331 billion (of which $275 billion is for lost wages and $7 billion for retraining). To our knowledge, this is the first valuation of the net global benefits from replacing coal with renewable energy.

Table 1 Net benefits of a global phase out of coal

In practice, obstacles to bargaining or poorly defined property rights can prevent Coasian bargaining to strike a global agreement on climate finance to replace coal with renewables, but our point is that in light of the large net gains we identify there should be renewed efforts to lift these obstacles. We point to promising avenues to overcome such obstacles and discuss how to make the funding to replace coal with renewables in the economic interests of all key stakeholders involved (i.e. governments, investors, and coal communities). In particular, we identify blended climate finance as a promising avenue to catalyse public investments.

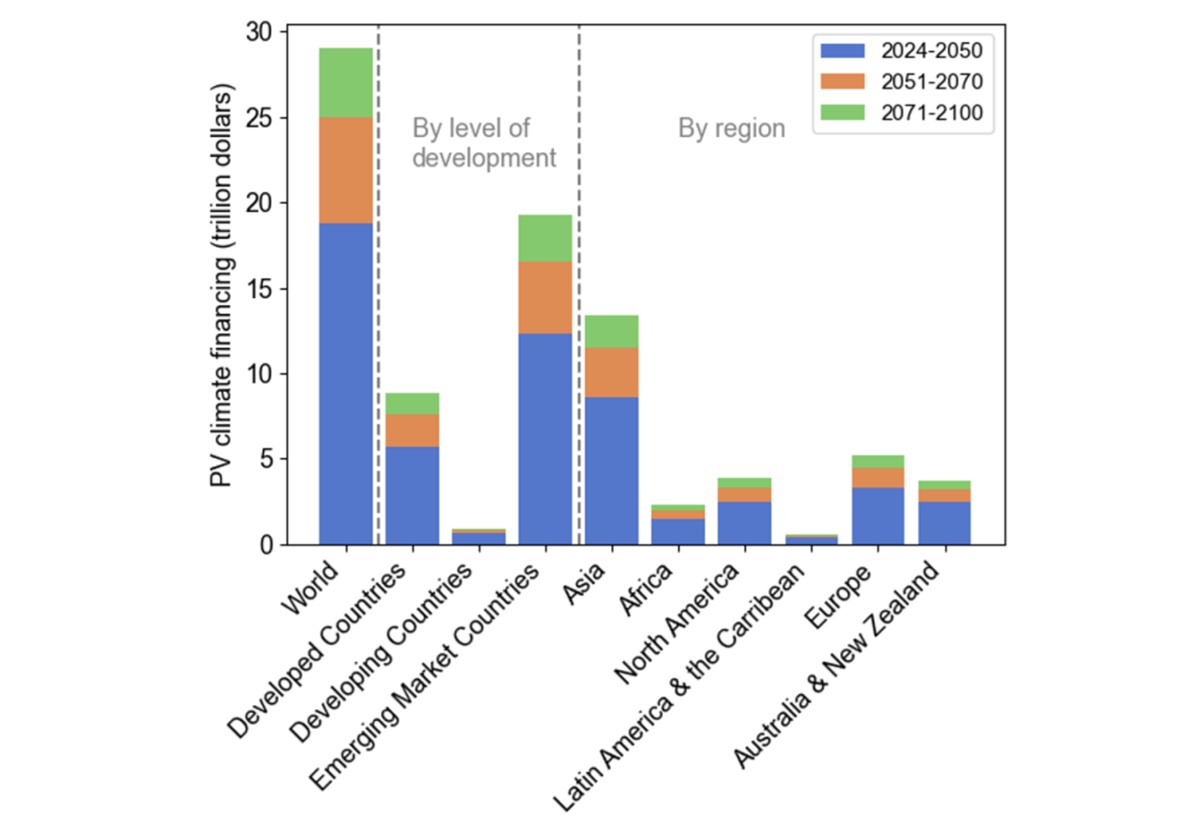

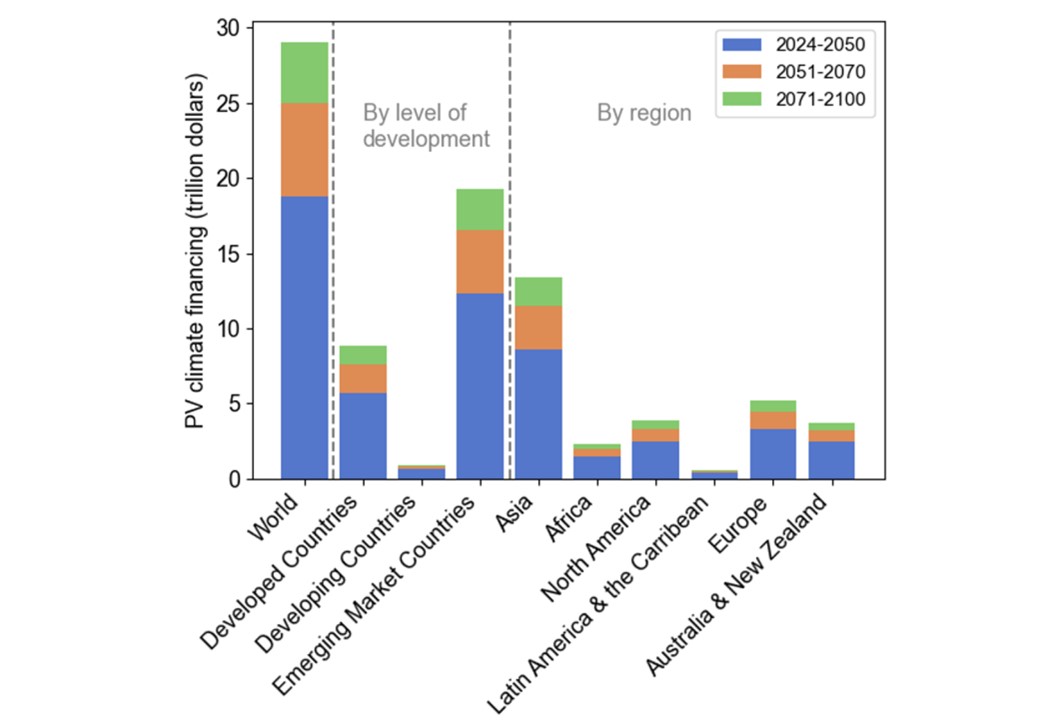

“Here is why blended finance matters – enormously. The beauty of this concept is leverage: if a small pot of multi-lateral development banks or western aid provides the first-loss tranche for investments to replace coal with renewables, it could attract a much larger dollop of private sector capital” (Tett 2022). With a 1:9 ratio of catalytic public to private funding, $26 trillion out of the $29 trillion could thus be raised via capital markets, while governments would only have to invest by around $2.9 trillion to enhance the capacity of MDBs to invest in the equity tranches. In our paper, we quantify climate financing needs for replacing coal with renewables across countries in the world. 4

Figure 1 Climate finance needs to replace coal with renewables (present value)

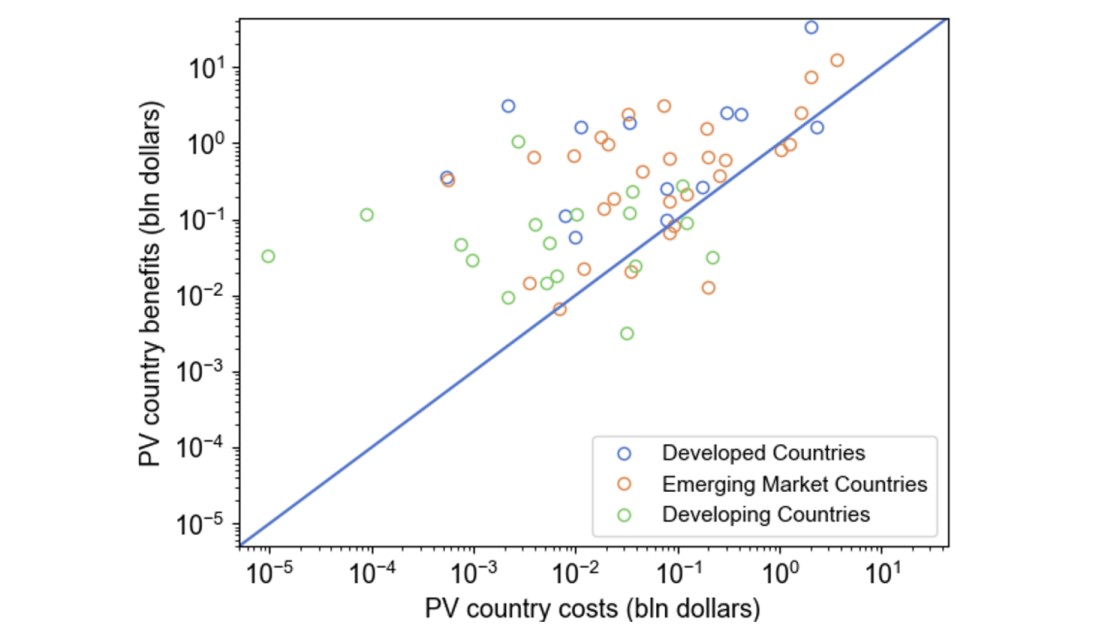

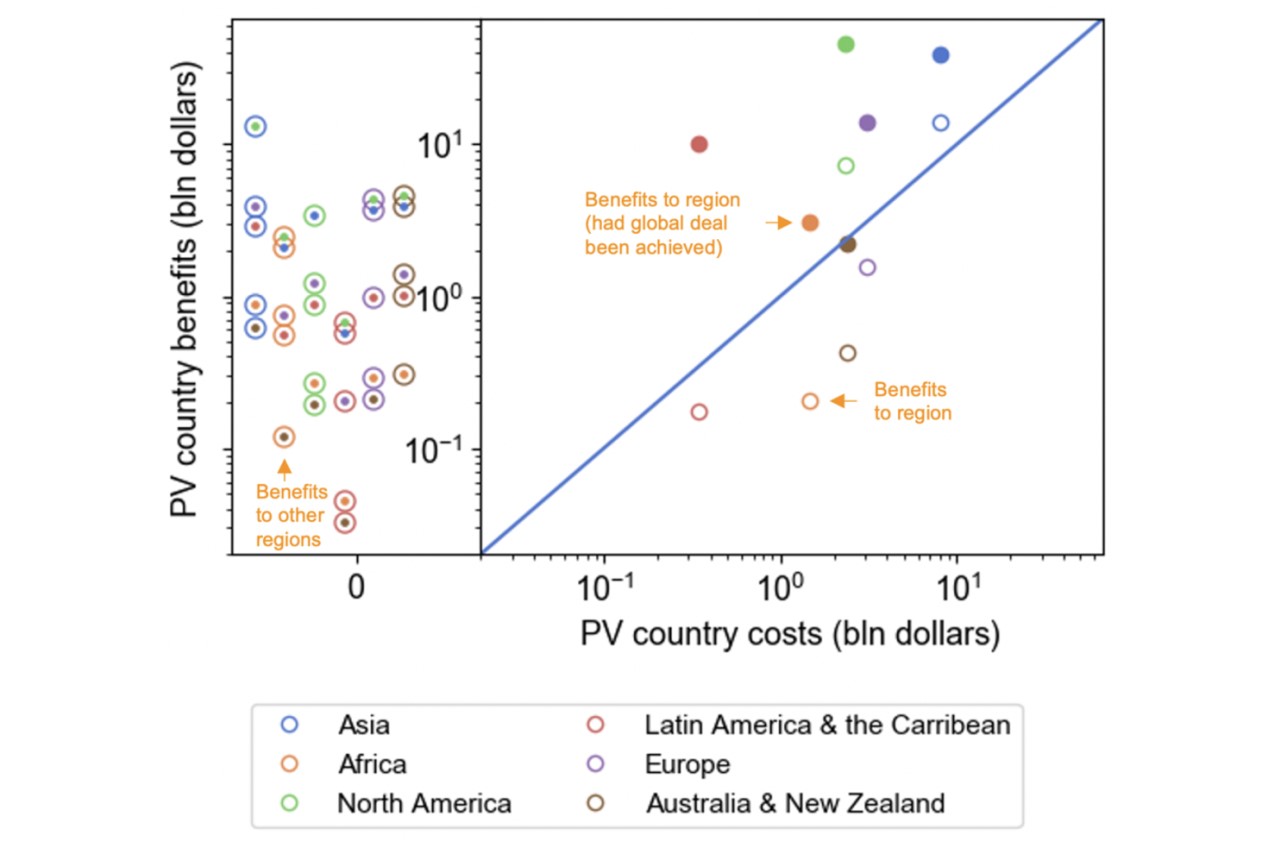

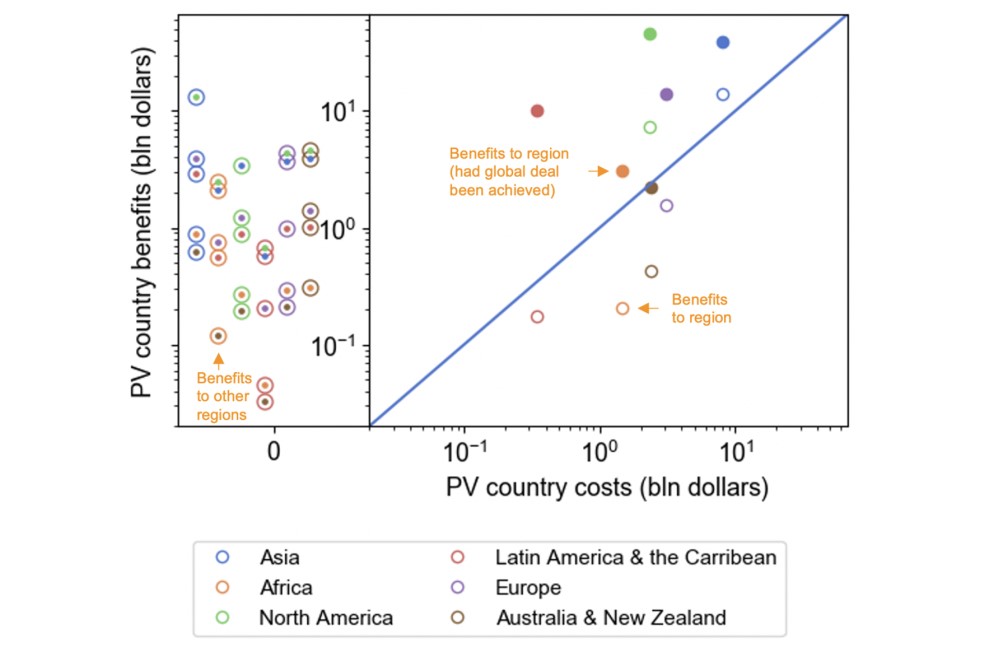

It seems a reasonable baseline under Coasian bargaining that each country cover its own costs to domestically replace coal with renewables. We find that it is in the economic interest of most countries to participate in a global deal to end coal, even in absence of cross-country compensatory transfers (see Figure 2). The benefits for each country from a global deal to phase out coal are given by the quantity of avoided emissions times the country-specific SCC (estimated by Ricke et al. 2018). This multiplication tells what share of the global benefits of avoided climate damages accrues to each country, capturing that impacts of climate change are unevenly felt across countries.

Figure 2 Country-level costs and benefits in a global deal to phase out coal (present value)

As noted, contributions to help cover foreign climate finance needs may be called for based on equity considerations. Such equity considerations have so far not proved to be a strong impetus for action, however. Once one takes account of the benefits to each country from emission reductions brought about by replacing coal with renewables anywhere in the world, there is a much more direct impetus for action: self interest. Indeed, the Coase theorem states that it is in the economic interests of a region A to pay a polluting region B to stop polluting if that makes region A better off. Take America as an example of region A and Africa as an example of region B (see Figure 3), to illustrate how climate financing from rich regions to poor regions is, in fact, enlightened self-interest!

We observe that the present value of investments Africa would need to make to replace its coal with renewables is $1 billion (of which 90% could be drawn from capital markets if a successful blended finance arrangement is in place). The benefit to Africa in a global deal to phase out coal is given by $3.1 trillion dollars in avoided climate damages, while the benefit to Africa from in a deal that sees its own coal being phased out is $0.2 trillion in avoided damages. In both cases, benefits are computed by taking the collective SCC of Africa and multiplying that by the size of avoided emissions, which then gives an estimate of avoided losses (due to climate change) to Africa’s GDP. Africa may not be able to afford to spend $1 billion to end coal – as recent foreign climate finance offered by rich countries to help South Africa phase out coal indicates (Pilling 2022). Given the greater historical emissions of rich countries, it may also not be fair for Africa to pay for its own coal phase out. The left panel of Figure 3 shows that rich regions, such as North America and Europe, stand to benefit enormously if Africa were to phase out coal. The orange circle with the green dot inside shows the benefits to North America of Africa’s coal phase out are around $2.5 billion; the benefits to Europe of Africa’s phase out are around $0.7 billion. Hence, it is squarely in rich countries’ interest to offer climate finance to help Africa with its coal phase out. With blended finance, these rich countries would only have to pay 10% of $1 billion ($0.1 billion) in present value terms to do so.

Critical for benefits to materialise is that rich countries offer finance to build out renewables, as well as funding to compensate for the opportunity costs of coal of developing countries, conditional on the commitment to end coal. Otherwise, no emission reductions may take place and benefits to rich countries in terms of avoided climate damages are not realised. Phasing in renewables and phasing out coal concurrently is moreover critical to ensure sufficient energy supply for Africa.

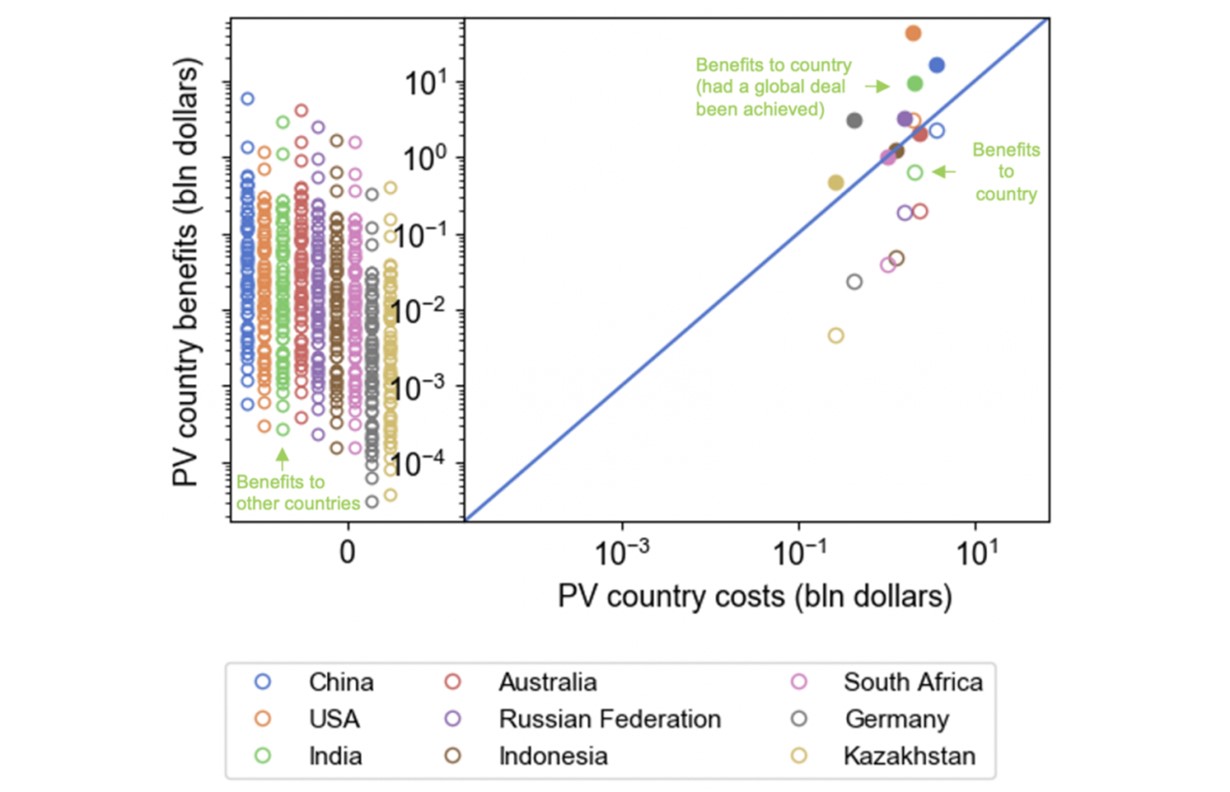

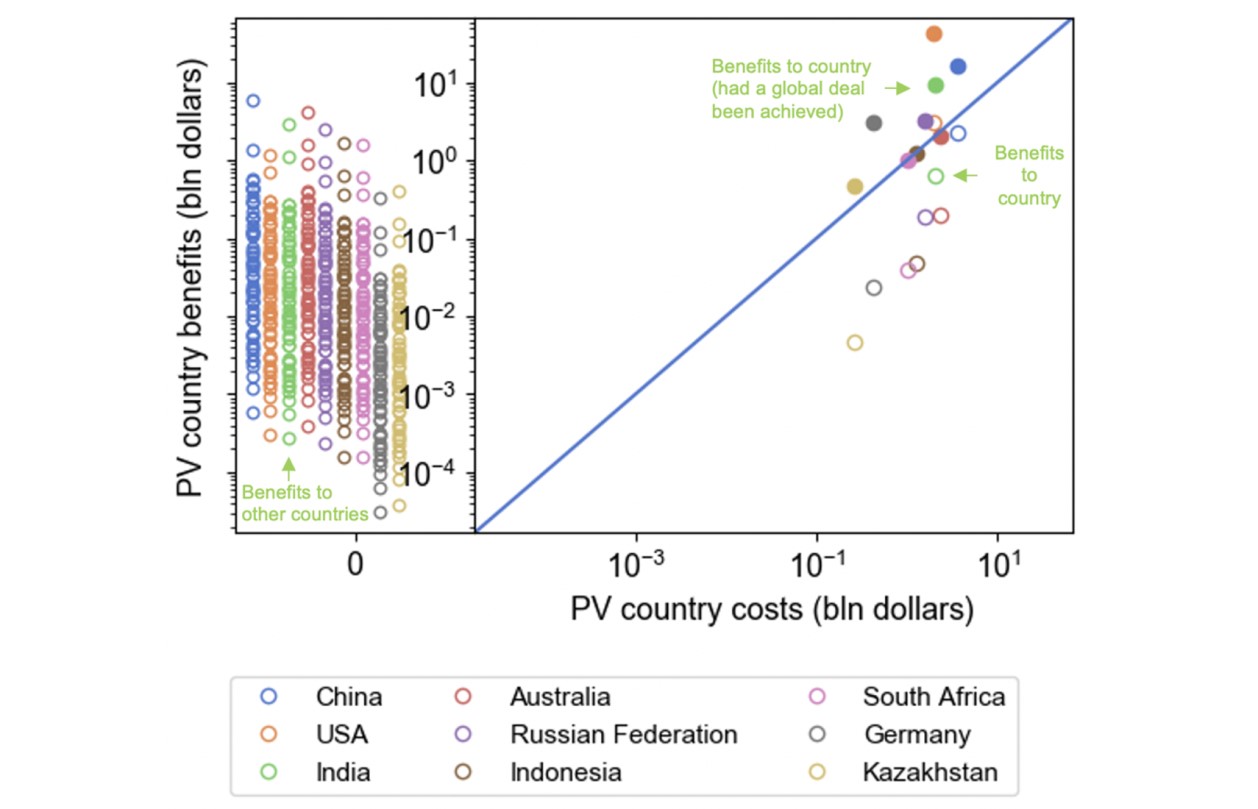

Figure 3 Present value of costs to phase out coal in one region and present value of benefits this brings both to the region that is phasing out coal (right part), as well as other regions in the world (left part)

Similarly, it can be in the economic interest of rich countries to help pay for the costs of replacing coal with renewables in the most coal-reliant countries (see Figure 4), such as India, South Africa, and Indonesia.

Figure 4 Present value of costs to phase out coal in one of the top-9 coal countries and present value of benefits this brings both to the country that is phasing out coal (right part), as well as other countries in the world (left part)

Big picture, our conceptual contribution is that paying the polluter – via climate finance – to stop polluting (as is happening now, for example, in South Africa) results in a Coasian bargain. Coase won the Nobel prize for his insight that paying the polluter to stop polluting may make you better off. But, to the best of our knowledge, no work has linked his theory to the idea that the provision of climate finance could result in a Coasian bargain. No work has quantified whether such a bargain exists. Our empirical contribution it to provide the first quantification of the costs of climate finance to end coal and the net benefits this brings to different countries.

Conclusion

While the rationale for climate finance for developing countries has so far focused on equity considerations, we identify a new rationale: self-interest. Rich countries are made better off by helping poor countries phase out coal. For climate finance to be effective, financing for renewables, as well as compensation for the opportunity cost of coal, should be made conditional on the phase out of coal, such that substantive emission reductions take place and tangible benefits are felt in terms of avoided GDP losses (from climate damages) for rich countries. It seems to us that the most probable way to make “finance flows a reality” at COP27 is to make countries aware of the net gain they can reap from financing the phase out of coal.

By highlighting the net gain countries obtain by providing climate finance, while also still emphasising equity considerations, we stand the best chance to make finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development (Article 2c of the Paris Agreement).

27 settembre 2022

David Bloom, David Canning, Rainer Kotschy, Klaus Prettner, Johannes Schünemann

HEALTH AND ECONOMIC GROWTH: RECONCILING THE MICRO AND MACRO EVIDENCE

(synthesis; full article 7 Sep 2022, – https://cepr.org/voxeu/columns/health-and-economic-growth-reconciling-micro-and-macro-evidence -)

Abstract: Economists use micro-based and macro-based approaches to assess the macroeconomic return to population health. The results of both approaches differ widely, which presents a micro-macro puzzle of the role of health in economic growth. This column resolves this puzzle by showing that the estimated direct effect of health is of similar size in both approaches when holding constant the indirect effects of health that are included in macro-based approaches only. Public health measures, as well as policies that target the indirect effects of health on economic growth, are important levers for fostering economic development.

Keywords: public health; labour productivity,development; macroeconomic policy; labour markets.

Although many contributions in the literature document a positive relationship between population health and macroeconomic performance, the size of this return remains subject to debate (e.g. Acemoglu and Johnson 2007, Bleakley 2007, Weil 2007, Bleakley and Lange 2009, Aghion et al. 2011, Cervellati and Sunde 2011, 2012, Bloom et al. 2014). One reason for this debate is that economists apply two conceptually different methods for estimating the macroeconomic return to population health. Micro-based approaches aggregate the estimated effect of individual health on wages to the macroeconomic level. Macro-based approaches, by contrast, estimate an aggregate production function that decomposes human capital into its components, including population health.

While micro-based approaches document a moderate positive effect of health (Shastry and Weil 2003, Weil 2007), macro-based approaches find estimates that are either negative and close to zero (Caselli et al. 1996, Acemoglu and Johnson 2007, 2014, Hansen and Lønstrup 2015) or 2.5 to 18.5 times larger than micro-based estimates (Barro and Lee 1994, Barro 1997, Bloom and Williamson 1998, Gallup and Sachs 2001, Bloom et al. 2004, Sala-i-Martin et al. 2004, Lorentzen et al. 2008, Aghion et al. 2011, Bloom et al. 2014). This presents a micro-macro puzzle of the macroeconomic return to health. In Bloom et al. (2022), we resolve this puzzle by showing that the estimated direct effect of health on labour productivity is of similar size in both micro-based and macro-based approaches when holding constant the indirect effects of health, which are included in macro-based approaches only.

Direct and indirect macroeconomic effects of health

Health improvements influence the economy through many pathways. Most immediately is a direct effect of better health on worker’s productivity (Bloom and Canning 2002, Currie and Vogl 2012). However, many indirect effects also exist. Better health and higher life expectancy create incentives to invest in education (Cervellati and Sunde 2013) and in innovation (Prettner 2013). In addition, a rising life expectancy fosters saving and therefore physical capital accumulation (Bloom et al. 2007). Finally, better health, particularly that of women, reduces fertility and spurs an economic transition from stagnation toward sustained economic growth (Bloom et al. 2015, 2020).

Micro-based approaches estimate the macroeconomic return to health drawing on evidence of the effect of individual health on labour productivity in a Mincerian wage regression. In this regression, individual characteristics such as health, education, and experience determine labour productivity via the exponential function. Controlling for all effects apart from health, this regression uses individual-level data to estimate health’s direct effect on labour productivity—that is, the microeconomic return to individual health. The micro-based approach then aggregates the microeconomic return to individual health to derive the macroeconomic return to population health by summing over all individuals. Importantly, this approach captures health’s direct effect on labour productivity but not its indirecteffects, which are controlled for in the Mincerian wage regression.

Macro-based approaches, by contrast, decompose aggregate output – which equals aggregate income in a closed economy – into physical capital, human capital, and technology. Specifically, these approaches regress income growth on changes in population health and other control variables. This approach yields health’s direct effect if all indirect effects are comprehensively controlled for. Alternatively, it yields health’s total effect if the regression uses exogenous variation in population health that captures both health’s direct and indirect effects.

Reconciling micro-based and macro-based approaches

The previous discussion stipulates that micro-based and macro-based approaches deliver quantitatively similar results for health’s direct effect on labour productivity. In Bloom et al. (2022), we therefore set up a macro-based model that incorporates a Mincerian wage regression, so that we can compare our results of the macroeconomic return to health with the evidence of the micro-based approach. We estimate this model for a panel of 133 countries observed every five years from 1965 to 2015. Our specifications use within-country variation of population health as measured by the adult survival rate, controlling for past economic development, physical capital accumulation, secondary education, demographic structure, institutions, and time trends.

Our results document a positive effect of population health on income per capita. Likewise, the results for the other variables confirm the signs expected from theory. Lagged economic development exhibits a negative coefficient, which implies conditional convergence. In contrast, capital accumulation, growth of the working-age population, and secondary education promote income per capita. In extended specifications, we show the results’ robustness to the inclusion of additional controls, alternative specifications, and changes in sample composition and sample length. The estimated effect of adult survival on income per capita is quantitatively stable across all specifications and significantly different from zero throughout.

Consistency of micro-based and macro-based estimates

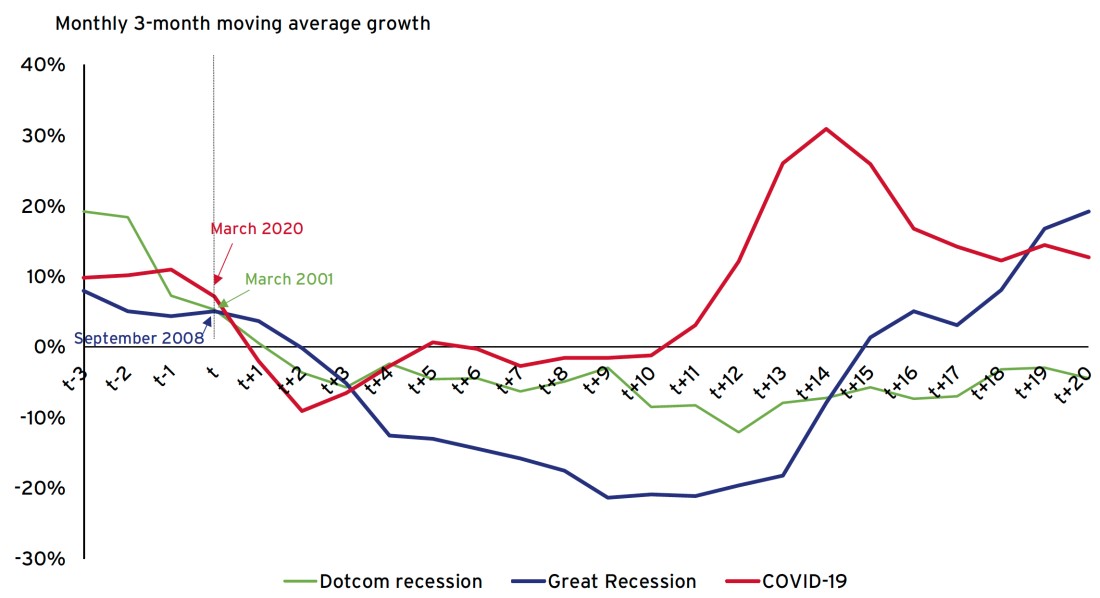

How do these estimates tie in with estimates from the micro-based approach? Table 1 compares our baseline results with those of Weil (2007), which show that an increase in the adult survival rate of ten percentage points raises labour productivity by 6.7% to 13.4% depending on the datasets used in the underlying Mincerian wage regression. Our results indicate that an increase in the adult survival rate of ten percentage points translates into a 10.6% increase in labour productivity (Bloom et al. 2022, p. 14), which falls in the range of plausible estimates reported by Weil (2007). Likewise, the 95% confidence interval of our estimate ranges from 3.4% to 17.9% and includes the plausible values implied by Weil’s (2007) evidence. Hence, the micro-based and macro-based estimates of the direct macroeconomic return to health are quantitatively similar, and the two different approaches are consistent with one another. Moreover, our estimates also match the stylised facts of the empirical literature on the remaining explanatory variables: the estimation results for the rate of convergence, the capital share, and the return to education are qualitatively and quantitatively consistent with evidence from previous empirical studies.

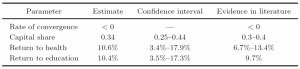

Table 1 Comparison of our estimates with the evidence in the literature

Conclusions

Our results reconcile the micro-based and macro-based evidence of the return to health by showing that the results of both approaches are consistent with one another. Therefore, they provide a rationale for using the micro-based approach to estimate the direct economic benefits of health interventions at the aggregate level. Furthermore, our results indicate that public health measures are an important lever for fostering economic development. Potential policies along these lines are vaccination programs, antibiotic distribution programs, and micronutrient supplementation schemes, which tend to lead to large direct improvements in health (World Bank 1993, WHO 2001, Field et al. 2009, Luca et al. 2018). In addition, policies that target the indirect effects of health on economic growth—such as birth control, family planning, and educational programs (Bloom et al. 2020, Kotschy et al. 2020) – could further promote economic development.

1 agosto 2022

CARSTEN FINK, YANN MÉNIÈRE, ANDREW A. TOOLE, REINHILDE VEUGELERS

The innovation response to the Covid crisis: A new eBook

(synthesis; full article Vox Eu CEPR 30 May 2022 – https://voxeu.org/article/innovation-response-covid-crisis-new-ebook

Abstract: How has the global innovation system fared in the wake of the Covid-19 crisis? A new eBook untangles how the COVID-19 shock affected innovation ecosystems in different parts of the world and how scientists, entrepreneurs, and creative professionals responded to the shock. Innovation not only proved crucial in finding solutions to the crisis, overall the innovation system proved more resilient to the pandemic’s fallout compared to previous crises.

Keywords: Covid-19, Productivity, Innovation, R&D, patents, entrepreneurs, scientific innovation, intellectual property

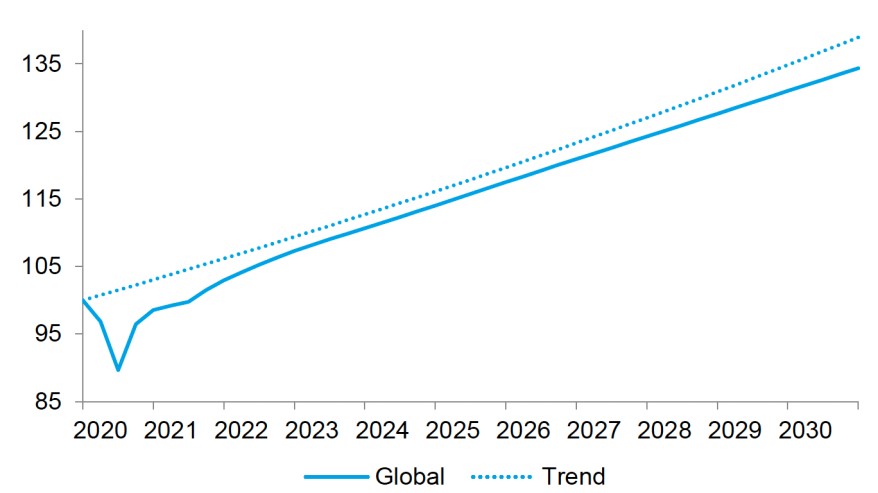

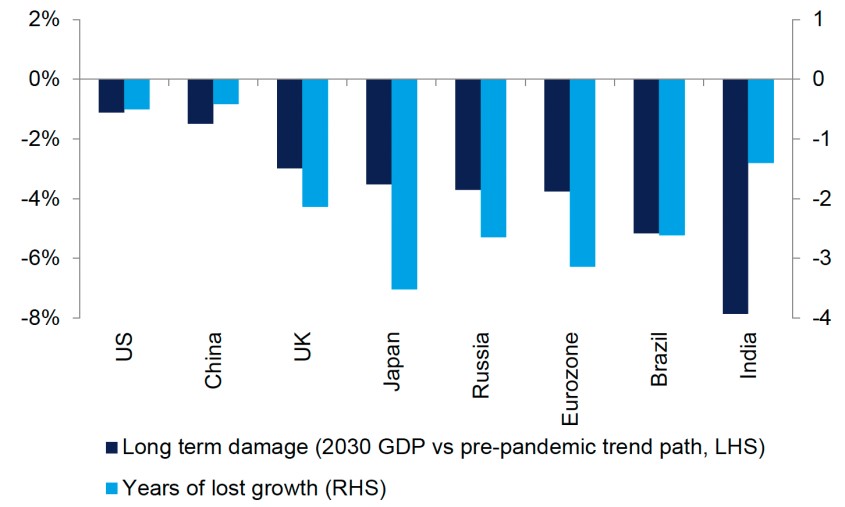

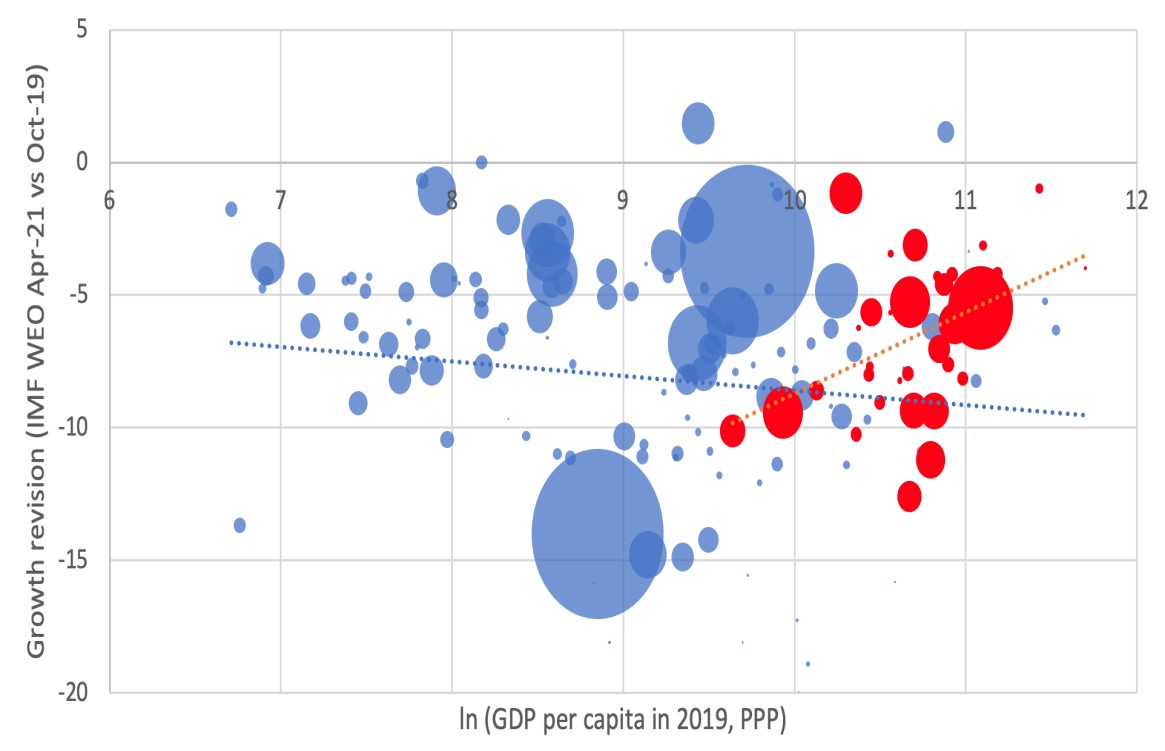

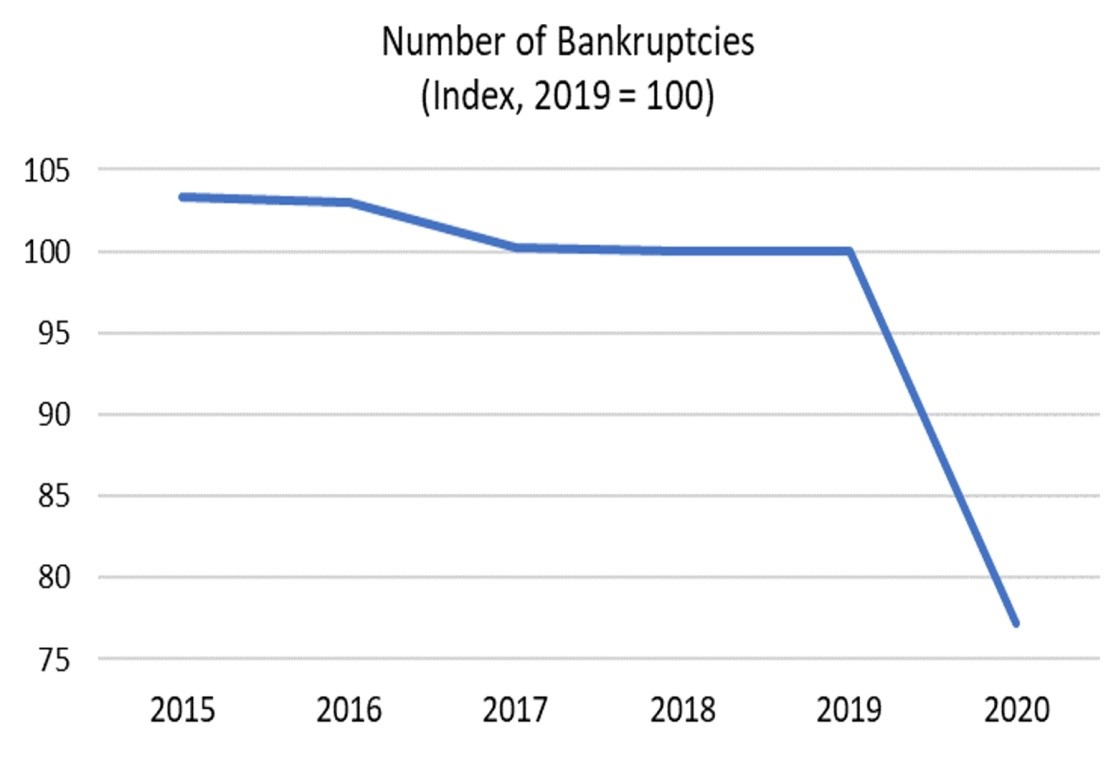

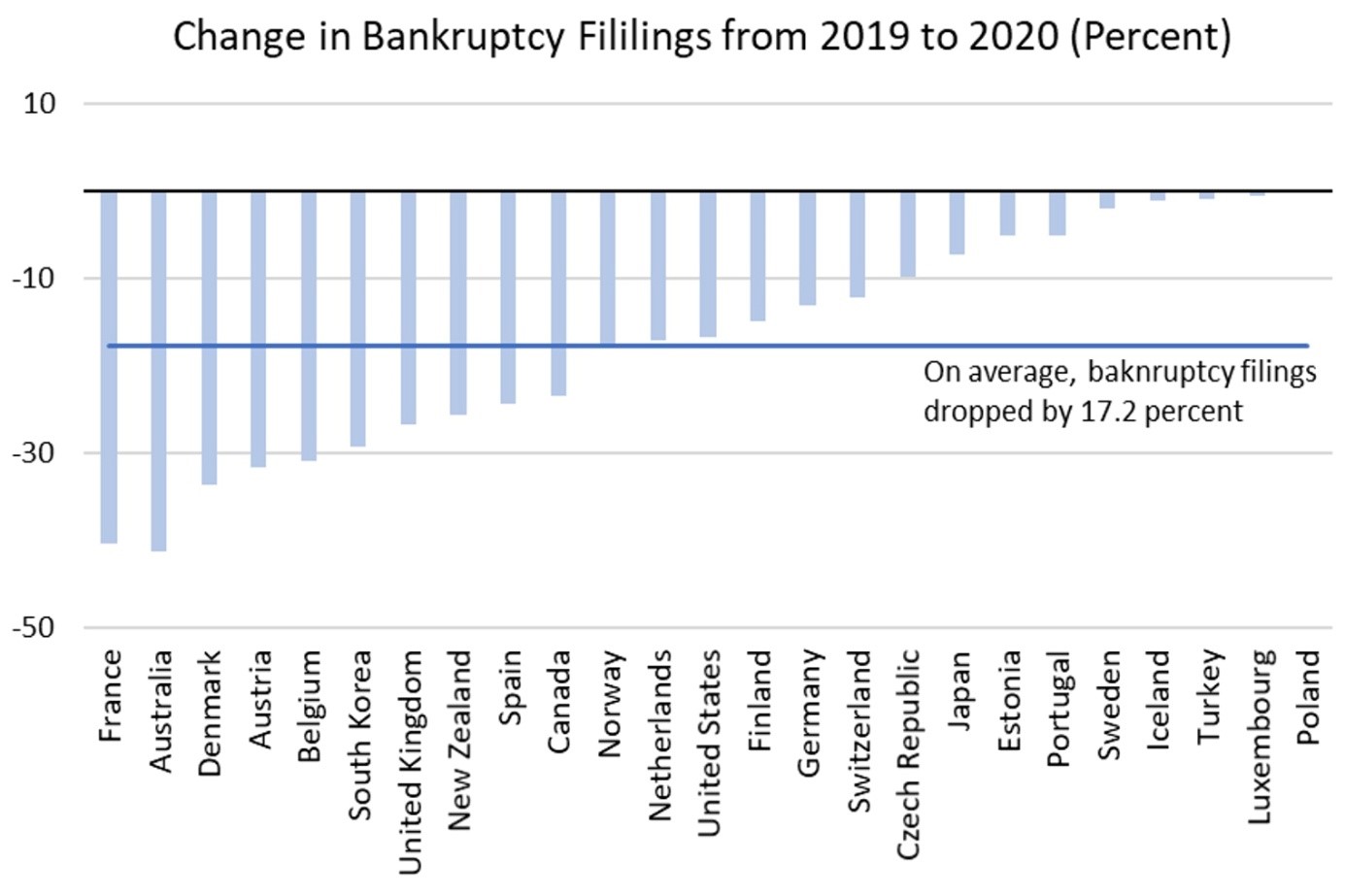

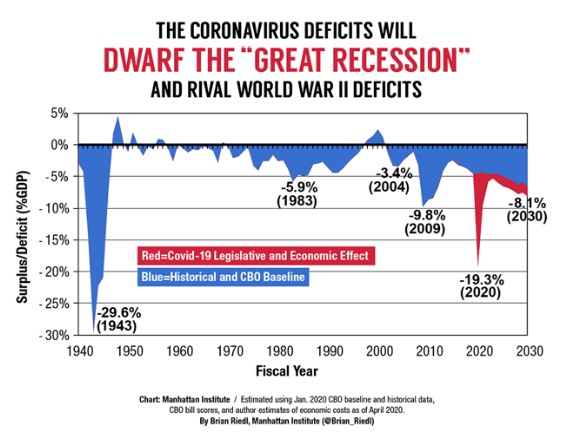

The World Health Organization declared COVID-19 to be a global pandemic on 11 March 2020. Not only has COVID-19 caused massive losses to public health worldwide, it also prompted major economic havoc worldwide (e.g. Bénassy-Quéré and Weder di Mauro 2020 for Europe, Djankov and Panizza 2020 for developing countries, and more analysis on Vox here). The decline in global GDP in 2020 turned out to be the biggest annual decline since WWII (Gopinath 2021, IMF 2021).

Previous crises have shown that innovators, despite their long-term focus, are not immune to short-term disruptions. During the 2007-2008 global financial crisis and the following Great Recession, for example, firms experienced curtailed access to finance for innovation (Lee et al. 2015) and were less able and willing to invest in innovation (Archebugi et al. 2013). Fiscal contraction in the general economy, in turn, put pressure on aggregate demand and public budgets to support research (Cruz-Castro and Sanz-Menéndez 2016). At the same time, crises can also be a catalyst for innovation, as they alter societies’ immediate and future technological needs. This was manifestly the case for innovative activity during WWII, which prompted major research efforts in the US to develop military technologies and medical treatments to support the war and laid the foundation for many postwar innovations and innovation policy (Gross and Sampat 2020).

How did the innovation system respond to the Covid-19 crisis? A new eBook from CEPR, the European Patent Office (EPO), the US Patent and Trademark Office (USTPO), and the World Intellectual Property Organization (WIPO) takes a first step toward understanding what happened in different parts of the world and how different actors in the innovation ecosystem – private and not-for-profit organisations, governments, and individuals – adjusted (Fink et al. 2022).

Impact across the world: Much similarity, some divergence

The first part of the eBook provides insights into the short-term response of innovators at the global and national levels, as captured by intellectual property (IP) application trends during the first two years of the pandemic. It draws a comprehensive picture of the unfolding of the crisis in the IP world, from which a number of important lessons emerge.

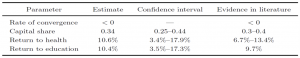

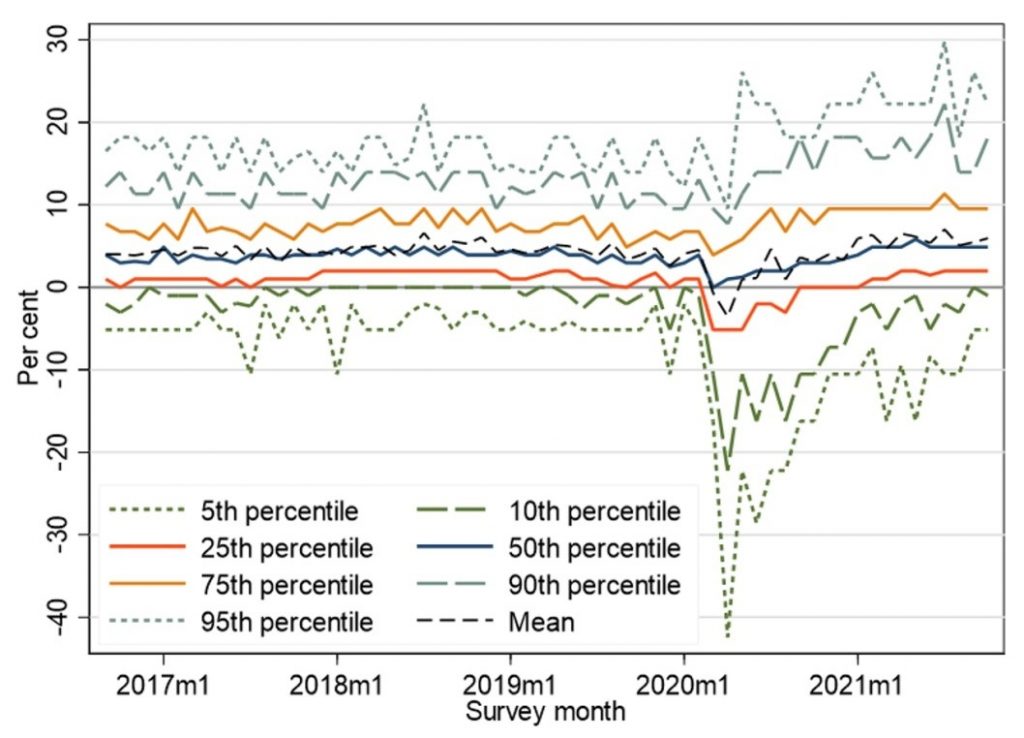

First, the impact of the pandemic on the filing of patents, trademarks and other IP rights has been less severe compared to previous crises such as the bursting of the dotcom bubble in the early 2000s or the Great Recession. Patent filings around the world were negatively hit, but declines proved shallow and short-lived – typically confined to the weeks and months following the pandemic’s onset in March 2020 (see Figure 1 for international patent applications).

Figure 1 International patent applications in crisis times

Notes: International patent applications refer to applications filed in the international phase of the Patent Cooperation Treaty (PCT). The figures presented are monthly 3-month moving average growth rates relative the same period in the previous year. Patent counts are based on the international filing date of PCT applications, either at national/regional patent offices or directly at WIPO.

Source: WIPO IP Statistics Database

The crisis nonetheless left its mark on patenting performance across economies and across technology fields. China and the Republic of Korea stand out as the least impacted economies, seeing continued growth in patenting.1 The fastest growing fields of patenting include health-related technologies (pharmaceuticals, biotechnologies, medical technologies) and digital technologies (e.g. digital communication, computer technologies). While already on the rise before 2020, the urgent needs created by the pandemic boosted innovation in these two fields. Conversely, the COVID-19 crisis aggravated the relative decline of patenting in more traditional technology sectors, such as mechanical engineering.

China and the Republic of Korea largely benefitted from this trend, thanks to their specialisation in digital innovation. Both countries showed sustained activity of large incumbent firms as well as local start-ups in this sector during the pandemic. By contrast, the relative specialisation of Germany and Japan in more traditional engineering-based industries may explain why the crisis had a more pronounced negative effect on patent filings from these two countries.

Other indicators confirm the overall resilience of innovative activities. Evidence from the US shows that R&D expenditures by companies exhibited less volatility than investments in physical capital. However, the crisis seems to have impacted some categories of smaller, budget-constrained innovators more severely. US and European SMEs often had to scale down their investments in patented innovations and reported a lack of funding for such investments. Evidence from Brazil also reveals that patenting decreased more among individual micro-entrepreneurs, micro-enterprises and small businesses than among larger companies, with one notable exception: there was a considerable uptake of utility models by local micro-entrepreneurs as the pandemic unfolded.

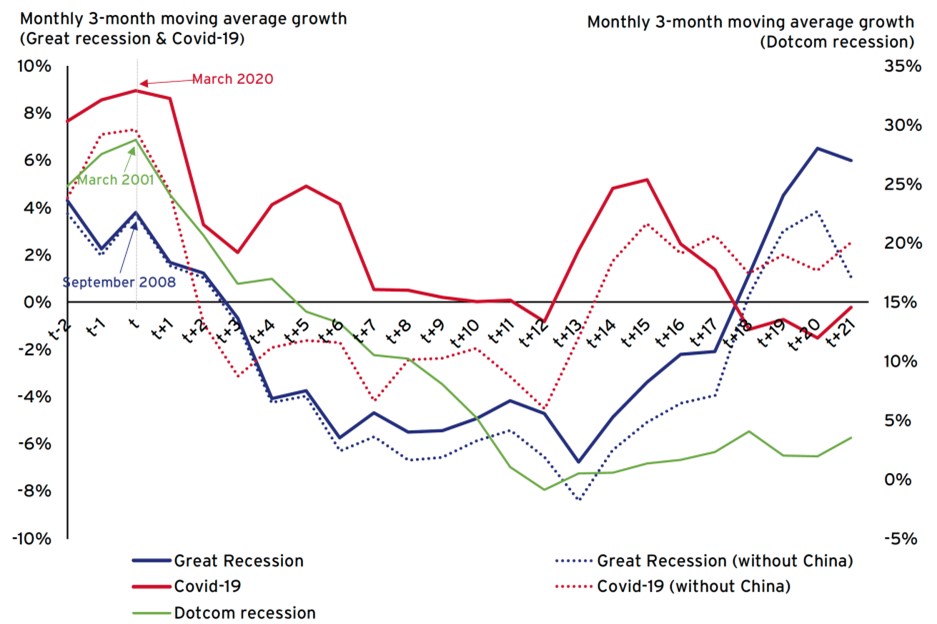

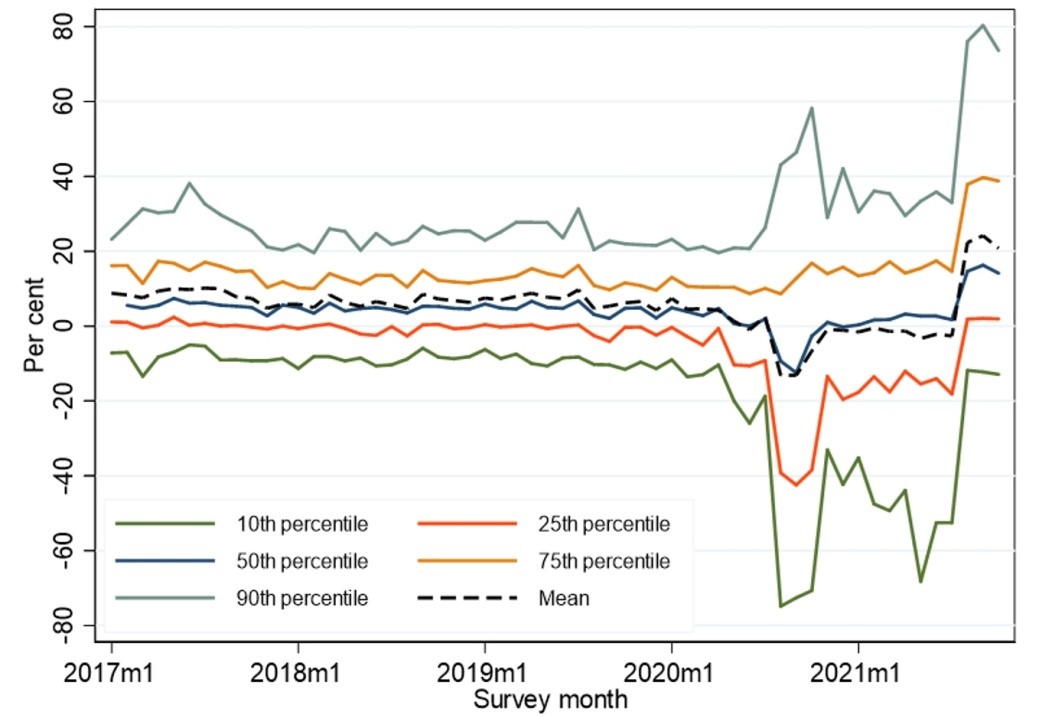

More broadly, many contributions to the eBook provide evidence for vibrant entrepreneurship unleashed by the crisis and fostered by the rapid adoption of digital technologies. This is evident in trademark filing trends – capturing the commercialisation of new goods and services. Figure 2 depicts the evolution of international trademark filings in the course of the three crises discussed earlier. The COVID-19 crisis stands out in showing the shallowest decline, followed by an extraordinary boom in international trademark applications about a year into the crisis. Healthcare products and ecommerce-related goods and services, broadly mirroring the patenting focus, were one key driver behind this recovery, even if the prominence of different product groups varied across economies.

Figure 2 International trademark applications in crisis times

Notes: International trademark applications refer to applications filed under WIPO’s Madrid System. Figures are presented according to the Madrid filing date.

Source: WIPO IP Statistics Database

More explicit measures of entrepreneurship – presented in the contributions from the Republic of Korea (Chapter 8) and Australia (Chapter 10) – confirm a surge in business entries and startup activity in 2021. Interestingly, a similar startup boom occurred in the midst of the Spanish flu pandemic in 1919 (Beach et al. 2020), highlighting how societal disruption generates momentum to start new activities for those entrepreneurs willing and able to take the risk amidst high overall uncertainty.

Responses in the innovation ecosystem

The second part of the eBook focuses on how different segments of the innovation ecosystem responded to the COVID-19 pandemic. One focus is the science sector. Survey evidence from the US (Chapter 12) reveals that total research time decreased substantially for all academic researchers, but these losses were not uniform across scientific fields of study or types of researchers. Women researchers and researchers with children were most heavily affected and the crisis may have permanently altered their scientific career opportunities. The chapter argues that the policy responses by academic institutions may prove insufficient to address these adverse outcomes and may have even accentuated them.

A second focus is how the biomedical innovation ecosystem responded to the crisis. Among other contributions, Chapter 15 tells the story of the mRNA Covid-19 vaccine. It highlights the difficulty of obtaining early-stage financial support for innovation. Only a handful of stubborn scientists, start-up entrepreneurs, angel investors and policy officers at the US Defense Advanced Research Projects Agency were willing to fund the high risk of the high-gain mRNA technology in its early years. In hindsight, the COVID-19 vaccines based on mRNA technologies made crucial contributions to overcoming the impacts of COVID-19, but society could easily have missed out on them.

Policy takeaways and outlook

Overall, the eBook concludes that the global innovation system proved to be resilient to the Covid-19 pandemic and its ingenuity contributed much towards addressing it. Policy support was instrumental for both.

Fiscal support measures cushioned the demand shocks, helping businesses stay solvent and workers to stay employed (Gourinchas et al. 2021). The destruction of productive intangible capital could have been far worse. Monetary policy support, in turn, enabled the continued availability of financing for innovation and fuelling the entrepreneurship wave described above (WIPO 2021). As financial conditions have tightened more recently (through 2022), the availability of risk capital has sharply declined. This raises the question of whether the loose monetary conditions and fiscal policies during the crisis generated an unsustainable degree of ‘innovative exuberance’.

A second takeaway is that policymakers should not take the ingenuity of the innovation system for granted. As already pointed out, the mRNA technology could have been easily missed by a short-sighted, risk-averse innovation support system. To be able to count on the innovation system to quickly deliver powerful solutions to societal challenges, innovation policy should take a longer-term, proactive perspective, supporting new ideas which have the potential to become breakthroughs in their early high-risk phases. Continuous investments in scientific research remain crucial in generating the knowledge underlying technological breakthroughs.

Of course, the crisis is not over at this time and our understanding of its ramifications will remain imperfect for some time to come. While most countries have lifted many of the public health measures put in place to stem the pandemic, COVID-19 mutations are still spreading around the world. The management of future infection waves may cause less disruption than during the pandemic’s first two years – thanks in large part to recent innovations in biomedical and digital solutions. However, it will surely continue to leave a mark on innovation systems.

More research is also needed to deepen our understanding of how innovators responded to the crisis. The full bibliographical details of patent applications are typically only published with a delay of 18 months. Thus, bibliographical data for patents for inventions that occurred after the pandemic’s onset have only recently become available. Future studies can thus shed more light on how different innovation stakeholders will have responded, including the effects on individual inventors and on collaboration across institutions and across countries.

4 luglio 2022

MAKSYM CHEPELIEV, MARYLA MALISZEWSKA, ISRAEL OSORIO RODARTE, MARIA FILIPA SEARA E PEREIRA, DOMINIQUE VAN DER MENSBRUGGHE

Globalisation, not localisation, is the key to post-pandemic prosperity

(synthesis; full article 30 may 2022 – https://voxeu.org/article/globalisation-not-localisation-key-post-pandemic-prosperity)

Abstract: Growing economic nationalism and protectionism in recent years have tested the resilience of global value chains. This column argues that policies that are supportive of rather than hostile to trade could prove critical to strengthen a recovery from the pandemic and reduce extreme poverty in developing countries. Measures to enhance trade could boost integration into global value chains, increase incomes, and lift over 21 million additional people out of poverty by 2030. A more supportive environment for trade also boosts resilience to future supply shocks by supporting diversification and widening access to raw materials, goods, and services.

Keywords: Covid-19 International trade, global value chains, reshoring, localisation, globalisation, Trade barriers

In recent years, extreme weather events and trade tensions spurred by growing economic nationalism and protectionism have tested the resilience of global value chains (GVCs). The sudden and massive Covid-19 induced drop in global trade in the first half of 2020 dealt them another blow (WTO 2020), prompting predictions that the pandemic would result in restructuring of the GVCs, shortening the supply chains, and leading to reshoring (Javorcik 2020, Kilic and Marin 2020). Then, as the world economy was still recovering from Covid-19, the war in Ukraine caused more major disruptions to GVCs, hitting developing countries particularly hard (Chepeliev et al. 2022, Ruta 2022).

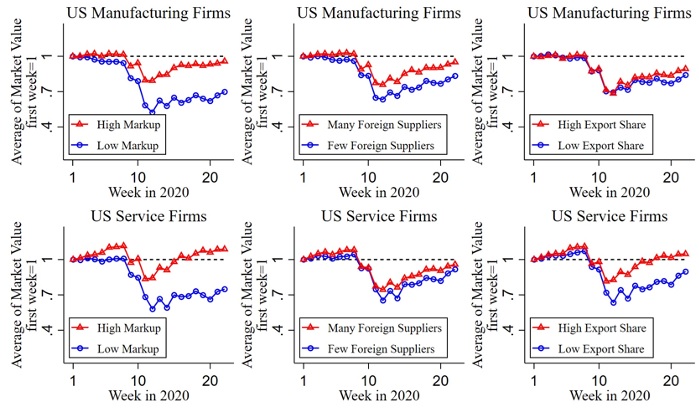

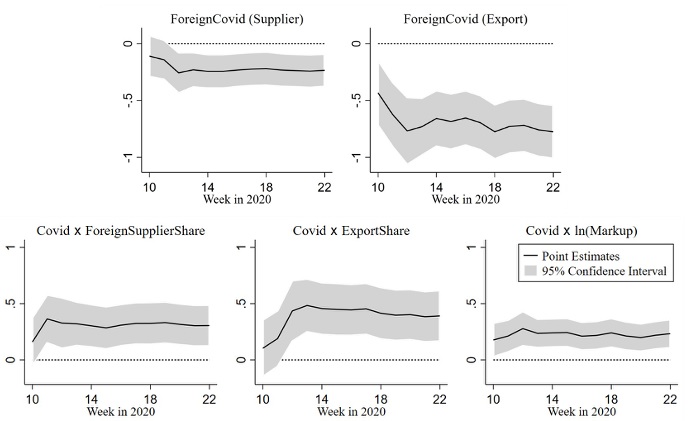

Recent studies suggest that GVCs transmit shocks to production and trade from one country to another. On the other hand, participation in GVCs may soften the blow of a domestic shock such as a lockdown (Espitia et al. 2021) or natural disaster like the 2011 earthquake in Japan (Freund et al. 2021), by ensuring access to critical inputs when foreign markets are closed. GVCs can also drive a recovery, spreading the benefits as countries emerge from lockdowns or lift trade restrictions at varying paces.

What further shocks to GVCs should we expect in coming years? Is it possible to design policies to help developing countries enhance resilience to trade shocks without endangering growth?

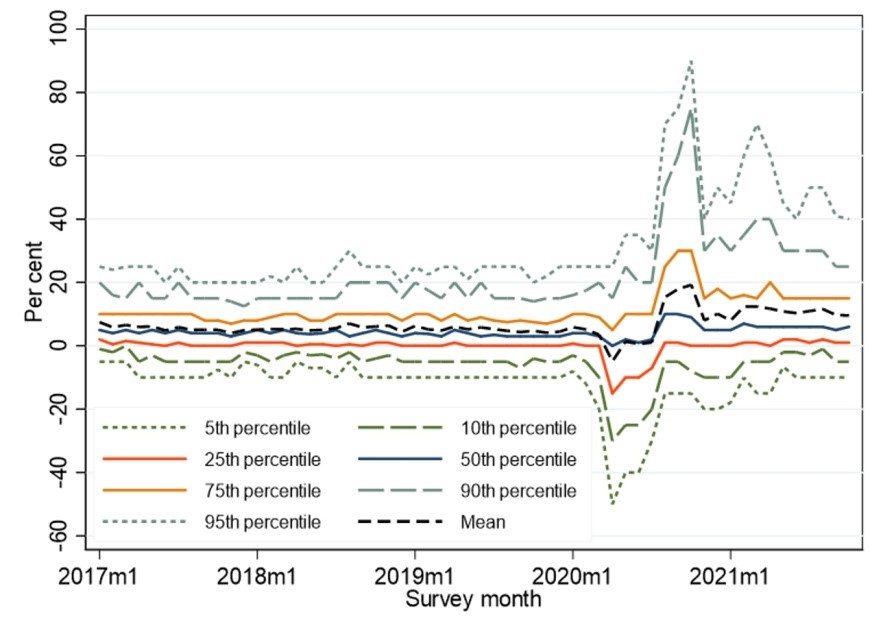

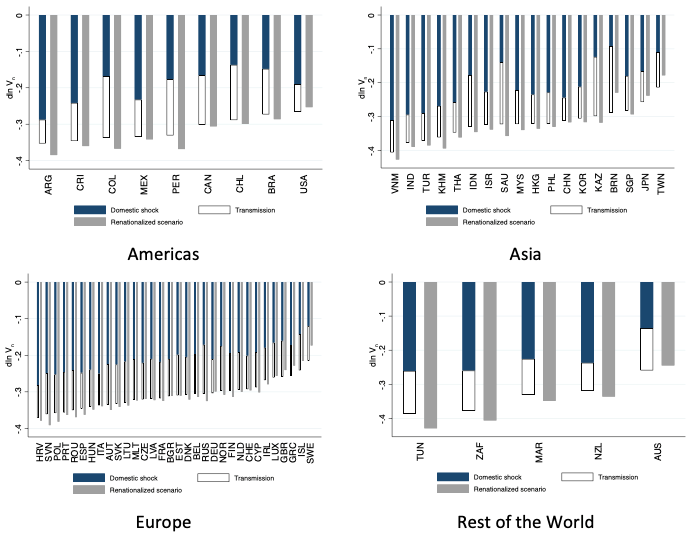

In a new paper (Chepeliev et al. 2022b), we couple ENVISAGE, a state-of-the-art global economic model (van der Mensbrugghe 2019), with the GIDD microsimulation framework (Bussolo et al. 2010) to simulate three scenarios: (1) high-income economies and China raise barriers to imports and increase domestic subsidies to re-shore production (‘Reshoring leading economies’), (2) wider localisation when developing countries join the reshoring efforts (‘Reshoring all’), and (3) developing countries seek to reduce trade costs and make it easier to use imports in domestic production (‘GVC Friendly Liberalisation + Trade Facilitation (TF)’).

The risk of reshoring and the fruits of liberalisation

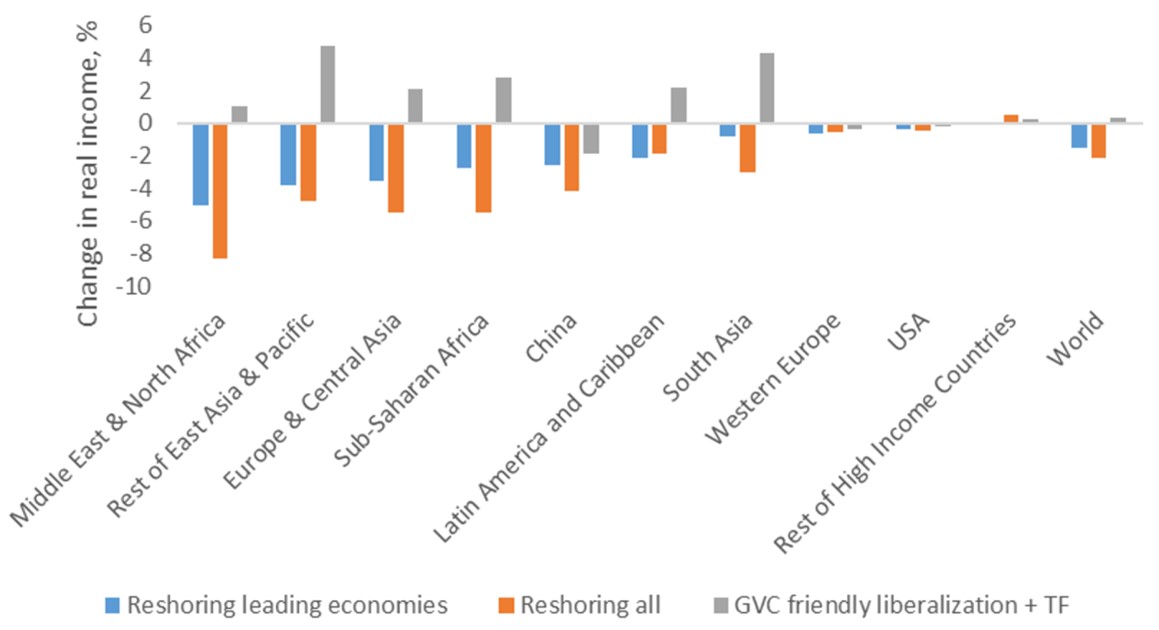

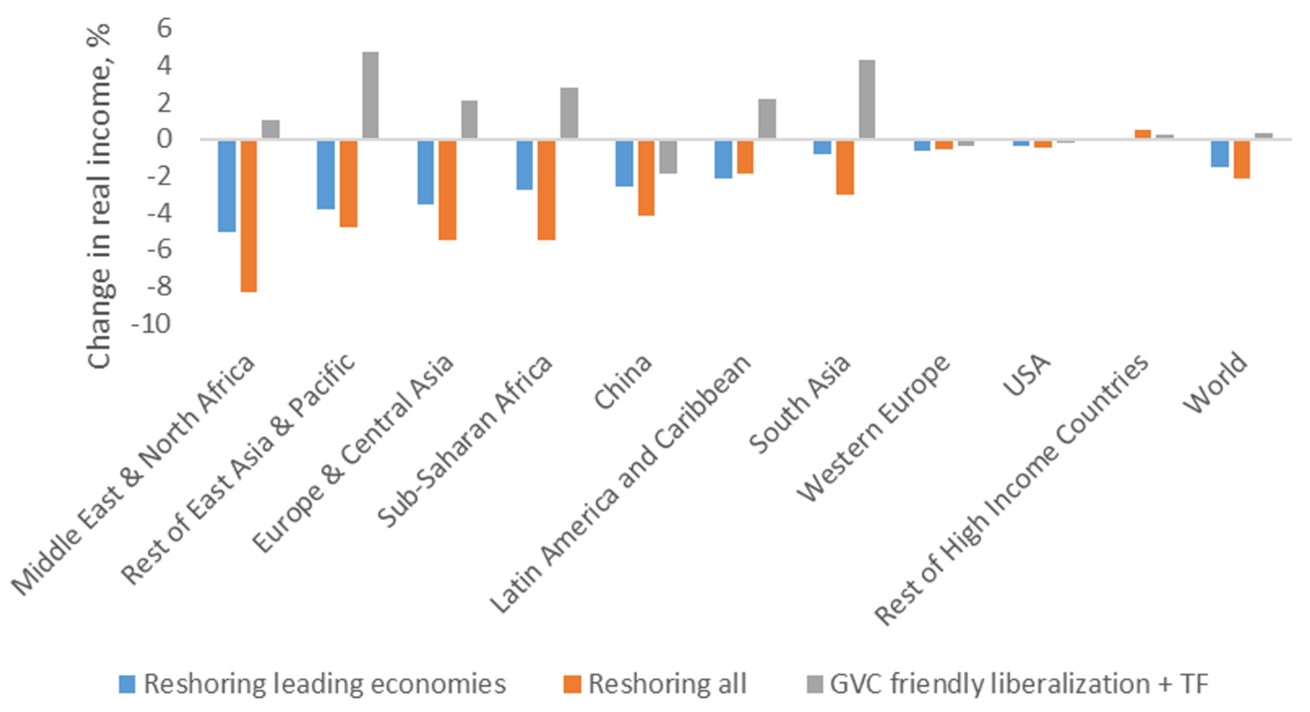

A possible reshoring of production by the leading economies and China would have a negative impact in most regions, with real income decreasing by 1.5% worldwide. A localised world takes the biggest toll on developing countries with the Middle East and North Africa, Rest of East Asia and Pacific, and Europe and Central Asian regions being hit the most severely (Figure 1). However, countries subsidising domestic production would also be worse off as reshoring decreases trade and income, limits the variety of products available to producers and consumers, and increases prices.

To counter the impact on regions that are highly dependent and integrated into GVCs, developing countries may be tempted to respond with their own reshoring policies. But such a response would only compound the damage done when leading economies re-shore production (Figure 1). Developing countries have an alternative. They could mitigate the damage by adopting policies that are more GVC-friendly and support greater integration. This response would produce gains across all developing regions.

Figure 1 Percent change in real income under various scenarios relative to baseline in 2030

Implications for global value chains

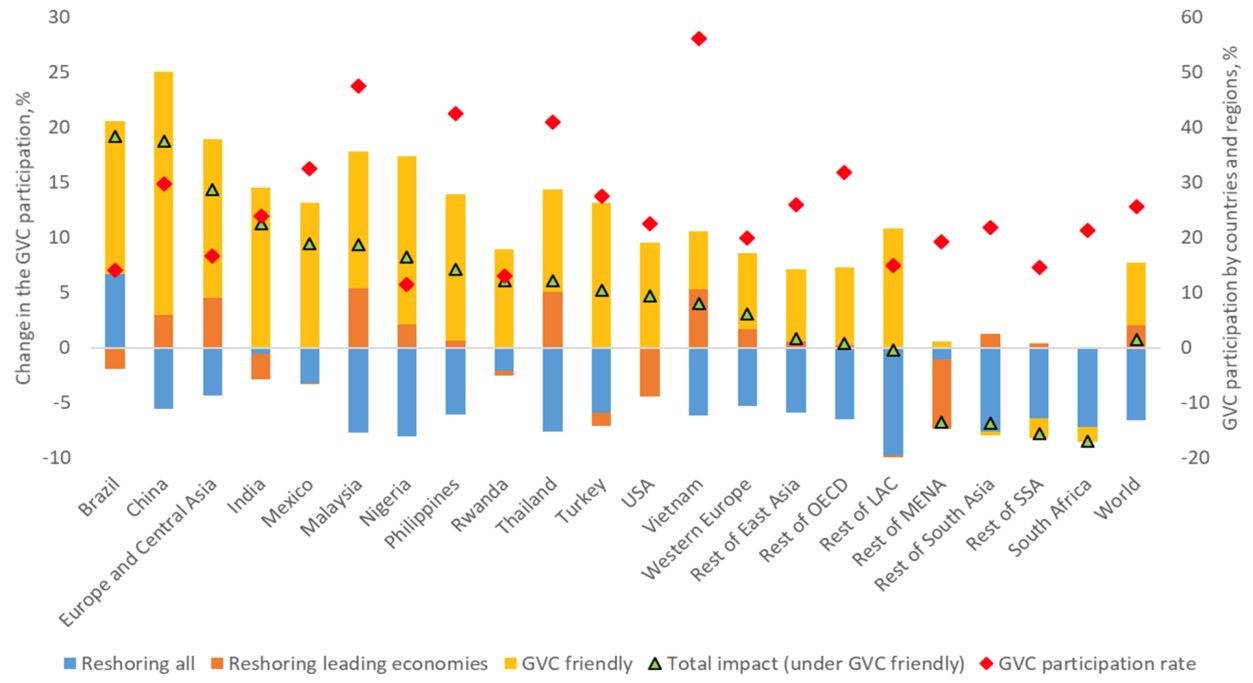

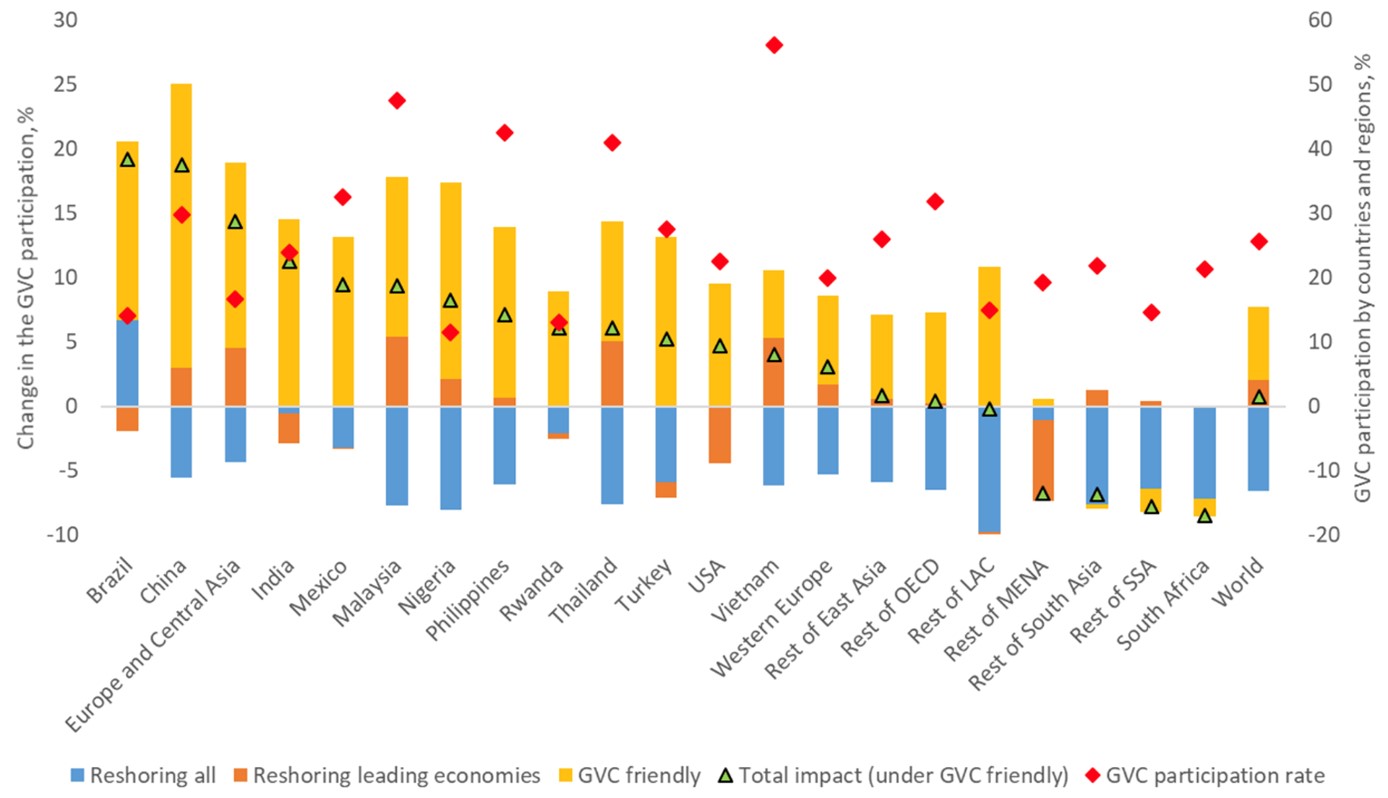

In the ‘Reshoring all’ scenario, the global average GVC participation rate for the sectors highly involved with GVCs1 could fall by over 6% in 2030 relative to the baseline. The ‘Reshoring leading economies’ scenario could have a moderate positive impact on GVC participation in selected countries. As trade shifts toward higher-value and more GVC-integrated goods like computers and electronics, Malaysia, Thailand, and Vietnam all become more integrated into GVCs (Figure 2).

It is through ‘GVC friendly liberalisation and trade facilitation’ efforts, when a major positive impact on the GVC participation for sectors under consideration is observed (Figure 2). For most developing countries, corresponding increase in GVC participation is above 10%. Leading economies also see substantial gains, with China benefiting the most with a GVC participation rate increase of more than 20%. Deeper GVC participation translates into faster growth.

Figure 2 Percent change in the global value chain participation rate relative to the baseline scenario in 2030

Note: Estimates are reported for the sectors identified in endnote 1. Columns on the figure report a decomposition of the trade policy impacts. ‘Reshoring all’ case provides impacts relative to the baseline; ‘Reshoring leading economies’ case reports impacts relative to the ‘Reshoring all’ case; and ‘GVC friendly’ option measures impacts relative to the ‘Reshoring leading economies’ case. ‘Total impact’ reports the sum over all three bars and corresponds to the impact of the ‘GVC friendly’ scenario relative to the baseline case.

Developing countries are more resilient to supply shocks in a globalised world

In the ‘Reshoring all’ world, countries face higher trade barriers and have less ability to substitute between domestic and imported commodities or to choose among different import sources. In the ‘GVC-friendly’ world both developed and developing regions are more resilient in the face of disruptions in production or supply chains.

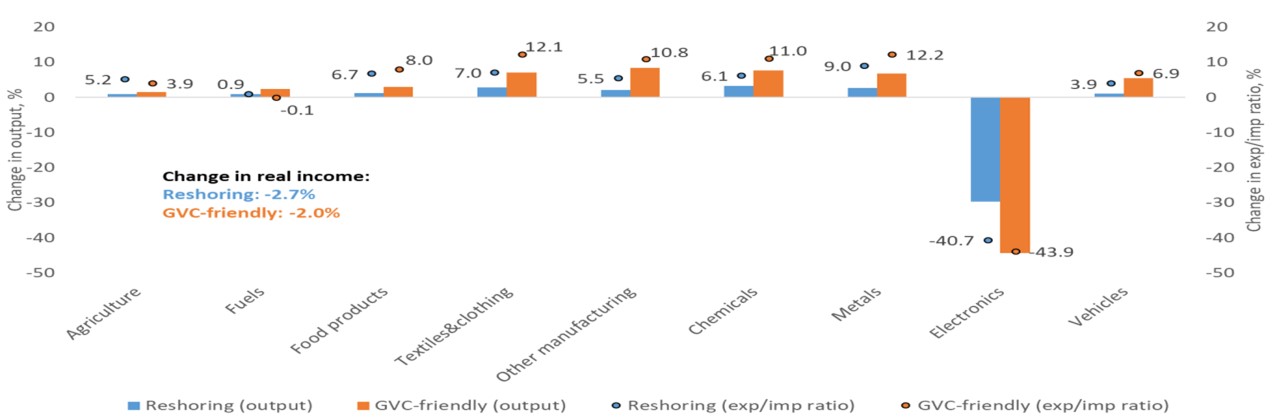

We showcase such differences by looking into a stylised experiment of a supply shock to Thailand’s electronics sector (10% reduction in total factor productivity in 2027) in a similar way in which the floods limited the output of electronics in Thailand in 2010 (e.g. Haraguchi and Lall 2015). We show that in a globalised world, the real income of Thailand’s consumers declines less than in the localised world, indicating a higher level of economic resiliency.

Due to the lower trade barriers and higher trade substitution possibilities, the output of Thailand’s electronics falls more in the ‘GVC-friendly’ world. At the same time, the output of all other sectors increases substantially (compared to the ‘Reshoring all’ scenario) as some resources are shifted away from electronics production. While exports of electronics are hit more in the ‘GVC-friendly’ world, exports of other goods increase, and the export-to-import ratio also grows faster for these sectors (Figure 3). Thailand’s real income is affected less dramatically in the liberalised world.

Figure 3 Impact on the economy of Thailand in 2027 (percent change relative to the corresponding scenario without shock)

Notes: Clustered columns show changes in Thailand’s output by sectors. Scatter plots show changes in the exports-to-imports ratio. All changes are shown relative to the corresponding scenario without shock to Thailand’s electronics production.

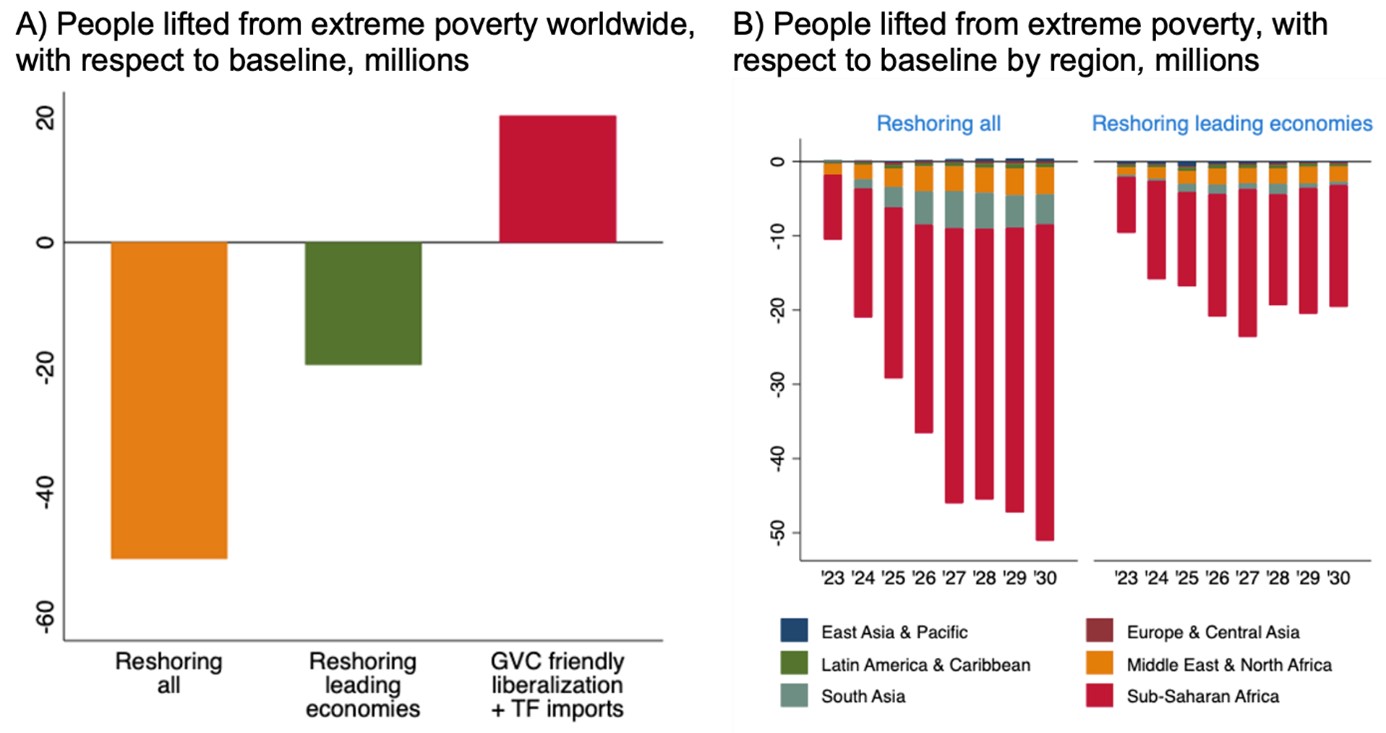

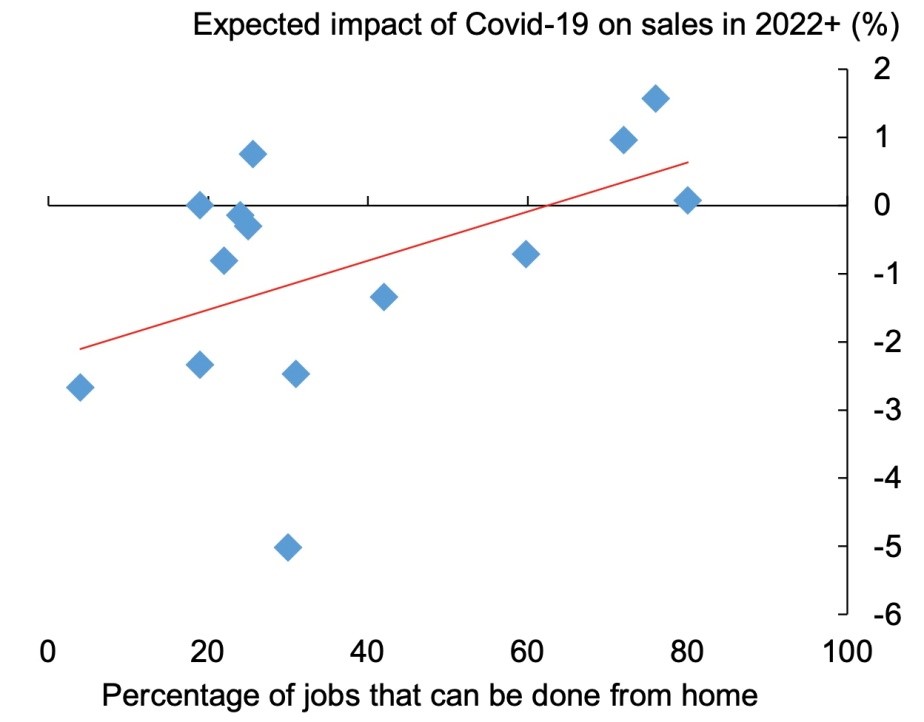

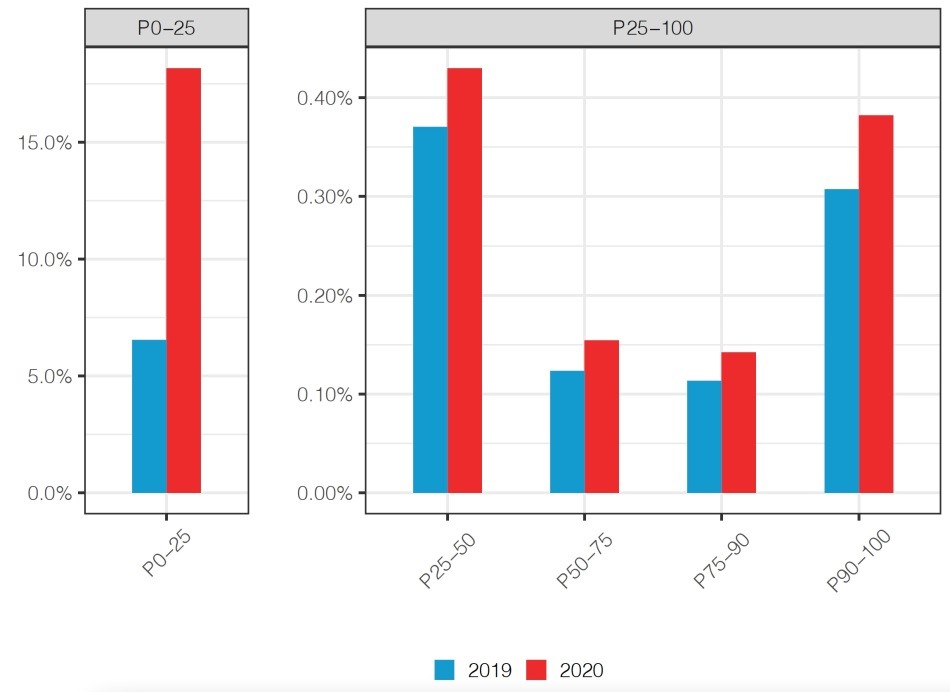

GVC-friendly liberalisation could lift over 21 million people from extreme poverty

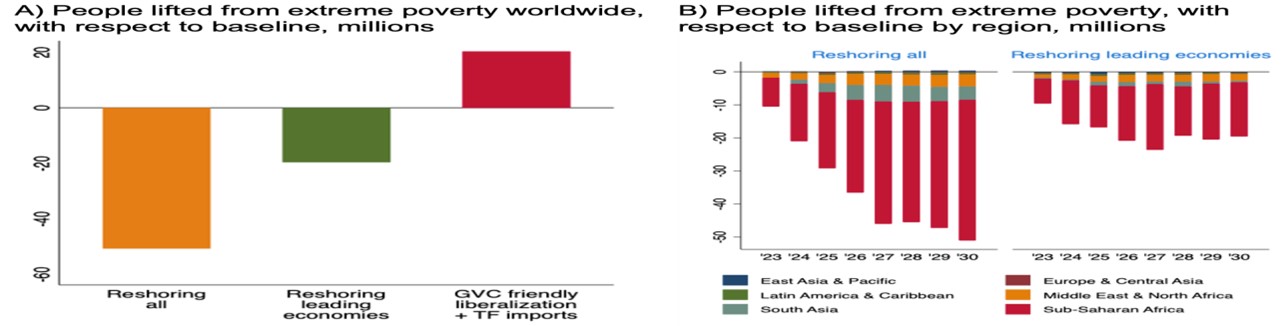

Reshoring efforts could also jeopardise the goal of poverty elimination. By 2030, reshoring efforts by leading economies would lead to an increase in the number of people living in extreme poverty by 19.4 million (Figure 4, Panel A). Under the ‘Reshoring all’ scenario, 51.8 million additional people would fall into extreme poverty by 2030, the equivalent to a 0.6% increase in the global extreme poverty headcount ratio. Sub-Saharan Africa is the most affected region under reshoring policies, accounting for around 80% of the new poor, followed by South Asia and the Middle East and North Africa region.

The ‘GVC-friendly’ scenario, on the other hand, could lift 21.5 million people from extreme poverty by 2030. South Asia, which has been hit particularly hard by the Covid-19 pandemic, benefits the most in terms of poverty eradication in the globalised world. In addition, we find that 56.2 million would graduate to global middle-class status, measured as individuals with a per capita consumption of more than PPP $10.00 a day. More than half of the new entrants in the global middle-class, or 30.9 million, would be in South Asia, and between 6.3 and 7.2 million would come from each of the three other developing regions.

Figure 4 Distributional impacts

Conclusion

The Covid-19 pandemic, trade tensions, wars, and extreme weather events all test the resilience of GVCs. Serving both as transmitters and buffers of external disruptions, GVCs can endanger future economic growth by transmitting negative production and trade shocks from one country to another. They can also drive growth by spreading the benefits of the recovery policies across countries.

While recent and ongoing events have taken a heavy toll on the world economy, fuelling an already heated debate around the benefits and costs of global supply chains, GVC restructuring in the form of reshoring is not the solution. If on a post-Covid recovery path leading economies and China decided to re-shore production, this would have a harmful impact on most countries, particularly in developing regions, leaving them more vulnerable. Having all economies re-shore would compound the damage.

The best policy response to reshoring by leading countries is to make developing economies more GVC-friendly. Elimination of input tariffs and implementation of trade facilitation measures would strengthen the integration of developing countries into regional and global value chains. The gains would be evident in all developing regions through an increase in real incomes and a reduction in extreme poverty. Becoming more GVC-friendly also makes developing countries more resilient to shocks.

17 giugno 2022

MAKSYM CHEPELIEV, MARYLA MALISZEWSKA, ISRAEL OSORIO RODARTE, MARIA FILIPA SEARA E PEREIRA, DOMINIQUE VAN DER MENSBRUGGHE

Globalisation, not localisation, is the key to post-pandemic prosperity

(synthesis; full article – Vox Eu CEPR 30 May 2022 – https://voxeu.org/article/globalisation-not-localisation-key-post-pandemic-prosperity)

Abstract: Growing economic nationalism and protectionism in recent years have tested the resilience of global value chains. This column argues that policies that are supportive of rather than hostile to trade could prove critical to strengthen a recovery from the pandemic and reduce extreme poverty in developing countries. Measures to enhance trade could boost integration into global value chains, increase incomes, and lift over 21 million additional people out of poverty by 2030. A more supportive environment for trade also boosts resilience to future supply shocks by supporting diversification and widening access to raw materials, goods, and services.

Keywords: COVID-19 international trade, global value, chains, reshoring, localisation, globalisation, Trade barriers

In recent years, extreme weather events and trade tensions spurred by growing economic nationalism and protectionism have tested the resilience of global value chains (GVCs). The sudden and massive Covid-19 induced drop in global trade in the first half of 2020 dealt them another blow (WTO 2020), prompting predictions that the pandemic would result in restructuring of the GVCs, shortening the supply chains, and leading to reshoring (Javorcik 2020, Kilic and Marin 2020). Then, as the world economy was still recovering from Covid-19, the war in Ukraine caused more major disruptions to GVCs, hitting developing countries particularly hard (Chepeliev et al. 2022, Ruta 2022).

Recent studies suggest that GVCs transmit shocks to production and trade from one country to another. On the other hand, participation in GVCs may soften the blow of a domestic shock such as a lockdown (Espitia et al. 2021) or natural disaster like the 2011 earthquake in Japan (Freund et al. 2021), by ensuring access to critical inputs when foreign markets are closed. GVCs can also drive a recovery, spreading the benefits as countries emerge from lockdowns or lift trade restrictions at varying paces.

What further shocks to GVCs should we expect in coming years? Is it possible to design policies to help developing countries enhance resilience to trade shocks without endangering growth?

In a new paper (Chepeliev et al. 2022b), we couple ENVISAGE, a state-of-the-art global economic model (van der Mensbrugghe 2019), with the GIDD microsimulation framework (Bussolo et al. 2010) to simulate three scenarios: (1) high-income economies and China raise barriers to imports and increase domestic subsidies to re-shore production (‘Reshoring leading economies’), (2) wider localisation when developing countries join the reshoring efforts (‘Reshoring all’), and (3) developing countries seek to reduce trade costs and make it easier to use imports in domestic production (‘GVC Friendly Liberalisation + Trade Facilitation (TF)’).

The risk of reshoring and the fruits of liberalisation

A possible reshoring of production by the leading economies and China would have a negative impact in most regions, with real income decreasing by 1.5% worldwide. A localised world takes the biggest toll on developing countries with the Middle East and North Africa, Rest of East Asia and Pacific, and Europe and Central Asian regions being hit the most severely (Figure 1). However, countries subsidising domestic production would also be worse off as reshoring decreases trade and income, limits the variety of products available to producers and consumers, and increases prices.

To counter the impact on regions that are highly dependent and integrated into GVCs, developing countries may be tempted to respond with their own reshoring policies. But such a response would only compound the damage done when leading economies re-shore production (Figure 1). Developing countries have an alternative. They could mitigate the damage by adopting policies that are more GVC-friendly and support greater integration. This response would produce gains across all developing regions.

Figure 1 Percent change in real income under various scenarios relative to baseline in 2030

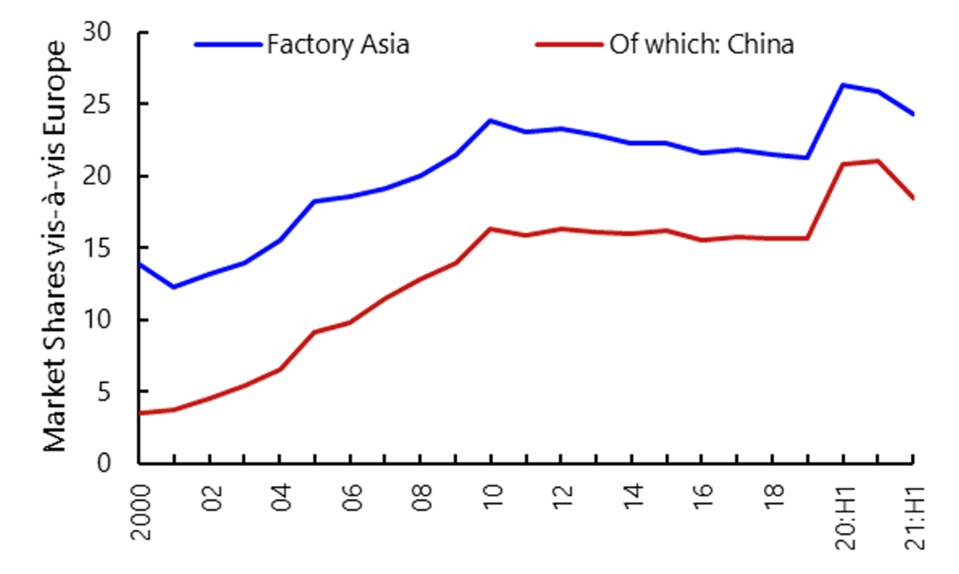

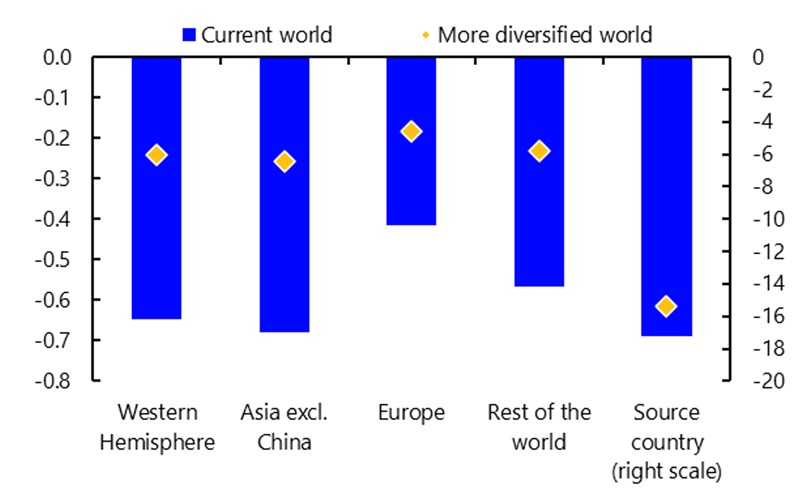

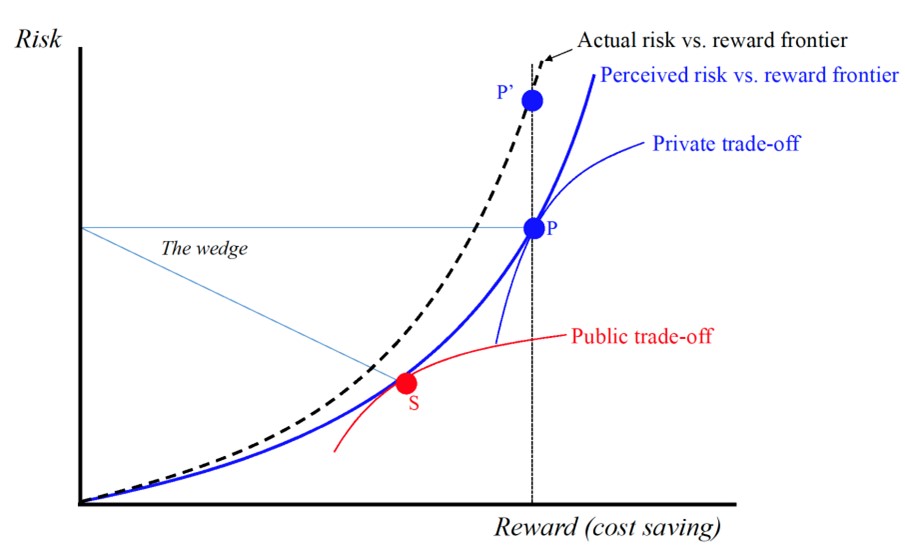

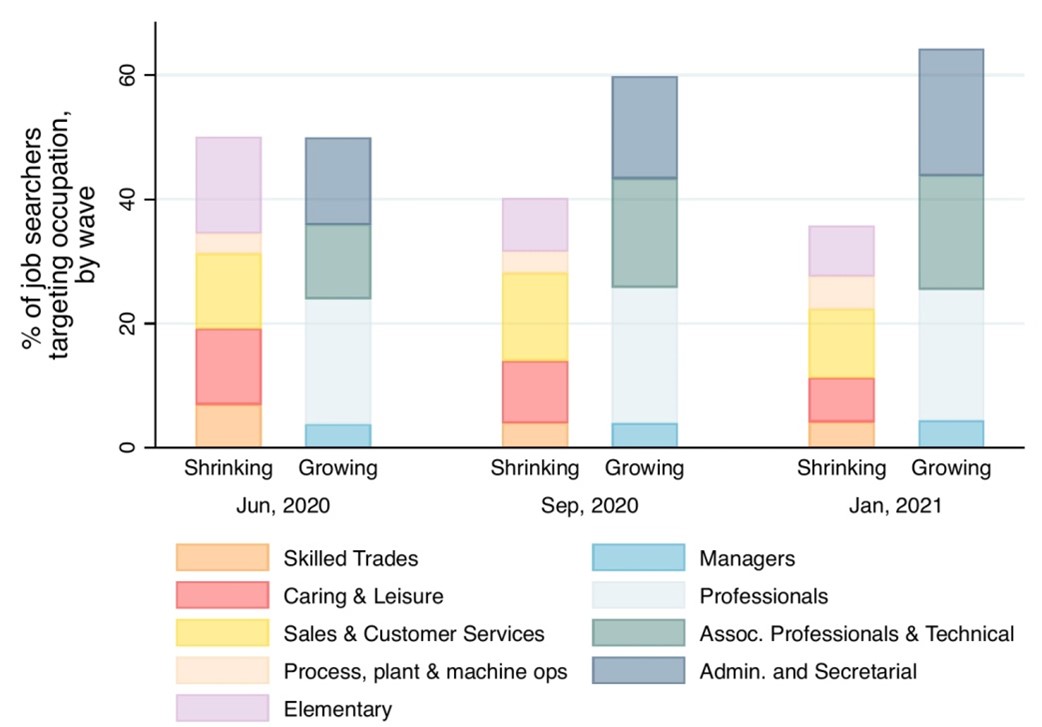

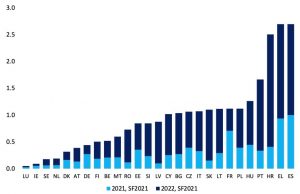

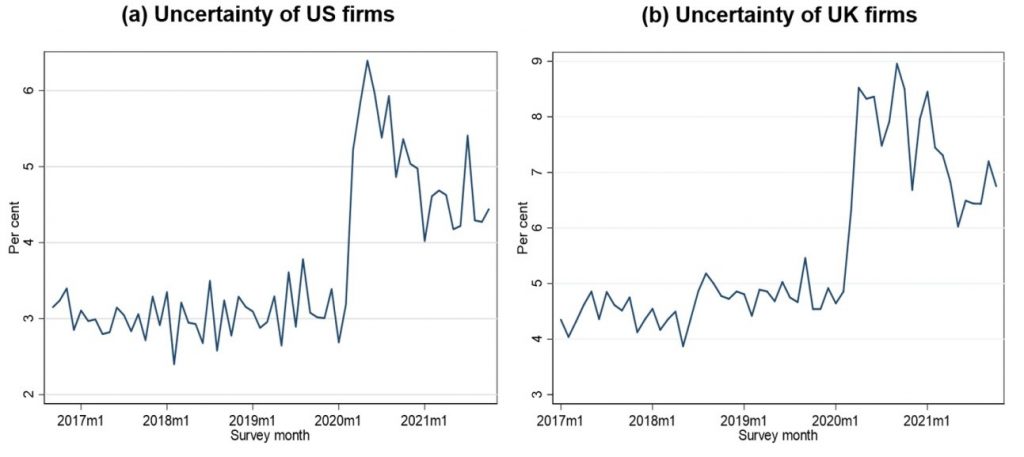

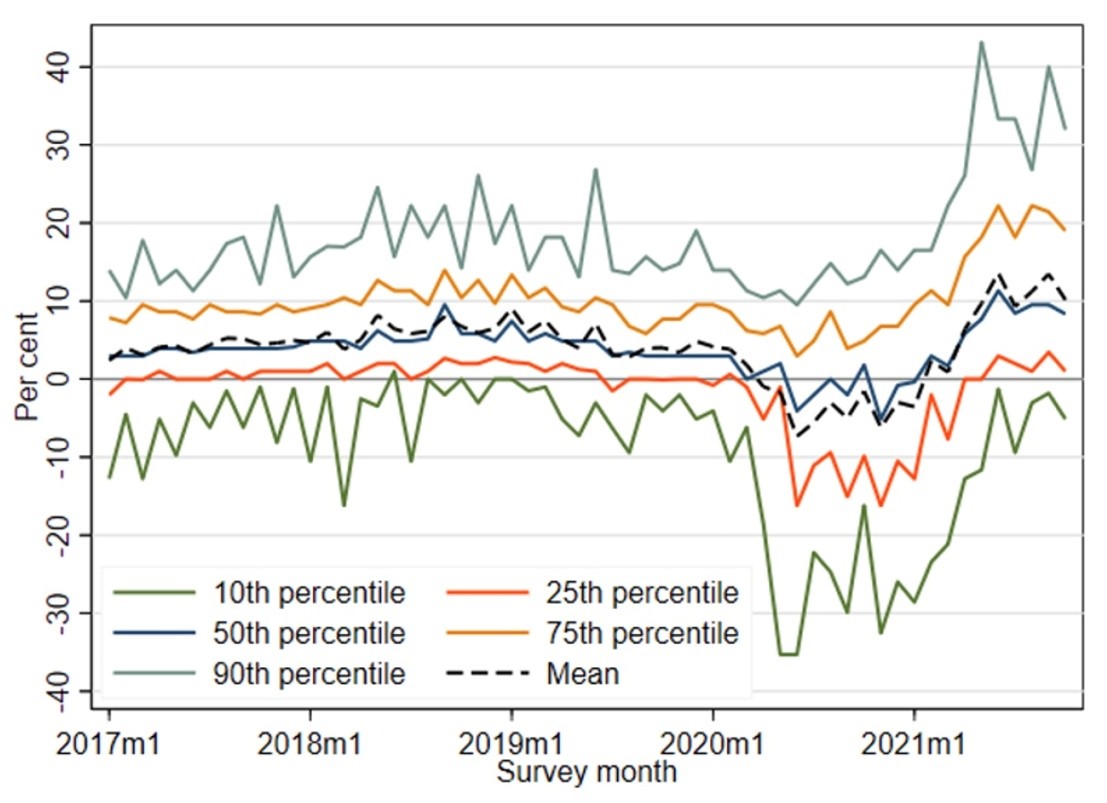

Implications for global value chains